INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

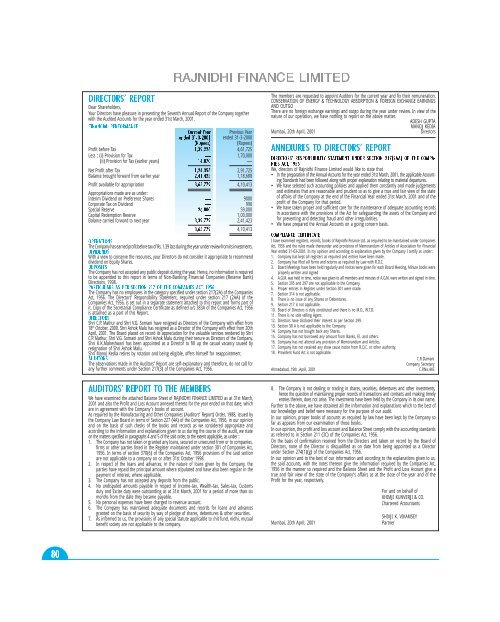

The members are requested to appoint Auditors for the current year and fix their remuneration.CONSERVATION OF ENERGY & TECHNOLOGY ABSORPTION & FOREIGN EXCHANGE EARNINGS<strong>AND</strong> OUTGOThere are no foreign exchange earnings and outgo during the year under review. In view of thenature of our operation, we have nothing to report on the above matter.ADESH GUPTAMANOJ KEDIA123 80RAJNIDHI FINANCE <strong>LIMITED</strong>DIRECTORS’ REPORTDear Shareholders,Your Directors have pleasure in presenting the Seventh Annual Report of the Company togetherwith the Audited Accounts for the year ended 31st March, 2001.FINANCIAL PERFORMANCECurrent Year Previous Year Mumbai, 20th April, 2001ended 31-3-2001 ended 31-3-2000(Rupees)(Rupees)Profit before Tax 1,39,226 4,61,725Less : (i) Provision for Tax — 1,70,000(ii) Provision for Tax (earlier years) 14,870 —Net Profit after Tax 1,24,356 2,91,725Balance brought forward from earlier year 2,41,423 1,18,688Profit available for appropriation 3,65,779 4,10,413Appropriations made are as under:Interim Dividend on Preference Shares — 9000Corporate Tax on Dividend — 990Special Reserve 26,000 59,000Capital Redemption Reserve — 1,00,000Balance carried forward to next year 3,39,779 2,41,4233,65,779 4,10,413OPERATIONSThe Company has earned profit before tax of Rs. 1.39 lacs during the year under review from its investments.DIVIDENDSWith a view to conserve the resources, your Directors do not consider it appropriate to recommenddividend on Equity Shares.DEPOSITSThe Company has not accepted any public deposit during the year. Hence, no information is requiredto be appended to this report in terms of Non-Banking Financial Companies (Reserve Bank)Directions, 1998.PARTICULARS AS PER SECTION 217 OF THE COMPANIES ACT, 1956The Company has no employees in the category specified under section 217(2A) of the CompaniesAct, 1956. The Directors’ Responsibility Statement, required under section 217 (2AA) of theCompanies Act, 1956, is set out in a separate statement attached to this report and forms part ofit. Copy of the Secretarial Compliance Certificate as defined u/s 383A of the Companies Act, 1956is attached as a part of this Report.DIRECTORSShri C.P. Mathur and Shri V.G. Somani have resigned as Directors of the Company with effect from18 th October, 2000. Shri Ashok Malu has resigned as a Director of the Company with effect from 20thApril, 2001. The Board placed on record its appreciation for the valuable services rendered by ShriC.P. Mathur, Shri V.G. Somani and Shri Ashok Malu during their tenure as Directors of the Company.Shri K.K.Maheshwari has been appointed as a Director to fill up the casual vacancy caused byresignation of Shri Ashok Malu.Shri Manoj Kedia retires by rotation and being eligible, offers himself for reappointment.AUDITORSThe observations made in the Auditors’ Report are self-explanatory and therefore, do not call forany further comments under Section 217(3) of the Companies Act, 1956.Ahmedabad, 19th .April, 2001AUDITORS’ REPORT TO THE MEMBERSWe have examined the attached Balance Sheet of RAJNIDHI FINANCE <strong>LIMITED</strong> as at 31st March,2001 and also the Profit and Loss Account annexed thereto for the year ended on that date, whichare in agreement with the Company’s books of account.As required by the Manufacturing and Other Companies (Auditors’ Report) Order, 1988, issued bythe Company Law Board in terms of Section 227 (4A) of the Companies Act, 1956, in our opinionand on the basis of such checks of the books and records as we considered appropriate andaccording to the information and explanations given to us during the course of the audit, we stateon the matters specified in paragraphs 4 and 5 of the said order, to the extent applicable, as under :1. The Company has not taken or granted any loans, secured or unsecured from or to companies,firms or other parties listed in the Register maintained under section 301 of Companies Act,1956. In terms of section 370(6) of the Companies Act, 1956 provisions of the said sectionare not applicable to a company on or after 31st October 1998.2. In respect of the loans and advances, in the nature of loans given by the Company, theparties have repaid the principal amount where stipulated and have also been regular in thepayment of interest, where applicable.3. The Company has not accepted any deposits from the public.4. No undisputed amounts payable in respect of Income-tax, Wealth-tax, Sales-tax, Customsduty and