INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

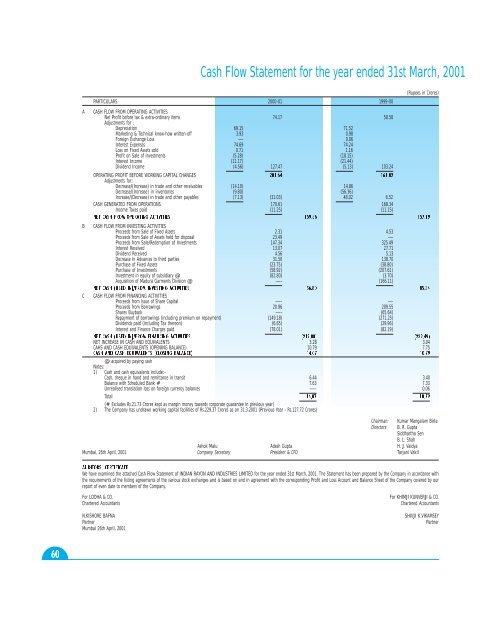

Cash Flow Statement for the year ended 31st March, 2001(Rupees in Crores)PARTICULARS 2000-01 1999-00A CASH FLOW FROM OPERATING ACTIVITIESNet Profit before tax & extra-ordinary items 74.17 58.58Adjustments for :Depreciation 69.15 71.52Marketing & Technical know-how written-off 3.93 0.98Foreign Exchange Loss — 0.06Interest Expenses 74.69 74.24Loss on Fixed Assets sold 0.71 1.16Profit on Sale of Investments (5.28) (18.15)Interest Income (11.17) (21.44)Dividend Income (4.56) 127.47 (5.13) 103.24OPERATING PROFIT BEFORE WORKING CAPITAL CHANGES 201.64 161.82Adjustments for:Decrease/(Increase) in trade and other receivables (14.10) 14.86Decrease/(Increase) in inventories (9.80) (56.36)Increase/(Decrease) in trade and other payables (7.13) (31.03) 48.02 6.52CASH GENERATED FROM OPERATIONS 170.61 168.34Income Taxes paid (11.25) (11.15)NET CASH FROM OPERATING ACTIVITIES 159.36 157.19B CASH FLOW FROM INVESTING ACTIVITIESProceeds from Sale of Fixed Assets 2.31 4.53Proceeds from Sale of Assets held for disposal 23.49 —Proceeds from Sale/Redemption of Investments 147.34 325.49Interest Received 13.07 27.71Dividend Received 4.56 5.13Decrease in Advances to third parties 31.50 138.70Purchase of Fixed Assets (23.75) (38.80)Purchase of Investments (58.92) (207.61)Investment in equity of subsidiary @ (82.80) (3.70)Acquisition of Madura Garments Division @ —- (166.11)NET CASH (USED IN)/FROM INVESTING ACTIVITIES 56.80 85.34C CASH FLOW FROM FINANCING ACTIVITIESProceeds from issue of Share Capital —- —Proceeds from Borrowings 20.96 209.55Shares Buyback —- (65.64)Repayment of borrowings (including premium on repayment) (149.18) (271.25)Dividends paid (including Tax thereon) (6.65) (29.96)Interest and Finance Charges paid (78.01) (82.19)NET CASH (USED IN)/FROM FINANCING ACTIVITIES (212.88) (239.49)NET INCREASE IN CASH <strong>AND</strong> EQUIVALENTS 3.28 3.04CAHS <strong>AND</strong> CASH EQUIVALENTS (OPENING BALANCE) 10.79 7.75CASH <strong>AND</strong> CASH EQUIVALENTS (CLOSING BALANCE) 14.07 10.79@ acquired by paying cashNotes:1) Cash and cash equivalents include:-Cash, cheque in hand and remittance in transit 6.44 3.40Balance with Scheduled Bank # 7.63 7.33Unrealised translation loss on foreign currency balances —- 0.06Total 14.07 10.79(# Excludes Rs.21.73 Crores kept as margin money towards corporate guarantee in previous year)2) The Company has undrawn working capital facilities of Rs.229.37 Crores as on 31.3.2001 (Previous Year - Rs.127.72 Crores)Chairman: Kumar Mangalam <strong>Birla</strong>Directors: B. R. GuptaSiddhartha SenB. L. ShahAshok Malu Adesh Gupta H. J. VaidyaMumbai, 26th April, 2001 Company Secretary President & CFO Tarjani VakilAUDITORS’ CERTIFICATEWe have examined the attached Cash Flow Statement of <strong>INDIAN</strong> <strong>RAYON</strong> <strong>AND</strong> <strong>INDUSTRIES</strong> <strong>LIMITED</strong> for the year ended 31st March, 2001. The Statement has been prepared by the Company in accordance withthe requirements of the listing agreements of the various stock exchanges and is based on and in agreement with the corresponding Profit and Loss Account and Balance Sheet of the Company covered by ourreport of even date to members of the Company.For LODHA & CO.For KHIMJI KUNVERJI & CO.Chartered AccountantsChartered AccountantsN.KISHORE BAFNASHIVJI K.VIKAMSEYPartnerPartnerMumbai 26th April, 2001123