Employee Share Plans in Europe and the USA - Sorainen

Employee Share Plans in Europe and the USA - Sorainen

Employee Share Plans in Europe and the USA - Sorainen

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

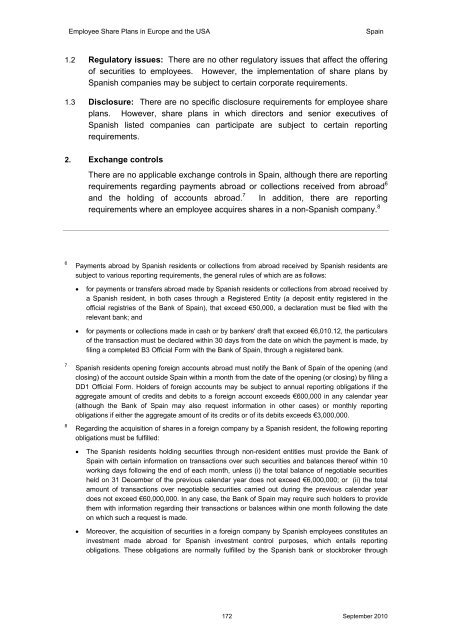

<strong>Employee</strong> <strong>Share</strong> <strong>Plans</strong> <strong>in</strong> <strong>Europe</strong> <strong>and</strong> <strong>the</strong> <strong>USA</strong>Spa<strong>in</strong>1.2 Regulatory issues: There are no o<strong>the</strong>r regulatory issues that affect <strong>the</strong> offer<strong>in</strong>gof securities to employees. However, <strong>the</strong> implementation of share plans bySpanish companies may be subject to certa<strong>in</strong> corporate requirements.1.3 Disclosure: There are no specific disclosure requirements for employee shareplans. However, share plans <strong>in</strong> which directors <strong>and</strong> senior executives ofSpanish listed companies can participate are subject to certa<strong>in</strong> report<strong>in</strong>grequirements.2. Exchange controlsThere are no applicable exchange controls <strong>in</strong> Spa<strong>in</strong>, although <strong>the</strong>re are report<strong>in</strong>grequirements regard<strong>in</strong>g payments abroad or collections received from abroad 6<strong>and</strong> <strong>the</strong> hold<strong>in</strong>g of accounts abroad. 7 In addition, <strong>the</strong>re are report<strong>in</strong>grequirements where an employee acquires shares <strong>in</strong> a non-Spanish company. 86Payments abroad by Spanish residents or collections from abroad received by Spanish residents aresubject to various report<strong>in</strong>g requirements, <strong>the</strong> general rules of which are as follows:• for payments or transfers abroad made by Spanish residents or collections from abroad received bya Spanish resident, <strong>in</strong> both cases through a Registered Entity (a deposit entity registered <strong>in</strong> <strong>the</strong>official registries of <strong>the</strong> Bank of Spa<strong>in</strong>), that exceed €50,000, a declaration must be filed with <strong>the</strong>relevant bank; <strong>and</strong>• for payments or collections made <strong>in</strong> cash or by bankers' draft that exceed €6,010.12, <strong>the</strong> particularsof <strong>the</strong> transaction must be declared with<strong>in</strong> 30 days from <strong>the</strong> date on which <strong>the</strong> payment is made, byfil<strong>in</strong>g a completed B3 Official Form with <strong>the</strong> Bank of Spa<strong>in</strong>, through a registered bank.78Spanish residents open<strong>in</strong>g foreign accounts abroad must notify <strong>the</strong> Bank of Spa<strong>in</strong> of <strong>the</strong> open<strong>in</strong>g (<strong>and</strong>clos<strong>in</strong>g) of <strong>the</strong> account outside Spa<strong>in</strong> with<strong>in</strong> a month from <strong>the</strong> date of <strong>the</strong> open<strong>in</strong>g (or clos<strong>in</strong>g) by fil<strong>in</strong>g aDD1 Official Form. Holders of foreign accounts may be subject to annual report<strong>in</strong>g obligations if <strong>the</strong>aggregate amount of credits <strong>and</strong> debits to a foreign account exceeds €600,000 <strong>in</strong> any calendar year(although <strong>the</strong> Bank of Spa<strong>in</strong> may also request <strong>in</strong>formation <strong>in</strong> o<strong>the</strong>r cases) or monthly report<strong>in</strong>gobligations if ei<strong>the</strong>r <strong>the</strong> aggregate amount of its credits or of its debits exceeds €3,000,000.Regard<strong>in</strong>g <strong>the</strong> acquisition of shares <strong>in</strong> a foreign company by a Spanish resident, <strong>the</strong> follow<strong>in</strong>g report<strong>in</strong>gobligations must be fulfilled:• The Spanish residents hold<strong>in</strong>g securities through non-resident entities must provide <strong>the</strong> Bank ofSpa<strong>in</strong> with certa<strong>in</strong> <strong>in</strong>formation on transactions over such securities <strong>and</strong> balances <strong>the</strong>reof with<strong>in</strong> 10work<strong>in</strong>g days follow<strong>in</strong>g <strong>the</strong> end of each month, unless (i) <strong>the</strong> total balance of negotiable securitiesheld on 31 December of <strong>the</strong> previous calendar year does not exceed €6,000,000; or (ii) <strong>the</strong> totalamount of transactions over negotiable securities carried out dur<strong>in</strong>g <strong>the</strong> previous calendar yeardoes not exceed €60,000,000. In any case, <strong>the</strong> Bank of Spa<strong>in</strong> may require such holders to provide<strong>the</strong>m with <strong>in</strong>formation regard<strong>in</strong>g <strong>the</strong>ir transactions or balances with<strong>in</strong> one month follow<strong>in</strong>g <strong>the</strong> dateon which such a request is made.• Moreover, <strong>the</strong> acquisition of securities <strong>in</strong> a foreign company by Spanish employees constitutes an<strong>in</strong>vestment made abroad for Spanish <strong>in</strong>vestment control purposes, which entails report<strong>in</strong>gobligations. These obligations are normally fulfilled by <strong>the</strong> Spanish bank or stockbroker throughUK/1729295/03 172 September 2010