(WIP) ACC 350 Exam 1 Study Material

Work in Process

Work in Process

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

P<br />

. 7<br />

per<br />

-<br />

3<br />

solutions<br />

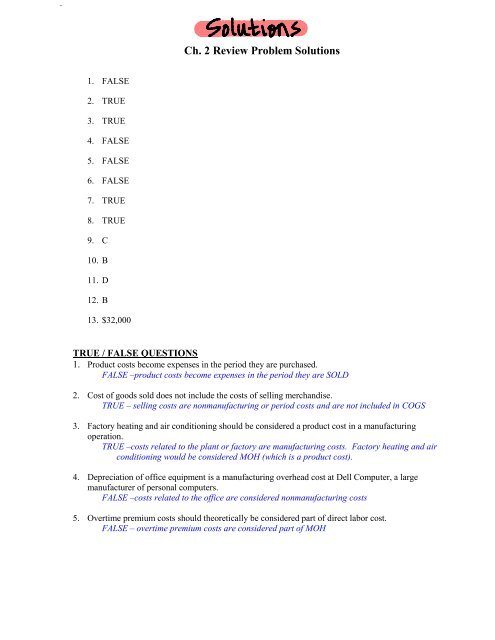

Ch. 2 Review Problem Solutions<br />

1. FALSE<br />

2. TRUE<br />

3. TRUE<br />

4. FALSE<br />

5. FALSE<br />

6. FALSE<br />

7. TRUE<br />

8. TRUE<br />

9. C<br />

10. B<br />

11. D<br />

12. B<br />

13. $32,000<br />

TRUE / FALSE QUESTIONS<br />

1. Product costs become expenses in the period they are purchased.<br />

FALSE –product costs become expenses in the period they are SOLD<br />

2. Cost of goods sold does not include the costs of selling merchandise.<br />

TRUE – selling costs are nonmanufacturing or period costs and are not included in COGS<br />

3. Factory heating and air conditioning should be considered a product cost in a manufacturing<br />

operation.<br />

TRUE –costs related to the plant or factory are manufacturing costs. Factory heating and air<br />

conditioning would be considered MOH (which is a product cost).<br />

4. Depreciation of office equipment is a manufacturing overhead cost at Dell Computer, a large<br />

manufacturer of personal computers.<br />

FALSE –costs related to the office are considered nonmanufacturing costs<br />

5. Overtime premium costs should theoretically be considered part of direct labor cost.<br />

FALSE – overtime premium costs are considered part of MOH