- Page 3 and 4:

Mission StatementThe Great Lakes Ma

- Page 5 and 6:

Technical Report Documentation1. Re

- Page 7 and 8:

TABLE OF CONTENTSOverview and Backg

- Page 9 and 10:

Overview and Background:During Marc

- Page 11 and 12:

Advisory Board:One of the first tas

- Page 13 and 14:

University of MichiganDr. Armin Tro

- Page 15 and 16:

Specific Project Awards to Universi

- Page 17 and 18:

- October 8, 2005 GLMRI Affiliate U

- Page 19 and 20:

- October 7, 2006 The 2 nd GLMRI Af

- Page 21 and 22:

SeawaySized Bulk Carrier Model fo

- Page 23 and 24:

Table of Contentspage1. Introductio

- Page 25 and 26:

List of FigurespageFigure 2.1: Typi

- Page 27 and 28:

2. BackgroundThe initial Sea Grant

- Page 29 and 30:

Figure 2.2: Typical Forward Plenum

- Page 31 and 32:

Table 3.1: BallastFree Bulk Carri

- Page 33 and 34:

4. Model Construction ConstraintsTh

- Page 35 and 36:

6. Computational Fluid Dynamics (CF

- Page 37 and 38:

Figure 6.3: Velocity Vectors at the

- Page 39 and 40:

8. Model ConstructionThe model of t

- Page 41 and 42:

9. Potential Economic Impacts of th

- Page 43:

Expanding Regional Freight Informat

- Page 47 and 48:

___________________________________

- Page 49 and 50:

Workshop participants also effectiv

- Page 51 and 52:

information to share with governmen

- Page 53 and 54:

Most of this information has been c

- Page 55 and 56:

A New Perspective on Information De

- Page 57 and 58:

• Assemble data and report inform

- Page 59 and 60:

Looking Ahead: Next StepsThe main o

- Page 61 and 62:

Again, according to MISNA, the mari

- Page 63:

References Cited[1] Maritime Inform

- Page 67:

Schematic Diagram of the Structure

- Page 71 and 72:

Example 1: Basic Mapping FunctionsF

- Page 73 and 74: Figure B.7User now queries the port

- Page 75 and 76: Example 3: Mapping the NetworkFigur

- Page 77: APPENDIX CCode Specifications for G

- Page 80 and 81: Michigan: 01 Alpena 19 Marine C

- Page 83: APPENDIX DMeeting Participants in t

- Page 86: Tax Systems and Barriersto Great La

- Page 89 and 90: This page intentionally left blank.