Excise duty were outstanding as at 31st March, 2001 for a period of more than sixmonths from the date they became payable.5. No personal expenses have been charged to revenue account.6. The Company has maintained adequate documents and records for loans and advancesgranted on the basis of security by way of pledge of shares, debentures & other securities.7. As informed to us, the provisions of any special statute applicable to chit fund, nidhi, mutualbenefit society are not applicable to the company.Mumbai, 20th April, 2001ANNEXURES TO DIRECTORS’ REPORT8. The Company is not dealing or trading in shares, securities, debentures and other investments,hence the question of maintaining proper records of transactions and contracts and making timelyentries therein, does not arise. The investments have been held by the Company in its own name.Further to the above, we have obtained all the information and explanations which to the best ofour knowledge and belief were necessary for the purpose of our audit.In our opinion, proper books of accounts as required by law have been kept by the Company sofar as appears from our examination of those books.In our opinion, the profit and loss account and Balance Sheet comply with the accounting standardsas referred to in Section 211 (3C) of the Companies Act, 1956.On the basis of confirmation received from the Directors and taken on record by the Board ofDirectors, none of the Director is disqualified as on date from being appointed as a Directorunder Section 274(1)(g) of the Companies Act, 1956.In our opinion and to the best of our information and according to the explanations given to us,the said accounts, with the notes thereon give the information required by the Companies Act,1956 in the manner so required and the Balance Sheet and the Profit and Loss Account give atrue and fair view of the state of the Company’s affairs as at the close of the year and of theProfit for the year, respectively.For and on behalf ofKHIMJI KUNVERJI & CO.Chartered AccountantsSHIVJI K. VIKAMSEYPartnerDirectorsDIRECTORS’ RESPONSIBILITY STATEMENT UNDER SECTION 217(2AA) OF THE COMPA-NIES ACT, 1956We, directors of Rajnidhi Finance Limited would like to state that• In the preparation of the Annual Accounts for the year ended 31st March, 2001, the applicable AccountingStandards had been followed along with proper explanation relating to material departures.• We have selected such accounting policies and applied them constantly and made judgementsand estimates that are reasonable and prudent so as to give a true and fair view of the stateof affairs of the Company at the end of the Financial Year ended 31st March, 2001 and of theprofit of the Company for that period.• We have taken proper and sufficient care for the maintenance of adequate accounting recordsin accordance with the provisions of the Act for safeguarding the assets of the Company andfor preventing and detecting fraud and other irregularities.• We have prepared the Annual Accounts on a going concern basis.COMPLIANCE CERTIFICATEI have examined registers, records, books of Rajnidhi Finance <strong>Ltd</strong>. as required to be maintained under CompaniesAct, 1956 and the rules made thereunder and provisions of Memorandum of Articles of Association for FinancialYear ended 31-03-2001. In my opinion and according to explanation given by the Company I certify as under:1. Company has kept all registers as required and entries have been made.2. Company has filed all forms and returns as required by Law with R.O.C.3. Board Meetings have been held regularly and notices were given for each Board Meeting, Minute books wereproperly written and signed4. A.G.M. was held in time, notice was given to all members and minutes of A.G.M. were written and signed in time.5. Section 295 and 297 are not applicable to the Company.6. Proper entries in Register under Section 301 were made.7. Section 314 is not applicable.8. There is no issue of any Shares or Debentures.9. Section 217 is not applicable.10. Board of Directors is duly constituted and there is no M.D., W.T.D.11. There is no sole selling Agent.12. Directors have disclosed their interest as per Section 299.13. Section 58 A is not applicable to the Company.14. Company has not bought back any Shares.15. Company has not borrowed any amount from Banks, F.I. and others.16. Company has not altered any provision of Memorandum and Articles.17. Company has not received any show cause notice from R.O.C. or other authority.18. Provident Fund Act is not applicable.C.R.DamaniCompany SecretaryC.P.No.445