INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

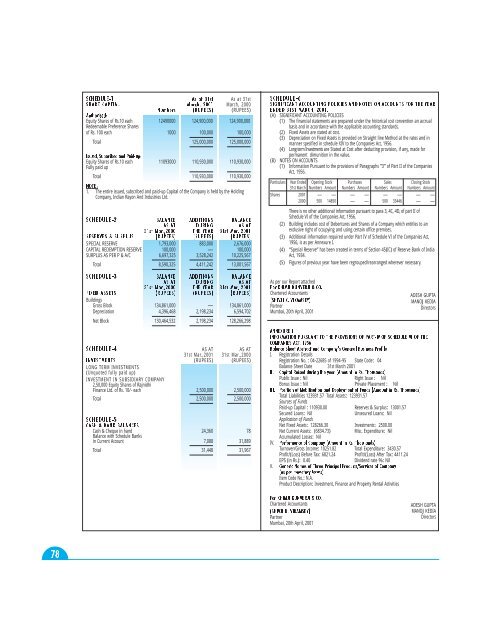

SCHEDULE-1 As at 31st As at 31stSHARE CAPITAL March, 2001 March, 2000Numbers (RUPEES) (RUPEES)Authorised:Equity Shares of Rs.10 each 12490000 124,900,000 124,900,000Redeemable Preference Sharesof Rs. 100 each 1000 100,000 100,000Total 125,000,000 125,000,000Issued, Subscribed and Paid-up:Equity Shares of Rs.10 each 11093000 110,930,000 110,930,000Fully paid upTotal 110,930,000 110,930,000NOTE:1. The entire issued, subscribed and paid-up Capital of the Company is held by the HoldingCompany, Indian Rayon And Industries <strong>Ltd</strong>.SCHEDULE-2 BALANCE ADDITIONS BALANCEAS AT DURING AS AT31st Mar.,2000 THE YEAR 31st Mar.,2001RESERVES & SURPLUS (RUPEES) (RUPEES) (RUPEES)SPECIAL RESERVE 1,793,000 883,000 2,676,000CAPITAL REDEMPTION RESERVE 100,000 — 100,000SURPLUS AS PER P & A/C 6,697,325 3,528,242 10,225,567Total 8,590,325 4,411,242 13,001,567SCHEDULE-3 BALANCE ADDITIONS BALANCEAS AT DURING AS AT31st Mar.,2000 THE YEAR 31st Mar.,2001FIXED ASSETS (RUPEES) (RUPEES) (RUPEES)BuildingsGross Block 134,861,000 — 134,861,000Depreciation 4,396,468 2,198,234 6,594,702Net Block 130,464,532 2,198,234 128,266,298SCHEDULE-4 AS AT AS AT31st Mar.,2001 31st Mar.,2000INVESTMENTS (RUPEES) (RUPEES)LONG TERM INVESTMENTS(Unquoted fully paid up)INVESTMENT IN SUBSIDIARY COMPANY2,50,000 Equity Shares of RajnidhiFinance <strong>Ltd</strong>. of Rs. 10/- each 2,500,000 2,500,000Total 2,500,000 2,500,000SCHEDULE-5CASH & BANK BALANCESCash & Cheque in hand 24,360 78Balance with Schedule Banksin Current Account 7,088 31,889Total 31,448 31,967123SCHEDULE-6SIGNIFICANT ACCOUNTING POLICIES <strong>AND</strong> NOTES ON ACCOUNTS FOR THE YEARENDED 31ST MARCH, 2001.(A)(B)SIGNIFICANT ACCOUNTING POLICIES(1) The financial statements are prepared under the historical cost convention an accrualbasis and in accordance with the applicable accounting standards.(2) Fixed Assets are stated at cost.(3) Depreciation on Fixed Assets is provided on Straight line Method at the rates and inmanner specified in schedule XIV to the Companies Act, 1956.(4) Long term Investments are Stated at Cost after deducting provision, if any, made forpermanent dimunition in the value.NOTES ON ACCOUNTS(1) Information Pursuant to the provisions of Paragraphs ”3” of Part II of the CompaniesAct, 1956.Particulars Year Ended Opening Stock Purchases Sales Closing Stock31st March Numbers Amount Numbers Amount Numbers Amount Numbers AmountShares 2001 — — — — — — — —2000 500 14850 — — 500 33446 — —There is no other additional information pursuant to para 3, 4C, 4D, of part II ofSchedule VI of the Companies Act, 1956.(2) Building includes cost of Debentures and Shares of a Company which entitles to anexclusive right of occupying and using certain office premises.(3) Additional information required under Part IV of Schedule VI of the Companies Act,1956, is as per Annexure I.(4) “Special Reserve” has been created in terms of Section 45(IC) of Reserve Bank of IndiaAct, 1934.(5) Figures of previous year have been regrouped/rearranged wherever necessary.As per our Report attachedFor KHIMJI KUNVERJI & CO.Chartered Accountants(SHIVJI K. VIKAMSEY)PartnerMumbai, 20th April, 2001ANNEXURE IINFORMATION PURSUANT TO THE PROVISIONS OF PART-IV OF SCHEDULE VI OF THECOMPANIES ACT, 1956Balance Sheet Abstract and Company’s General Business ProfileI. Registration DetailsRegistration No. : 04-22685 of 1994-95 State Code: 04Balance Sheet Date 31st March 2001II. Capital Raised during the year (Amount in Rs. Thousands)Public Issue : Nil Right Issue : NilBonus Issue : Nil Private Placement : NilIII. Position of Mobilisation and Deployment of Funds (Amount in Rs. Thousands)Total Liabilities 123931.57 Total Assets: 123931.57Sources of FundsPaid-up Capital : 110930.00 Reserves & Surplus: 13001.57Secured Loans: NilUnsecured Loans: NilApplication of FundsNet Fixed Assets: 128266.30 Investments: 2500.00Net Current Assets: (6834.73)Misc. Expenditure: NilAccumulated Losses: NilIV.Performance of Company (Amount in Rs. Thousands)Turnover/Gross Income: 10251.82 Total Expenditure: 3430.57Profit/(Loss) Before Tax: 6821.24 Profit/(Loss) After Tax: 4411.24EPS (in Rs.): 0.40Dividend rate %: NilV. Generic Names of Three Principal Products/Services of Company(as per monetary terms)Item Code No.: N.A.Product Description: Investment, Finance and Property Rental ActivitiesFor KHIMJI KUNVERJI & CO.Chartered Accountants(SHIVJI K. VIKAMSEY)PartnerMumbai, 20th April, 2001ADESH GUPTAMANOJ KEDIADirectorsADESH GUPTAMANOJ KEDIADirectors