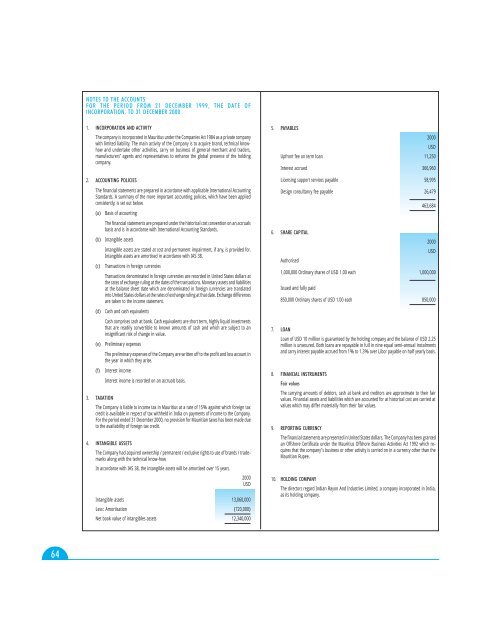

NOTES TO THE ACCOUNTS1. INCORPORATION <strong>AND</strong> ACTIVITY2. ACCOUNTING POLICIES(a) Basis of accounting(b) Intangible assets(c) Transactions in foreign currencies(d) Cash and cash equivalents(e) Preliminary expenses(f) Interest incomeInterest income is recorded on an accruals basis.3. TAXATION4. INTANGIBLE ASSETS123FOR THE PERIOD FROM 21 DECEMBER 1999, THE DATE OFINCORPORATION, TO 31 DECEMBER 2000The company is incorporated in Mauritius under the Companies Act 1984 as a private companywith limited liability. The main activity of the Company is to acquire brand, technical knowhowand undertake other activities, carry on business of general merchant and traders,manufacturers’ agents and representatives to enhance the global presence of the holdingcompany.The financial statements are prepared in accordance with applicable International AccountingStandards. A summary of the more important accounting policies, which have been appliedconsistently, is set out below.The financial statements are prepared under the historical cost convention on an accrualsbasis and is in accordance with International Accounting Standards.Intangible assets are stated at cost and permanent impairment, if any, is provided for.Intangible assets are amortised in accordance with IAS 38.Transactions denominated in foreign currencies are recorded in United States dollars atthe rates of exchange ruling at the dates of the transactions. Monetary assets and liabilitiesat the balance sheet date which are denominated in foreign currencies are translatedinto United States dollars at the rates of exchange ruling at that date. Exchange differencesare taken to the income statement.Cash comprises cash at bank. Cash equivalents are short term, highly liquid investmentsthat are readily convertible to known amounts of cash and which are subject to aninsignificant risk of change in value.The preliminary expenses of the Company are written off to the profit and loss account inthe year in which they arise.The Company is liable to income tax in Mauritius at a rate of 15% against which foreign taxcredit is available in respect of tax withheld in India on payments of income to the Company.For the period ended 31 December 2000, no provision for Mauritian taxes has been made dueto the availability of foreign tax credit.The Company had acquired ownership / permanent / exclusive rights to use of brands / trademarksalong with the technical know-how.In accordance with IAS 38, the intangible assets will be amortised over 15 years.2000USDIntangible assets 13,060,000Less: Amortisation (720,000)Net book value of intangibles assets 12,340,0005. PAYABLES2000USDUpfront fee on term loan 11,250Interest accrued 366,960Licensing support services payable 58,995Design consultancy fee payable 26,4796. SHARE CAPITALAuthorised463,6842000USD1,000,000 Ordinary shares of USD 1.00 each 1,000,000Issued and fully paid850,000 Ordinary shares of USD 1.00 each 850,0007. LOANLoan of USD 10 million is guaranteed by the holding company and the balance of USD 2.25million is unsecured. Both loans are repayable in full in nine equal semi-annual instalmentsand carry interest payable accrued from 1% to 1.3% over Libor payable on half yearly basis.8. FINANCIAL INSTRUMENTSFair valuesThe carrying amounts of debtors, cash at bank and creditors are approximate to their fairvalues. Financial assets and liabilities which are accounted for at historical cost are carried atvalues which may differ materially from their fair values.9. REPORTING CURRENCYThe financial statements are presented in United States dollars. The Company has been grantedan Offshore Certificate under the Mauritius Offshore Business Activities Act 1992 which requiresthat the company’s business or other activity is carried on in a currency other than theMauritian Rupee.10. HOLDING COMPANYThe directors regard Indian Rayon And Industries Limited, a company incorporated in India,as its holding company.

