financial report and registration document 2011 - Groupe SEB

financial report and registration document 2011 - Groupe SEB

financial report and registration document 2011 - Groupe SEB

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Note 19.3. RESERVES AND RETAINED<br />

EARNINGS (BEFORE<br />

APPROPRIATION OF PROFIT)<br />

Reserves <strong>and</strong> retained earnings include the reserves recorded in the<br />

balance sheet of <strong>SEB</strong> S.A. (including €766 million available for distribution<br />

at 31 December <strong>2011</strong>, €747 million at 31 December 2010 <strong>and</strong> €753 million at<br />

31 December 2009), <strong>and</strong> <strong>SEB</strong> S.A.’s shares of the post-acquisition retained<br />

earnings of consolidated subsidiaries.<br />

<strong>SEB</strong> S.A.’s share of the retained earnings of foreign subsidiaries is considered<br />

as being permanently reinvested <strong>and</strong> withholding taxes or additional taxes on<br />

distributed income are recognised only when distribution of these amounts<br />

is planned or considered probable.<br />

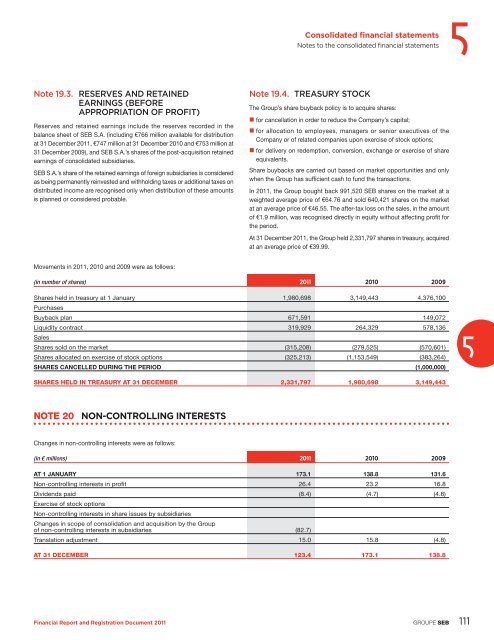

Movements in <strong>2011</strong>, 2010 <strong>and</strong> 2009 were as follows:<br />

Financial Report <strong>and</strong> Registration Document <strong>2011</strong><br />

5<br />

Consolidated fi nancial statements<br />

Notes to the consolidated fi nancial statements<br />

Note 19.4. TREASURY STOCK<br />

The Group’s share buyback policy is to acquire shares:<br />

� for cancellation in order to reduce the Company’s capital;<br />

� for allocation to employees, managers or senior executives of the<br />

Company or of related companies upon exercise of stock options;<br />

� for delivery on redemption, conversion, exchange or exercise of share<br />

equivalents.<br />

Share buybacks are carried out based on market opportunities <strong>and</strong> only<br />

when the Group has suffi cient cash to fund the transactions.<br />

In <strong>2011</strong>, the Group bought back 991,520 <strong>SEB</strong> shares on the market at a<br />

weighted average price of €64.76 <strong>and</strong> sold 640,421 shares on the market<br />

at an average price of €46.55. The after-tax loss on the sales, in the amount<br />

of €1.9 million, was recognised directly in equity without affecting profi t for<br />

the period.<br />

At 31 December <strong>2011</strong>, the Group held 2,331,797 shares in treasury, acquired<br />

at an average price of €39.99.<br />

(in number of shares) <strong>2011</strong> 2010 2009<br />

Shares held in treasury at 1 January<br />

Purchases<br />

1,980,698 3,149,443 4,376,100<br />

Buyback plan 671,591 149,072<br />

Liquidity contract<br />

Sales<br />

319,929 264,329 578,136<br />

Shares sold on the market (315,208) (279,525) (570,601)<br />

Shares allocated on exercise of stock options (325,213) (1,153,549) (383,264)<br />

SHARES CANCELLED DURING THE PERIOD (1,000,000)<br />

SHARES HELD IN TREASURY AT 31 DECEMBER 2,331,797 1,980,698 3,149,443<br />

NOTE 20 NON-CONTROLLING INTERESTS<br />

Changes in non-controlling interests were as follows:<br />

(in € millions) <strong>2011</strong> 2010 2009<br />

AT 1 JANUARY 173.1 138.8 131.6<br />

Non-controlling interests in profi t 26.4 23.2 16.8<br />

Dividends paid<br />

Exercise of stock options<br />

Non-controlling interests in share issues by subsidiaries<br />

Changes in scope of consolidation <strong>and</strong> acquisition by the Group<br />

(8.4) (4.7) (4.8)<br />

of non-controlling interests in subsidiaries (82.7)<br />

Translation adjustment 15.0 15.8 (4.8)<br />

AT 31 DECEMBER 123.4 173.1 138.8<br />

GROUPE <strong>SEB</strong><br />

5<br />

111