INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

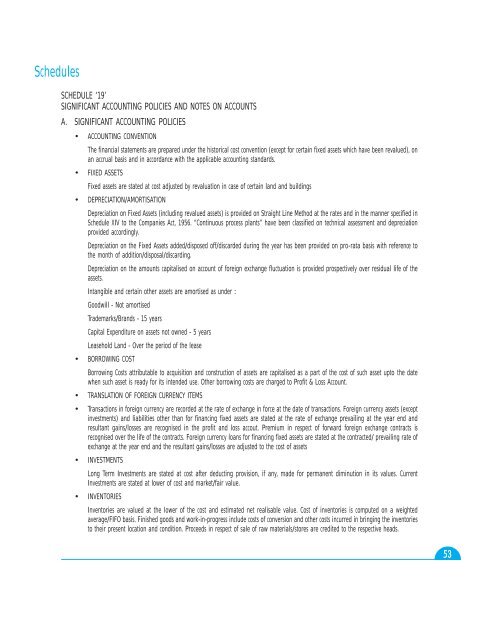

SchedulesSCHEDULE ‘19’SIGNIFICANT ACCOUNTING POLICIES <strong>AND</strong> NOTES ON ACCOUNTSA. SIGNIFICANT ACCOUNTING POLICIES• ACCOUNTING CONVENTIONThe financial statements are prepared under the historical cost convention (except for certain fixed assets which have been revalued), onan accrual basis and in accordance with the applicable accounting standards.• FIXED ASSETSFixed assets are stated at cost adjusted by revaluation in case of certain land and buildings• DEPRECIATION/AMORTISATIONDepreciation on Fixed Assets (including revalued assets) is provided on Straight Line Method at the rates and in the manner specified inSchedule XIV to the Companies Act, 1956. “Continuous process plants” have been classified on technical assessment and depreciationprovided accordingly.Depreciation on the Fixed Assets added/disposed off/discarded during the year has been provided on pro-rata basis with reference tothe month of addition/disposal/discarding.Depreciation on the amounts capitalised on account of foreign exchange fluctuation is provided prospectively over residual life of theassets.Intangible and certain other assets are amortised as under :Goodwill - Not amortisedTrademarks/Brands - 15 yearsCapital Expenditure on assets not owned - 5 yearsLeasehold Land - Over the period of the lease• BORROWING COSTBorrowing Costs attributable to acquisition and construction of assets are capitalised as a part of the cost of such asset upto the datewhen such asset is ready for its intended use. Other borrowing costs are charged to Profit & Loss Account.• TRANSLATION OF FOREIGN CURRENCY ITEMS• Transactions in foreign currency are recorded at the rate of exchange in force at the date of transactions. Foreign currency assets (exceptinvestments) and liabilities other than for financing fixed assets are stated at the rate of exchange prevailing at the year end andresultant gains/losses are recognised in the profit and loss accout. Premium in respect of forward foreign exchange contracts isrecognised over the life of the contracts. Foreign currency loans for financing fixed assets are stated at the contracted/ prevailing rate ofexchange at the year end and the resultant gains/losses are adjusted to the cost of assets• INVESTMENTSLong Term Investments are stated at cost after deducting provision, if any, made for permanent diminution in its values. CurrentInvestments are stated at lower of cost and market/fair value.• INVENTORIESInventories are valued at the lower of the cost and estimated net realisable value. Cost of inventories is computed on a weightedaverage/FIFO basis. Finished goods and work-in-progress include costs of conversion and other costs incurred in bringing the inventoriesto their present location and condition. Proceeds in respect of sale of raw materials/stores are credited to the respective heads.53