BIRLA SUN LIFE INSURANCE COMPANY <strong>LIMITED</strong>BOARD OF DIRECTORS’ REPORTApril 16, 2001The Members of <strong>Birla</strong> Sun Life Insurance Company LimitedThe Board of Directors of your Company are pleased to present the first audited accounts,auditor’s report, Management Report and the report of the Board of Directors to themembers of <strong>Birla</strong> Sun Life Insurance Company Limited from August 4, 2000 to March 31,2001. The Company was incorporated on August 4, 2000 for selling life and group insuranceproducts in the Indian market. It has been promoted by the <strong>Aditya</strong> <strong>Birla</strong> Group of Indiaand Sun Life Financial of Canada. The <strong>Aditya</strong> <strong>Birla</strong> Group is a premium conglomerate withinterests in aluminium, fibre, cement, telecommunications, fertilisers, textiles, financialservices, etc and has operations in India, South-east Asia and Canada. Sun Life Financialoffers life assurance products and wealth management services to individuals and groups.Its main operations are in North America, Europe and Asia. The <strong>Aditya</strong> <strong>Birla</strong> Group andSun Life already operate one of the largest mutual fund in India and other companies inthe financial services sector which distribute financial products and provide broking servicesto customers.Both partners intend that the Company should be a significant player in the insurancesector via this Company. You will be pleased to note that the Insurance Regulatory andDevelopment Authority (‘IRDA’) has permitted your Company to sell life insurance productsin India. The Certificate of Registration to transact life insurance business in India wasgranted by the IRDA on January 31, 2001. Prior to the grant of this Certificate, themembers of the Company had subscribed to 120,000,000 (120 million) shares of Rs 10each amounting to Rs 1,200,000,000 (1.2 billion). The IRDA has also approved the initialproducts that the Company plans to offer in the market. The Company has commencedselling these products on March 19, 2001. By March 31, 2001, the Company had sold 286policies in the cities of Mumbai and Delhi.Since life assurance profits take a number of years to emerge and since the Company hashad a very short time to operate in the year ended March 31, 2001, the Company hasincurred a loss amounting to Rs 83.19 million. A summary of the financial results of theCompany is as under:ParticularsRs millionPremium Income (net) 3.19Income from investments 15.65Less : ExpensesCommission 0.64Operating expenses 94.90Depreciation 4.58Provision for actuarial liability 1.63Loss for the year 83.19ACTUARY’S REPORTThe report of the Appointed Actuary, as prescribed under Insurance Regulatory andDevelopment Authority (Actuarial Report & Abstract) Regulations, 2000, is attached to theReport of the Board of Directors.DIVIDENDSince the Company has incurred a loss for the year, the Directors are unable to recommendany dividend for this financial year (ie for the period August 4, 2000 to March 31, 2001)CURRENT OPERATIONS, FUTURE PROSPECTS <strong>AND</strong> STRATEGYAs you are aware, India has a population exceeding one billion and the penetration ofinsurance products in India is low compared to world standards for developing countries.India’s 200 million middle class population is growing and with increasing aspirations theneed for risk cover will be felt acutely. Till recently, the Life Insurance Corporation of Indiawas the only company offering such products in India. In order to provide the Indianmarket with a wide variety of insurance products and also to broad base the market,private players are now allowed to offer insurance products in the Indian market providedthat the stipulations laid down by the IRDA are met by each participant.The Company has conducted extensive market surveys to determine the market and thenature of products that would be best suited to the particular requirements of the Indiancustomer. Keeping this in mind, the Company has introduced a new product in the market.The Company is currently offering an investment linked product to individual customerswhich offers customers flexibilty in selecting the tenure of the product, its premium paymentterms, investment profile and receipt of benefits. The product has been branded on thebasis of the benefit options. The names of the products are as follows:Name of product Description BenefitsFlexi Cash Flow Money Back Plan Returns money at periodic intervalsFlexi Save Plus Endowment Plan Returns money at the end of the contract termFlexi Life Line Whole Life Plan Returns money at the end of the contract termThe customer also has the choice of selecting from one of three funds wherein the proposedinvestment mix are outlined at the very beginning providing the customer with a sense of theexpected yields on the investments and the risks involved along with the same. The benefitsthat the customer will receive will have a direct correlation with the