INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

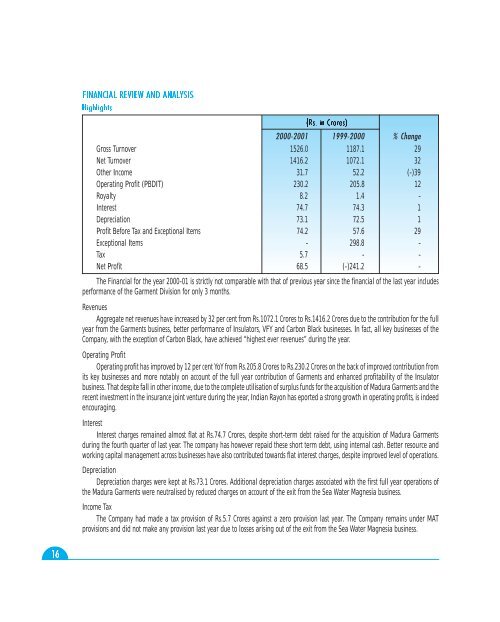

FINANCIAL REVIEW <strong>AND</strong> ANALYSISHighlights16123(Rs. in Crores)2000-2001 1999-2000 % ChangeGross Turnover 1526.0 1187.1 29Net Turnover 1416.2 1072.1 32Other Income 31.7 52.2 (-)39Operating Profit (PBDIT) 230.2 205.8 12Royalty 8.2 1.4 -Interest 74.7 74.3 1Depreciation 73.1 72.5 1Profit Before Tax and Exceptional Items 74.2 57.6 29Exceptional Items - 298.8 -Tax 5.7 - -Net Profit 68.5 (-)241.2 -The Financial for the year 2000-01 is strictly not comparable with that of previous year since the financial of the last year includesperformance of the Garment Division for only 3 months.RevenuesAggregate net revenues have increased by 32 per cent from Rs.1072.1 Crores to Rs.1416.2 Crores due to the contribution for the fullyear from the Garments business, better performance of Insulators, VFY and Carbon Black businesses. In fact, all key businesses of theCompany, with the exception of Carbon Black, have achieved “highest ever revenues” during the year.Operating ProfitOperating profit has improved by 12 per cent YoY from Rs.205.8 Crores to Rs.230.2 Crores on the back of improved contribution fromits key businesses and more notably on account of the full year contribution of Garments and enhanced profitability of the Insulatorbusiness. That despite fall in other income, due to the complete utilisation of surplus funds for the acquisition of Madura Garments and therecent investment in the insurance joint venture during the year, Indian Rayon has eported a strong growth in operating profits, is indeedencouraging.InterestInterest charges remained almost flat at Rs.74.7 Crores, despite short-term debt raised for the acquisition of Madura Garmentsduring the fourth quarter of last year. The company has however repaid these short term debt, using internal cash. Better resource andworking capital management across businesses have also contributed towards flat interest charges, despite improved level of operations.DepreciationDepreciation charges were kept at Rs.73.1 Crores. Additional depreciation charges associated with the first full year operations ofthe Madura Garments were neutralised by reduced charges on account of the exit from the Sea Water Magnesia business.Income TaxThe Company had made a tax provision of Rs.5.7 Crores against a zero provision last year. The Company remains under MATprovisions and did not make any provision last year due to losses arising out of the exit from the Sea Water Magnesia business.