INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

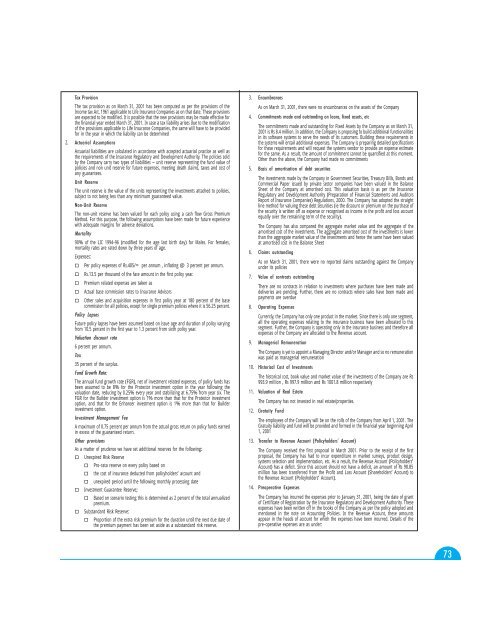

Tax ProvisionThe tax provision as on March 31, 2001 has been computed as per the provisions of theIncome tax Act, 1961 applicable to Life Insurance Companies as on that date. These provisionsare expected to be modified. It is possible that the new provisions may be made effective forthe financial year ended March 31, 2001. In case a tax liability arises due to the modificationof the provisions applicable to Life Insurance Companies, the same will have to be providedfor in the year in which the liability can be determined2. Actuarial AssumptionsActuarial liabilities are calculated in accordance with accepted actuarial practice as well asthe requirements of the Insurance Regulatory and Development Authority. The policies soldby the Company carry two types of liabilities – unit reserve representing the fund value ofpolicies and non unit reserve for future expenses, meeting death claims, taxes and cost ofany guarantees.Unit ReserveThe unit reserve is the value of the units representing the investments attached to policies,subject to not being less than any minimum guaranteed value.Non-Unit ReserveThe non-unit reserve has been valued for each policy using a cash flow Gross PremiumMethod. For this purpose, the following assumptions have been made for future experiencewith adequate margins for adverse deviations.Mortality90% of the LIC 1994-96 (modified for the age last birth day) for Males. For females,mortality rates are rated down by three years of age.Expenses:o Per policy expenses of Rs.405/= per annum , inflating @ 3 percent per annum.o Rs.13.5 per thousand of the face amount in the first policy year.o Premium related expenses are taken aso Actual base commission rates to Insurance Advisorso Other sales and acquisition expenses in first policy year at 180 percent of the basecommission for all policies, except for single premium policies where it is 56.25 percent.Policy LapsesFuture policy lapses have been assumed based on issue age and duration of policy varyingfrom 10.5 percent in the first year to 1.3 percent from sixth policy year.Valuation discount rate6 percent per annum.Tax35 percent of the surplus.Fund Growth Rate:The annual fund growth rate (FGR), net of investment related expenses, of policy funds hasbeen assumed to be 8% for the Protector investment option in the year following thevaluation date, reducing by 0.25% every year and stabilizing at 6.75% from year six. TheFGR for the Builder investment option is 1% more than that for the Protector investmentoption, and that for the Enhancer investment option is 1% more than that for Builderinvestment option.Investment Management FeeA maximum of 0.75 percent per annum from the actual gross return on policy funds earnedin excess of the guaranteed return.Other provisionsAs a matter of prudence we have set additional reserves for the following:o Unexpired Risk Reserveo Pro-rata reserve on every policy based ono the cost of insurance deducted from policyholders’ account ando unexpired period until the following monthly processing dateo Investment Guarantee Reserve;o Based on scenario testing this is determined as 2 percent of the total annualizedpremium.o Substandard Risk Reserve:o Proportion of the extra risk premium for the duration until the next due date ofthe premium payment has been set aside as a substandard risk reserve.3. EncumbrancesAs on March 31, 2001, there were no encumbrances on the assets of the Company4. Commitments made and outstanding on loans, fixed assets, etcThe commitments made and outstanding for Fixed Assets by the Company as on March 31,2001 is Rs 8.4 million. In addition, the Company is proposing to build additional functionalitiesin its software systems to serve the needs of its customers. Building these requirements inthe systems will entail additional expenses. The Company is preparing detailed specificationsfor these requirements and will request the systems vendor to provide an expense estimatefor the same. As a result, the amount of commitment cannot be quantified at this moment.Other than the above, the Company had made no commitments5. Basis of amortisation of debt securitiesThe investments made by the Company in Government Securities, Treasury Bills, Bonds andCommercial Paper issued by private sector companies have been valued in the BalanceSheet of the Company at amortised cost. This valuation basis is as per the InsuranceRegulatory and Development Authority (Preparation of Financial Statements and AuditorsReport of Insurance Companies) Regulations, 2000. The Company has adopted the straightline method for valuing these debt securities (ie the discount or premium on the purchase ofthe security is written off as expense or recognised as income in the profit and loss accountequally over the remaining term of the security).The Company has also compared the aggregate market value and the aggregate of theamortised cost of the investments. The aggregate amortised cost of the investments is lowerthan the aggregate market value of the investments and hence the same have been valuedat amortised cost in the Balance Sheet6. Claims outstandingAs on March 31, 2001, there were no reported claims outstanding against the Companyunder its policies7. Value of contracts outstandingThere are no contracts in relation to investments where purchases have been made anddeliveries are pending. Further, there are no contracts where sales have been made andpayments are overdue8. Operating ExpensesCurrently, the Company has only one product in the market. Since there is only one segment,all the operating expenses relating to the insurance business have been allocated to thissegment. Further, the Company is operating only in the insurance business and therefore allexpenses of the Company are allocated to the Revenue account.9. Managerial RemunerationThe Company is yet to appoint a Managing Director and/or Manager and so no remunerationwas paid as managerial remuneration10. Historical Cost of InvestmentsThe historical cost, book value and market value of the investments of the Company are Rs993.9 million , Rs 997.9 million and Rs 1001.8 million respectively11. Valuation of Real EstateThe Company has not invested in real estate/properties.12. Gratuity FundThe employees of the Company will be on the rolls of the Company from April 1, 2001. TheGratuity liability and fund will be provided and formed in the financial year beginning April1, 200113. Transfer to Revenue Account (Policyholders’ Account)The Company received the first proposal in March 2001. Prior to the receipt of the firstproposal, the Company has had to incur expenditure in market surveys, product design,systems selection and implementation, etc. As a result, the Revenue Account (Policyholders’Account) has a deficit. Since this account should not have a deficit, an amount of Rs 98.85million has been transferred from the Profit and Loss Account (Shareholders’ Account) tothe Revenue Account (Policyholders’ Account).14. Preoperative ExpensesThe Company has incurred the expenses prior to January 31, 2001, being the date of grantof Certificate of Registration by the Insurance Regulatory and Development Authority. Theseexpenses have been written off in the books of the Company as per the policy adopted andmentioned in the note on Accounting Policies. In the Revenue Account, these amountsappear in the heads of account for which the expenses have been incurred. Details of thepre-operative expenses are as under:73