INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

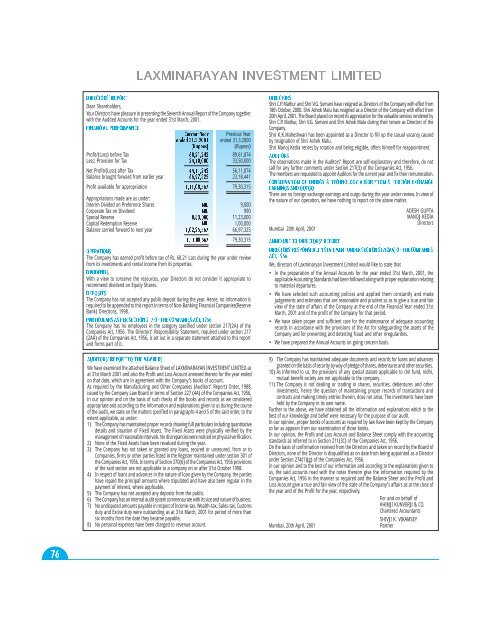

DIRECTORSShri C.P. Mathur and Shri V.G. Somani have resigned as Directors of the Company with effect from18th October, 2000. Shri Ashok Malu has resigned as a Director of the Company with effect from20th April, 2001. The Board placed on record its appreciation for the valuable services rendered byShri C.P. Mathur, Shri V.G. Somani and Shri Ashok Malu during their tenure as Directors of theCompany.Shri K.K.Maheshwari has been appointed as a Director to fill up the casual vacancy causedby resignation of Shri Ashok Malu.Shri Manoj Kedia retires by rotation and being eligible, offers himself for reappointment.123 76LAXMINARAYAN INVESTMENT <strong>LIMITED</strong>DIRECTORS’ REPORTDear Shareholders,Your Directors have pleasure in presenting the Seventh Annual Report of the Company togetherwith the Audited Accounts for the year ended 31st March, 2001.FINANCIAL PERFORMANCECurrent Year Previous Yearended 31.3.2001 ended 31.3.2000(Rupees)(Rupees)Profit/(Loss) before Tax 68,21,242 89,61,874Less: Provision for Tax 24,10,000 33,50,000Net Profit/(Loss) after Tax 44,11,242 56,11,874Balance brought forward from earlier year 66,97,325 23,18,441Profit available for appropriation 1,11,08,567 79,30,315Appropriations made are as under:Interim Divided on Preference Shares NIL 9,000Corporate Tax on Dividend NIL 990Special Reserve 8,83,000 11,23,000Capital Redemption Reserve NIL 1,00,000Balance carried forward to next year 1,02,25,567 66,97,325 Mumbai 20th April, 20011,11,08,567 79,30,315ANNEXURE TO DIRECTORS’ REPORTOPERATIONSThe Company has earned profit before tax of Rs. 68.21 Lacs during the year under reviewACT, 1956from its investments and rental income from its properties.DIVIDENDSWith a view to conserve the resources, your Directors do not consider it appropriate torecommend dividend on Equity Shares.DEPOSITSThe Company has not accepted any public deposit during the year. Hence, no information isrequired to be appended to this report in terms of Non-Banking Financial Companies(ReserveBank) Directions, 1998.PARTICULARS AS PER SECTION 217 OF THE COMPANIES ACT, 1956The Company has no employees in the category specified under section 217(2A) of theCompanies Act, 1956. The Directors’ Responsibility Statement, required under section 217(2AA) of the Companies Act, 1956, is set out in a separate statement attached to this reportand forms part of it.AUDITORS’ REPORT TO THE MEMBERSWe have examined the attached Balance Sheet of LAXMINARAYAN INVESTMENT <strong>LIMITED</strong> asat 31st March 2001 and also the Profit and Loss Account annexed thereto for the year endedon that date, which are in agreement with the Company’s books of account.As required by the Manufacturing and Other Companies (Auditors’ Report) Order, 1988,issued by the Company Law Board in terms of Section 227 (4A) of the Companies Act, 1956,in our opinion and on the basis of such checks of the books and records as we consideredappropriate and according to the information and explanations given to us during the courseof the audit, we state on the matters specified in paragraphs 4 and 5 of the said order, to theextent applicable, as under:1) The Company has maintained proper records showing full particulars including quantitativedetails and situation of Fixed Assets. The Fixed Assets were physically verified by themanagement of reasonable intervals. No discrepancies were noticed on physical verification.2) None of the Fixed Assets have been revalued during the year.3) The Company has not taken or granted any loans, secured or unsecured, from or toCompanies, firms or other parties listed in the Register maintained under section 301 ofthe Companies Act, 1956. In terms of Section 370(6) of the Companies Act, 1956 provisionsof the said section are not applicable to a company on or after 31st October 1998.4) In respect of loans and advances in the nature of