INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

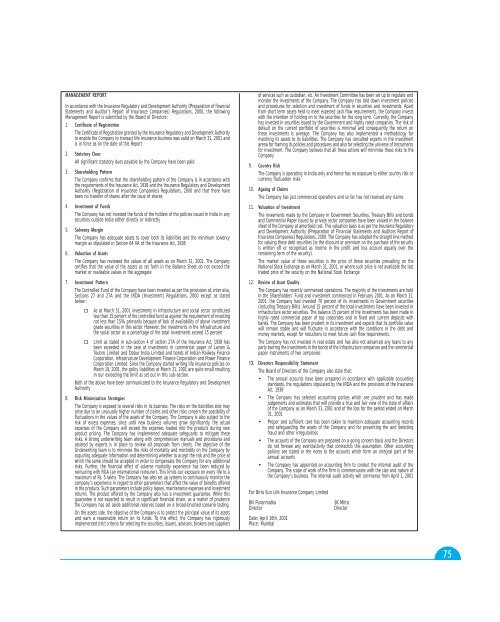

MANAGEMENT REPORTIn accordance with the Insurance Regulatory and Development Authority (Preparation of financialStatements and Auditor’s Report of Insurance Companies) Regulations, 2000, the followingManagement Report is submitted by the Board of Directors:1. Certificate of RegistrationThe Certificate of Registration granted by the Insurance Regulatory and Development Authorityto enable the Company to transact life insurance business was valid on March 31, 2001 andis in force as on the date of this Report2. Statutory DuesAll significant statutory dues payable by the Company have been paid3. Shareholding PatternThe Company confirms that the shareholding pattern of the Company is in accordance withthe requirements of the Insurance Act, 1938 and the Insurance Regulatory and DevelopmentAuthority (Registration of Insurance Companies) Regulations, 2000 and that there havebeen no transfer of shares after the issue of shares4. Investment of FundsThe Company has not invested the funds of the holders of the policies issued in India in anysecurities outside India either directly or indirectly5. Solvency MarginThe Company has adequate assets to cover both its liabilities and the minimum solvencymargin as stipulated in Section 64 VA of the Insurance Act, 19386. Valuation of AssetsThe Company has reviewed the values of all assets as on March 31, 2001. The Companycertifies that the value of the assets as set forth in the Balance Sheet do not exceed themarket or realisable values in the aggregate7. Investment PatternThe Controlled Fund of the Company have been invested as per the provisions of, inter alia,Sections 27 and 27A and the IRDA (Investment) Regulations, 2000 except as statedbelow :o As at March 31, 2001 investments in infrastructure and social sector constitutedless than 15 percent of the controlled fund as against the requirement of investingnot less than 15% primarily because of lack of availability of above investmentgrade securities in this sector. However, the investments in the infrastructure andthe social sector as a percentage of the total investments exceed 15 percento Limit as stated in sub-section 4 of section 27A of the Insurance Act, 1938 hasbeen exceeded in the case of investments in commercial paper of Larsen &Toubro Limited and Dabur India Limited and bonds of Indian Railway FinanceCorporation, Infrastructure Development Finance Corporation and Power FinanceCorporation Limited. Since the Company started writing life insurance policies onMarch 19, 2001, the policy liabilities at March 31, 2001 are quite small resultingin our exceeding the limit as set out in this sub-section.Both of the above have been communicated to the Insurance Regulatory and DevelopmentAuthority8. Risk Minimisation StrategiesThe Company is exposed to several risks in its business. The risks on the liabilities side mayarise due to an unusually higher number of claims and other risks concern the possibility offluctuations in the values of the assets of the Company. The Company is also subject to therisk of excess expenses, since until new business volumes grow significantly, the actualexpenses of the Company will exceed the expenses loaded into the products during newproduct pricing. The Company has implemented adequate safeguards to mitigate theserisks. A strong underwriting team along with comprehensive manuals and procedures andassisted by experts is in place to review all proposals from clients. The objective of theUnderwriting team is to minimise the risks of mortality and morbidity on the Company byacquiring adequate information and determining whether to accept the risk and the price atwhich the same should be accepted in order to compensate the Company for any additionalrisks. Further, the financial effect of adverse mortality experience has been reduced byreinsuring with RGA (an international reinsurer). This limits our exposure on every life to amaximum of Rs. 5 lakhs. The Company has also set up systems to continuously monitor thecompany’s experience in regard to other parameters that affect the value of benefits offeredin the products. Such parameters include policy lapses, maintenance expenses and investmentreturns. The product offered by the Company also has a investment guarantee. While thisguarantee is not expected to result in significant financial strain, as a matter of prudencethe Company has set aside additional reserves based on a broad-brushed scenario testing.On the assets side, the objective of the Company is to protect the principal value of its assetsand earn a reasonable return