INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

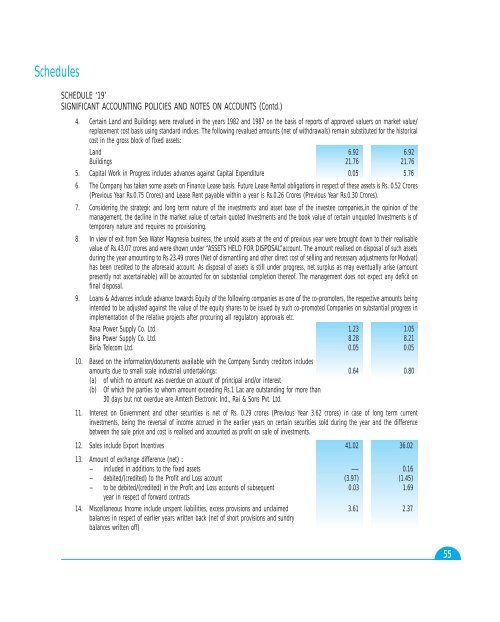

SchedulesSCHEDULE ‘19’SIGNIFICANT ACCOUNTING POLICIES <strong>AND</strong> NOTES ON ACCOUNTS (Contd.)4. Certain Land and Buildings were revalued in the years 1982 and 1987 on the basis of reports of approved valuers on market value/replacement cost basis using standard indices. The following revalued amounts (net of withdrawals) remain substituted for the historicalcost in the gross block of fixed assets:Land 6.92 6.92Buildings 21.76 21.765. Capital Work in Progress includes advances against Capital Expenditure 0.05 5.766. The Company has taken some assets on Finance Lease basis. Future Lease Rental obligations in respect of these assets is Rs. 0.52 Crores(Previous Year Rs.0.75 Crores) and Lease Rent payable within a year is Rs.0.26 Crores (Previous Year Rs.0.30 Crores).7. Considering the strategic and long term nature of the investments and asset base of the investee companies,in the opinion of themanagement, the decline in the market value of certain quoted Investments and the book value of certain unquoted Investments is oftemporary nature and requires no provisioning.8. In view of exit from Sea Water Magnesia business, the unsold assets at the end of previous year were brought down to their realisablevalue of Rs.43.07 crores and were shown under “ASSETS HELD FOR DISPOSAL”account. The amount realised on disposal of such assetsduring the year amounting to Rs.23.49 crores (Net of dismantling and other direct cost of selling and necessary adjustments for Modvat)has been credited to the aforesaid account. As disposal of assets is still under progress, net surplus as may eventually arise (amountpresently not ascertainable) will be accounted for on substantial completion thereof. The management does not expect any deficit onfinal disposal.9. Loans & Advances include advance towards Equity of the following companies as one of the co-promoters, the respective amounts beingintended to be adjusted against the value of the equity shares to be issued by such co-promoted Companies on substantial progress inimplementation of the relative projects after procuring all regulatory approvals etc.Rosa Power Supply Co. <strong>Ltd</strong>. 1.23 1.05Bina Power Supply Co. <strong>Ltd</strong>. 8.28 8.21<strong>Birla</strong> Telecom <strong>Ltd</strong>. 0.05 0.0510. Based on the information/documents available with the Company Sundry creditors includesamounts due to small scale industrial undertakings: 0.64 0.80(a)(b)of which no amount was overdue on account of principal and/or interestOf which the parties to whom amount exceeding Rs.1 Lac are outstanding for more than30 days but not overdue are Amtech Electronic Ind., Rai & Sons Pvt. <strong>Ltd</strong>.11. Interest on Government and other securities is net of Rs. 0.29 crores (Previous Year 3.62 crores) in case of long term currentinvestments, being the reversal of income accrued in the earlier years on certain securities sold during the year and the differencebetween the sale price and cost is realised and accounted as profit on sale of investments.12. Sales include Export Incentives 41.02 36.0213. Amount of exchange difference (net) :– included in additions to the fixed assets — 0.16– debited/(credited) to the Profit and Loss account (3.97) (1.45)– to be debited/(credited) in the Profit and Loss accounts of subsequent 0.03 1.69year in respect of forward contracts14. Miscellaneous Income include unspent liabilities, excess provisions and unclaimed 3.61 2.37balances in respect of earlier years written back (net of short provisions and sundrybalances written off)55