actual yield on the assetsin each fund. The Company will internally track the yields on these assets. The funds offeredto customers have also been branded and their assets composition will be as follows:AssetsInvestment OptionsUpper limit of % of assets in: Protector Builder EnhancerGovt and Govt approved securities 85% 70% 55%Corporate Bonds 30% 30% 30%Money Market instruments 20% 20% 20%Infrastructure investments 25% 25% 25%Listed equities 10% 20% 35%Annualised Minimum Guarantee 6% 4.5% 3%Currently, the Company has an individual field force of 213 agents in Mumbai and Delhi.These agents have been selected through a rigorous selection process, which involvedpsychometric tests and grueling interviews. The Company has also trained these agents inexcess of the requirements stipulated by the IRDA and in line with world standards. TheCompany expects the recruitment and training of agents to be an ongoing process since theseagents will be the principal channel of distribution for its products as generally life insuranceis sold and not bought by customers all over the world. The Company expects to openbranches in additional cities in the current financial year to complement the additional 800agents that it plans to recruit and train in this year. The Company is aware of the high cost ofrecruitment and training of agents and has taken appropriate steps to reduce their turnover.In addition to the agency channel, the Company is making path breaking efforts to widen itsdistribution reach by tying up with Citibank NA to offer the Company’s life insurance productsto its customers. This will ensure that the Company can distribute its products to the rightsegment of the market and in those cities where it does not have a physical presence. TheCompany is exploring similar relationships with other banks and financial product companies.The Company has also set up a call centre to handle customer queries and the same willalso be used as a direct marketing tool to assist the individual agency channel in its efforts.The Company has also set up a web site to disseminate information about the Companyand its products. The web-site will be converted into a sales channel whenever theregulations permit the sameThe Company is planning to offer retirement products such as gratuity funds andsuperannuation funds to certain groups of people such as employees of a company, doctors,lawyers, etc. These products are under development and will be used to tap the vastpotential for retirement benefits in the countryThe Company is also required to offer products to the rural and underprivileged populationof the Country. Adequate steps are being taken to ensure that these requirements are notonly met but surpassed since one of the Company ‘s manifold objectives is to improve thequality of life of the people of IndiaIn order to fulfill the targets set by the Company, significant expenditure will be incurred inthe initial years of operations. This will result in losses in these years. As per current plansand budgets, the Company expects to break even at the end of the sixth year of itsoperations and all the losses are expected to be equalised by the eighth year of operations.The insurance business is a capital intensive business, and further capital injections will berequired over this period. However, the losses resulting from investment in the developmentof the distribution network, new products and back office operations will gradually beovertaken by positive cash flow from the business that has been sold, leading to a positiveand healthy position.DIRECTORSThe first directors of your Company were:Mr. Kumar Mangalam <strong>Birla</strong>, Mr. S. K. Mitra, Mr. B. N. Puranmalka.Mr. Vijay Singh, representative of Sun Life on the Board of the Company, was appointed asan Additional Director in the meeting of the Board of Directors held on 8th August, ’00 andholds the position till the commencement of the First Annual General Meeting of the Company.Mr. Donald Stewart and Mr. Douglas Henck also from Sun Life were appointed as AdditionalDirectors of the Company in the meeting of the Board of Directors held on 24th December, 2000and hold the position till the commencement of the First Annual General Meeting of the Company.All are proposed to be re-appointed as Directors under Section 256 of the Companies Act, 1956.RETIREMENT OF DIRECTORSMr. SK Mitra, Director of your Company is liable to retire by rotation at the forthcomingFirst Annual General Meeting and being eligible, offers himself for re-appointment. Yourdirectors recommend his re-appointment.AUDITORSM/s SB Billimoria & Co, Chartered Accountants, retire at the conclusion of the forthcomingAnnual General Meeting and being eligible offer themselves for re-appointment. Yourdirectors recommend their re-appointment.AUDITORS’ REPORTThe report of the Auditors is attached to this report. All the Notes to Schedules andAccounts are self-explanatory and do not call for any further comments except for the issue65