on its funds. To this effect, the Company has rigorouslyimplemented strict criteria for selecting the securities, issuers, advisors, brokers and suppliersof services such as custodian, etc. An Investment Committee has been set up to regulate andmonitor the investments of the Company. The Company has laid down investment policiesand procedures for selection and investment of funds in securities and investments. Apartfrom short term assets held to meet expected cash flow requirements, the Company investswith the intention of holding on to the securities for the long term. Currently, the Companyhas invested in securities issued by the Government and highly rated companies. The risk ofdefault on the current portfolio of securities is minimal and consequently the return onthese investments is average. The Company has also implemented a methodology formatching its assets to its liabilities. The Company has consulted experts in the investmentarena for framing its policies and procedures and also for selecting the universe of instrumentsfor investment. The Company believes that all these actions will minimise these risks to theCompany9. Country RiskThe Company is operating in India only and hence has no exposure to either country risk orcurrency fluctuation risks10. Ageing of ClaimsThe Company has just commenced operations and so far has not received any claims11. Valuation of InvestmentThe invesments made by the Company in Government Securities, Treasury Bills and bondsand Commercial Paper issued by private sector companies have been valued in the balancesheet of the Company at amortised cost. This valuation basis is as per the Insurance Regulatoryand Development Authority (Preparation of Financial Statements and Auditors Report ofInsurance Companies) Regulations, 2000. The Company has adopted the straight line methodfor valuing these debt securities (ie the discount or premium on the purchase of the securityis written off or recognised as income in the profit and loss account equally over theremaining term of the security).The market value of these securities is the price of these securities prevailing on theNational Stock Exchange as on March 31, 2001, or where such price is not available the lasttraded price of the security on the National Stock Exchange12. Review of Asset QualityThe Company has recently commenced operations. The majority of the investments are heldin the Shareholders’ Fund and investment commenced in February 2001. As on March 31,2001, the Company had invested 70 percent of its investments in Government securities(including Treasury Bills). Around 15 percent of the total investments have been invested ininfrastructure sector securities. The balance 15 percent of the investments has been made inhighly rated commercial paper of top corporates and in fixed and current deposits withbanks. The Company has been prudent in its investment and expects that its portfolio valuewill remain stable and will fluctuate in accordance with the conditions in the debt andmoney markets, except for reductions to meet future cash flow requirements.The Company has not invested in real estate and has also not advanced any loans to anyparty barring the investments in the bonds of the infrastructure companies and the commercialpaper instruments of two companies13. Directors Responsibility StatementThe Board of Directors of the Company also state that:• The annual accounts have been prepared in accordance with applicable accountingstandards, the regulations stipulated by the IRDA and the provisions of the InsuranceAct, 1938• The Company has selected accounting polices which are prudent and has madejudgements and estimates that will provide a true and fair view of the state of affairsof the Company as on March 31, 2001 and of the loss for the period ended on March31, 2001• Proper and sufficient care has been taken to maintain adequate accounting recordsand safeguarding the assets of the Company and for preventing the and detectingfraud and other irregularities• The accounts of the Company are prepared on a going concern basis and the Directorsdo not foresee any event/activity that contradicts this assumption. Other accountingpolicies are stated in the notes to the accounts which form an integral part of theannual accounts• The Company has appointed an accounting firm to conduct the internal audit of theCompany. The scope of work of the firm is commensurate with the size and nature ofthe Company’s business. The internal audit activity will commence from April 1, 2001For <strong>Birla</strong> Sun Life Insurance Company LimitedBN PuranmalkaDirectorDate: April 16th, 2001Place: MumbaiSK MitraDirector75