Style: August 03, 2017

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

STYLE | finance 65<br />

THEY GET ONTO THE PROPERTY LADDER EARLY<br />

Buying a house as early as possible can open up the opportunity for other<br />

investments.<br />

By paying off your mortgage as quickly as you can, you can decrease<br />

your interest costs and keep more money in your own pocket.<br />

Once you reach particular loan-to-value ratios, you have the ability<br />

to leverage other investments off your property, and use money you<br />

formerly spent on mortgage repayments on potential income sources<br />

like managed funds.<br />

Property as an investment is an appreciating asset; it will build your<br />

net wealth and create its own equity, too. It’s common to live within<br />

your means, but by allocating your spend to a mortgage, rather than<br />

rent or discretionary spending, you are building wealth.<br />

THEY SEEK OUT PASSIVE INCOME OPTIONS<br />

Passive income is the money received for little effort or personal time from<br />

investments such as rental properties and shares.<br />

If you’re looking at long-term passive income, rental properties could<br />

be a good option as you’ll often have tenants paying off the mortgage.<br />

However, once the mortgage payments are serviced, there may be<br />

little tangible income left over.<br />

Receiving regular lump-sum dividend payments from shares in a<br />

company might be a better option for short-term passive income.<br />

But it’s important, before investing, that you know what the pay-out<br />

schedule is. For this kind of investment you also need a lump sum to<br />

invest and the patience to wait for investment growth.<br />

Don’t forget the option of setting up your own business, which plays<br />

to your expertise, but can generate income based on minimal input<br />

from you if you have someone else running the operation day to day.<br />

Alternatively, an option can be to invest or partner in a business.<br />

THEY RUN THEIR PERSONAL FINANCES LIKE A BUSINESS<br />

Know the importance of budgeting and cashflow.<br />

A lot of people spend their money ad hoc, so are surprised when the<br />

$100 a week they think they allow for discretionary spending (e.g.<br />

eating out) is actually closer to $200-$300. A clear budget helps keep<br />

you on top of your spending and makes you aware how much you<br />

actually have left over to invest. It also allows you to build accurate<br />

financial goals that are specific, measurable, attainable, realistic and<br />

time-based (SMART).<br />

Successful businesses know where they are financially at all times –<br />

personal finances should be no different.<br />

THEY SPEND AND BORROW SMARTLY<br />

Spend the right way and stick to budget.<br />

Ideally, all spending should be done with cash that you have and<br />

not bought on credit or hire purchase as you’ll be subject to higher<br />

interest rates.<br />

Try not to borrow money for things that decrease in value. If you<br />

do need to borrow money, make your mortgage work for you. Don’t<br />

make the mistake of setting the loan up within the mortgage as you’ll<br />

end up paying interest on the item over the lifetime of the mortgage.<br />

Always borrow to the side of the mortgage – just using the house as<br />

collateral is smart as the bank has the security of the property and so is<br />

likely to offer the loan at a lower interest rate.<br />

THEY INVEST<br />

Options for generating wealth are spread over multiple platforms.<br />

For retirement alone, we should be saving around 10-15 per cent of<br />

our annual income. If we save eight per cent in our KiwiSaver, five per<br />

cent should be invested through managed funds, which you can still<br />

have easy access to.<br />

This money will accumulate over time and can be used to help pay<br />

off the mortgage or fund a retirement lifestyle.<br />

THEY INSURE<br />

The time, effort and money invested into organising finances and growing<br />

wealth are protected by the right insurance.<br />

What insurance you need depends on your personal situation, but life<br />

insurance and income protection are key introductory insurances.<br />

Life insurance pays a lump sum to your family and dependents upon<br />

your passing to ensure your debt and funeral costs are covered –<br />

people often choose this to take care of their family when they’re gone<br />

and help them maintain the lifestyle to which they are accustomed. In<br />

some cases, life insurance also pays out when you are diagnosed with a<br />

terminal illness.<br />

Income insurance protects what many say is a person’s greatest<br />

asset – the ability to earn an income. This protection comes in the<br />

form of ongoing incremental payments that cover loss of income while<br />

you cannot work due to illness, and takes away the stress and worry<br />

for you and your family at a time when the focus is on recovery. It<br />

generally pays out for bills and day-to-day spending.<br />

THEY SEEK ADVICE<br />

Successful people leverage the knowledge and advice of professionals<br />

in all areas.<br />

For your money matters, financial advisors are best placed as it’s<br />

their job to know what’s going on and stay up to date. Many advisors<br />

work for their clients for free, too, as they are paid by the suppliers.<br />

An advisor will help you create a tailored financial plan based on<br />

your goals, objectives and risk tolerance. Every individual requires<br />

a unique plan, which will develop throughout your lifetime as your<br />

circumstances, priorities and goals change.<br />

A clear budget helps keep you on top<br />

of your spending...<br />

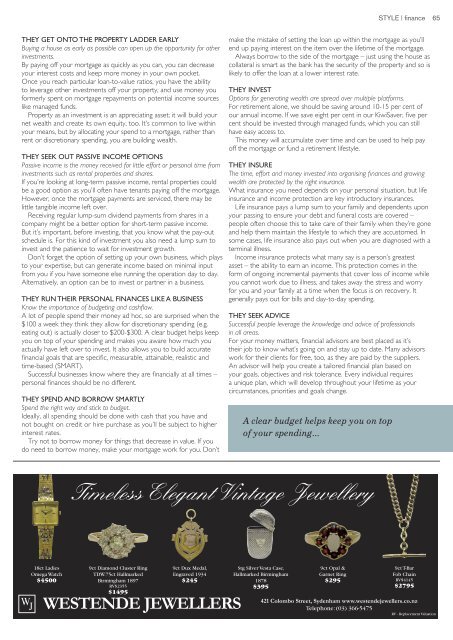

Timeless Elegant Vintage Jewellery<br />

18ct Ladies<br />

Omega Watch<br />

$4500<br />

9ct Diamond Cluster Ring<br />

TDW.75ct Hallmarked<br />

Birmingham 1897<br />

RV$2355<br />

$1495<br />

9ct Dux Medal,<br />

Engraved 1934<br />

$245<br />

Stg Silver Vesta Case,<br />

Hallmarked Birmingham<br />

1878<br />

$395<br />

9ct Opal &<br />

Garnet Ring<br />

$295<br />

9ct T-Bar<br />

Fob Chain<br />

RV$4145<br />

$2795<br />

421 Colombo Street, Sydenham www.westendejewellers.co.nz<br />

Telephone: (<strong>03</strong>) 366-5475<br />

RV - Replacement Valuation