loan given by the Company, the partieshave repaid the principal amounts where stipulated and have also been regular in thepayment of interest, where applicable.5) The Company has not accepted any deposits from the public.6) The Company has an internal audit system commensurate with its size and nature of business.7) No undisputed amounts payable in respect of Income-tax, Wealth-tax, Sales-tax, Customsduty and Excise duty were outstanding as at 31st March, 2001 for period of more thansix months from the date they became payable.8) No personal expenses have been charged to revenue account.Mumbai, 20th April, 2001AUDITORSThe observations made in the Auditors’ Report are self-explanatory and therefore, do notcall for any further comments under Section 217(3) of the Companies Act, 1956.The members are requested to appoint Auditors for the current year and fix their remuneration.CONSERVATION OF ENERGY & TECHNOLOGY ABSORPTION & FOREIGN EXCHANGEEARNINGS <strong>AND</strong> OUTGOThere are no foreign exchange earnings and outgo during the year under review. In view ofthe nature of our operation, we have nothing to report on the above matter.ADESH GUPTAMANOJ KEDIADirectorsDIRECTORS’ RESPONSIBILITY STATEMENT UNDER SECTION 217(2AA) OF THE COMPANIESWe, directors of Laxminaryan Investment Limited would like to state that• In the preparation of the Annual Accounts for the year ended 31st March, 2001, theapplicable Accounting Standards had been followed along with proper explanation relatingto material departures.• We have selected such accounting policies and applied them constantly and madejudgements and estimates that are reasonable and prudent so as to give a true and fairview of the state of affairs of the Company at the end of the Financial Year ended 31stMarch, 2001 and of the profit of the Company for that period.• We have taken proper and sufficient care for the maintenance of adequate accountingrecords in accordance with the provisions of the Act for safeguarding the assets of theCompany and for preventing and detecting fraud and other irregularities.• We have prepared the Annual Accounts on going concern basis.9) The Company has maintained adequate documents and records for loans and advancesgranted on the basis of security by way of pledge of shares, debentures and other securities.10) As informed to us, the provisions of any special statute applicable to chit fund, nidhi,mutual benefit society are not applicable to the company.11) The Company is not dealing or trading in shares, securities, debentures and otherinvestments, hence the question of maintaining proper records of transactions andcontracts and making timely entries therein, does not arise. The investments have beenheld by the Company in its own name.Further to the above, we have obtained all the information and explanations which to thebest of our knowledge and belief were necessary for the purpose of our audit.In our opinion, proper books of accounts as required by law have been kept by the Companyso far as appears from our examination of those books.In our opinion, the Profit and Loss Account and Balance Sheet comply with the accountingstandards as referred to in Section 211(3C) of the Companies Act, 1956.On the basis of confirmation received from the Directors and taken on record by the Board ofDirectors, none of the Director is disqualified as on date from being appointed as a Directorunder Section 274(1)(g) of the Companies Act, 1956.In our opinion and to the best of our information and according to the explanations given tous, the said accounts read with the notes thereon give the information required by theCompanies Act, 1956 in the manner so required and the Balance Sheet and the Profit andLoss Account give a true and fair view of the state of the Company’s affairs as at the close ofthe year and of the Profit for the year, respectively.For and on behalf ofKHIMJI KUNVERJI & CO.Chartered AccountantsSHIVJI K. VIKAMSEYPartner