(WIP) ACC 350 Exam 1 Study Material

Work in Process

Work in Process

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

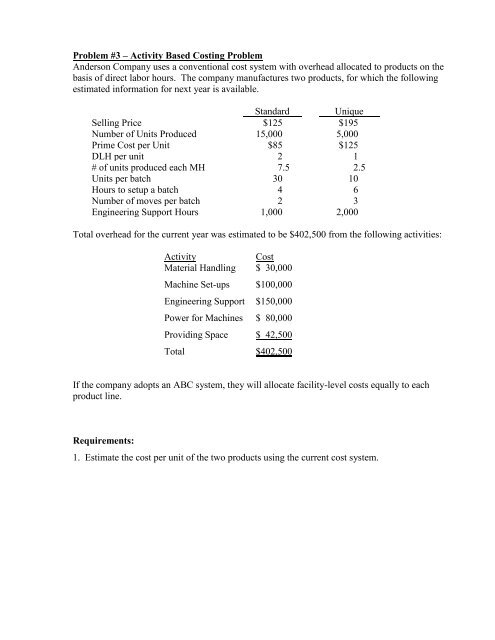

Problem #3 – Activity Based Costing Problem<br />

Anderson Company uses a conventional cost system with overhead allocated to products on the<br />

basis of direct labor hours. The company manufactures two products, for which the following<br />

estimated information for next year is available.<br />

Standard Unique<br />

Selling Price $125 $195<br />

Number of Units Produced 15,000 5,000<br />

Prime Cost per Unit $85 $125<br />

DLH per unit 2 1<br />

# of units produced each MH 7.5 2.5<br />

Units per batch 30 10<br />

Hours to setup a batch 4 6<br />

Number of moves per batch 2 3<br />

Engineering Support Hours 1,000 2,000<br />

Total overhead for the current year was estimated to be $402,500 from the following activities:<br />

Activity<br />

Cost<br />

<strong>Material</strong> Handling $ 30,000<br />

Machine Set-ups $100,000<br />

Engineering Support $150,000<br />

Power for Machines $ 80,000<br />

Providing Space $ 42,500<br />

Total $402,500<br />

If the company adopts an ABC system, they will allocate facility-level costs equally to each<br />

product line.<br />

Requirements:<br />

1. Estimate the cost per unit of the two products using the current cost system.