- Page 91 and 92: The HMT Generates Substantially Mor

- Page 93 and 94: vii

- Page 95 and 96: paid by the now terminated Incan Su

- Page 97 and 98: Chapter 1: Introduction1.1 Research

- Page 99 and 100: presentation, “A Transportation I

- Page 101 and 102: − United States General Accountin

- Page 103 and 104: − Short Sea Vessel Service and Ha

- Page 105 and 106: Detailed views of these data presen

- Page 107 and 108: Guarantee Fee for MARAD'sTitle XI P

- Page 109 and 110: Table 2.4: Great Lakes Assessments

- Page 111 and 112: Table 2.5: Great Lakes Assessments

- Page 113 and 114: Table 2.7: Great Lakes Assessments

- Page 115 and 116: Table 2.10: Duty Assessments on Gre

- Page 117 and 118: Certification Fee for Payment of Ve

- Page 119 and 120: 6) HMT TablesAs noted above and in

- Page 121 and 122: Table 2.14: Total Bid Dollars by Co

- Page 123: 2003 Arcadia Harbor, Mi $33,2462003

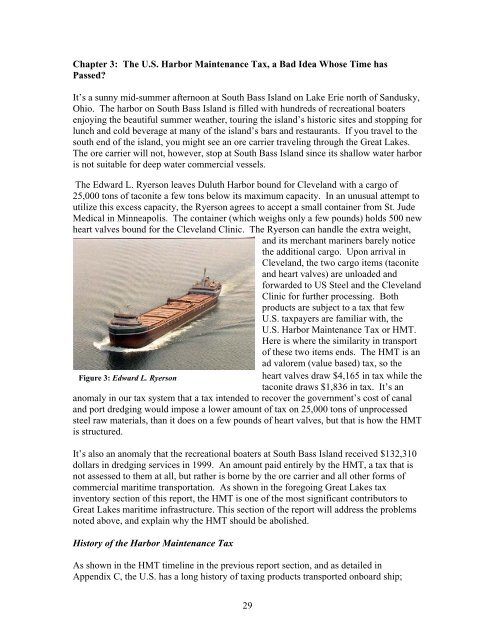

- Page 127 and 128: providing for - (1) revenue from im

- Page 129 and 130: Community’s RC. No panel has been

- Page 131 and 132: evenue to fund current and future h

- Page 133 and 134: The Support for Harbor Investment P

- Page 135 and 136: Table 3.3: Percent Change in U.S. F

- Page 137 and 138: Harbor Maintenance Tax Time Line198

- Page 139 and 140: Table 4.3: Output ImpactIndustry Di

- Page 141 and 142: ReferencesChapter 1[1] Stewart, Ric

- Page 143 and 144: [31] United States V. United States

- Page 145 and 146: [66] American Association of Port A

- Page 147 and 148: Appendix A: Tax Inventory DataSourc

- Page 149 and 150: Overview of Maritime Tax Inventory

- Page 151 and 152: Overview of Maritime Tax Inventory

- Page 153 and 154: Overview of Maritime Tax Inventory

- Page 155 and 156: 31 U.S.C. 9701; P.L. 100-710, 46 C.

- Page 157 and 158: Merchant Marine Act of 1936 as amen

- Page 159 and 160: Reform Act of 1998, P. L. 105-258,

- Page 161 and 162: Appendix C: Detailed HMT TimelineHA

- Page 163 and 164: complete and refunds are issued.Imp

- Page 165 and 166: There was unexpected good news for

- Page 167 and 168: Articles... assembled abroad in who

- Page 169 and 170: that each and every regulation is s

- Page 171 and 172: Another challenge to the HMF as app

- Page 173 and 174: Appendix D: Estimating Harbor Maint

- Page 175 and 176:

D-3

- Page 177 and 178:

Alternatives to Petroleum Based Fue

- Page 179 and 180:

Table of ContentsExecutive Summary

- Page 181 and 182:

Table 4.10:Great Lakes Biodiesel Pl

- Page 183 and 184:

of a longterm lowtemperature st

- Page 185 and 186:

Chapter 1: Overview1.1 Introduction

- Page 187 and 188:

Chapter 2: Biodiesel: An Alternativ

- Page 189 and 190:

2.2.2 Properties of BiodieselThe pr

- Page 191 and 192:

e renewable fuels (e.g. ethanol and

- Page 193 and 194:

2.4 Engine Test DataSummaries of th

- Page 195 and 196:

OEM manufacturer should be consulte

- Page 197 and 198:

A review of the literature addressi

- Page 199 and 200:

credit and a biodiesel mixture cred

- Page 201 and 202:

Figure 2: U.S. Diesel DemandMoving

- Page 203 and 204:

Demand Forecast. Table 3.4 below sh

- Page 205 and 206:

fuels (ethanol and biodiesel) be us

- Page 207 and 208:

Minnesota incentivesTable 3.11: Min

- Page 209 and 210:

Figure 3: Glycerin as Market RiskSo

- Page 211 and 212:

Figure 4: Great Lakes Region IMPLAN

- Page 213 and 214:

Definitions used in this report:Mea

- Page 215 and 216:

column shows that in Year 1 of cons

- Page 217 and 218:

Operations. Tables below show the e

- Page 219 and 220:

When operations for the biodiesel p

- Page 221 and 222:

verify that separation of the blend

- Page 223 and 224:

was considered the hot topic, very

- Page 225 and 226:

ReferencesChapter 1No referencesCha

- Page 227 and 228:

http://www.irs.gov/publications/p37

- Page 229 and 230:

Appendix A: Demand and Supply Suppo

- Page 231 and 232:

Table A2: Minnesota Soybean Produ

- Page 233 and 234:

Table A6: Marine Diesel Sales, Co

- Page 236:

Table of ContentsSections Page #1.

- Page 239 and 240:

2. Introduction: Background and Obj

- Page 241 and 242:

3. MethodsThe LLO has a surveygra

- Page 243 and 244:

Figure 2. Sidescan sonar mosaic of

- Page 245 and 246:

Figure 4. Single track (detailed) s

- Page 247 and 248:

Figure 7. Single track (detailed) s

- Page 249 and 250:

Figure 10. Detailed multibeam bathy

- Page 251 and 252:

5. Potential Economic Impacts of th

- Page 253 and 254:

Final Report: Great Lakes Maritime

- Page 255 and 256:

Evaluation Measures and ResultsTo e

- Page 257 and 258:

Appendix ASummary of Publicity & Re

- Page 259 and 260:

Appendix BGreat Lakes Maritime Tran

- Page 261 and 262:

Appendix DGreat Lakes Maritime Tran

- Page 263 and 264:

REFERENCESDuluth Port Authority. 20

- Page 265 and 266:

Steel Starts Here (12:00 minutes) b

- Page 267 and 268:

Appendix FGreat Lakes Shipping: Did

- Page 269 and 270:

15. What are the top 3 products shi

- Page 271 and 272:

Properly Loaded Ship Listing ShipHO

- Page 273 and 274:

FoghornGreenhouse gasGroundedHarbor