INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

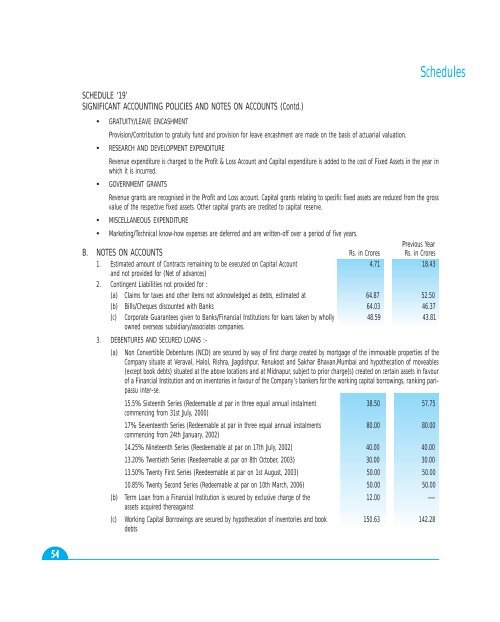

• GRATUITY/LEAVE ENCASHMENTProvision/Contribution to gratuity fund and provision for leave encashment are made on the basis of actuarial valuation.• RESEARCH <strong>AND</strong> DEVELOPMENT EXPENDITURERevenue expenditure is charged to the Profit & Loss Account and Capital expenditure is added to the cost of Fixed Assets in the year inwhich it is incurred.• GOVERNMENT GRANTSRevenue grants are recognised in the Profit and Loss account. Capital grants relating to specific fixed assets are reduced from the grossvalue of the respective fixed assets. Other capital grants are credited to capital reserve.• MISCELLANEOUS EXPENDITURE• Marketing/Technical know-how expenses are deferred and are written-off over a period of five years.Previous YearB. NOTES ON ACCOUNTS Rs. in Crores Rs. in Crores1. Estimated amount of Contracts remaining to be executed on Capital Account 4.71 18.43and not provided for (Net of advances)2. Contingent Liabilities not provided for :(a) Claims for taxes and other items not acknowledged as debts, estimated at 64.87 52.50(b) Bills/Cheques discounted with Banks 64.03 46.37(c) Corporate Guarantees given to Banks/Financial Institutions for loans taken by wholly 48.59 43.81owned overseas subsidiary/associates companies.3. DEBENTURES <strong>AND</strong> SECURED LOANS :-(a) Non Convertible Debentures (NCD) are secured by way of first charge created by mortgage of the immovable properties of theCompany situate at Veraval, Halol, Rishra, Jagdishpur, Renukoot and Sakhar Bhavan,Mumbai and hypothecation of moveables(except book debts) situated at the above locations and at Midnapur, subject to prior charge(s) created on certain assets in favourof a Financial Institution and on inventories in favour of the Company’s bankers for the working capital borrowings, ranking paripassuinter-se.15.5% Sixteenth Series (Redeemable at par in three equal annual instalment 38.50 57.75commencing from 31st July, 2000)17% Seventeenth Series (Redeemable at par in three equal annual instalments 80.00 80.00commencing from 24th January, 2002)14.25% Nineteenth Series (Reedeemable at par on 17th July, 2002) 40.00 40.0013.20% Twentieth Series (Reedeemable at par on 8th October, 2003) 30.00 30.0013.50% Twenty First Series (Reedeemable at par on 1st August, 2003) 50.00 50.0010.85% Twenty Second Series (Redeemable at par on 10th March, 2006) 50.00 50.00(b) Term Loan from a Financial Institution is secured by exclusive charge of the 12.00 —assets acquired thereagainst(c) Working Capital Borrowings are secured by hypothecation of inventories and book 150.63 142.28debts123SCHEDULE ‘19’SIGNIFICANT ACCOUNTING POLICIES <strong>AND</strong> NOTES ON ACCOUNTS (Contd.)Schedules