(WIP) ACC 350 Exam 1 Study Material

Work in Process

Work in Process

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Ptt<br />

e.<br />

chs<br />

.<br />

Review 1132<br />

Problems<br />

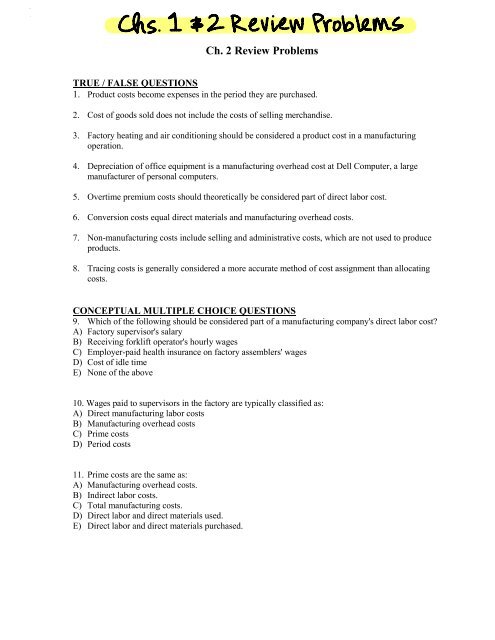

Ch. 2 Review Problems<br />

TRUE / FALSE QUESTIONS<br />

1. Product costs become expenses in the period they are purchased.<br />

2. Cost of goods sold does not include the costs of selling merchandise.<br />

3. Factory heating and air conditioning should be considered a product cost in a manufacturing<br />

operation.<br />

4. Depreciation of office equipment is a manufacturing overhead cost at Dell Computer, a large<br />

manufacturer of personal computers.<br />

5. Overtime premium costs should theoretically be considered part of direct labor cost.<br />

6. Conversion costs equal direct materials and manufacturing overhead costs.<br />

7. Non-manufacturing costs include selling and administrative costs, which are not used to produce<br />

products.<br />

8. Tracing costs is generally considered a more accurate method of cost assignment than allocating<br />

costs.<br />

CONCEPTUAL MULTIPLE CHOICE QUESTIONS<br />

9. Which of the following should be considered part of a manufacturing company's direct labor cost?<br />

A) Factory supervisor's salary<br />

B) Receiving forklift operator's hourly wages<br />

C) Employer-paid health insurance on factory assemblers' wages<br />

D) Cost of idle time<br />

E) None of the above<br />

10. Wages paid to supervisors in the factory are typically classified as:<br />

A) Direct manufacturing labor costs<br />

B) Manufacturing overhead costs<br />

C) Prime costs<br />

D) Period costs<br />

11. Prime costs are the same as:<br />

A) Manufacturing overhead costs.<br />

B) Indirect labor costs.<br />

C) Total manufacturing costs.<br />

D) Direct labor and direct materials used.<br />

E) Direct labor and direct materials purchased.