(WIP) ACC 350 Exam 1 Study Material

Work in Process

Work in Process

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Pg. 22<br />

Sarah Allison Takash<br />

<strong>ACC</strong> <strong>350</strong>, Spring 2018<br />

<strong>Exam</strong> 1 <strong>Study</strong> <strong>Material</strong><br />

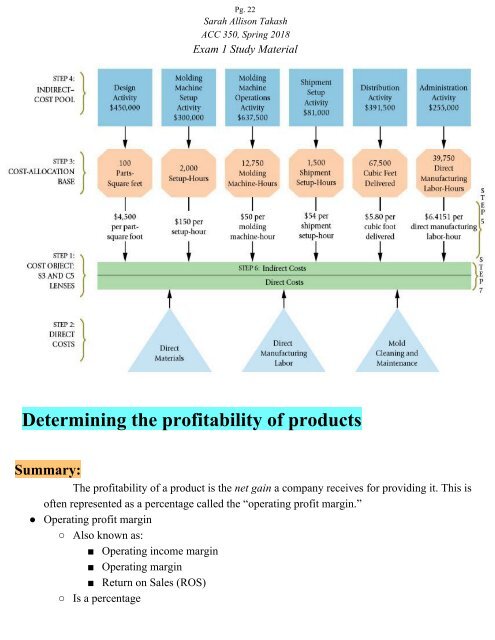

Determining the profitability of products<br />

Summary:<br />

The profitability of a product is the net gain a company receives for providing it. This is<br />

often represented as a percentage called the “operating profit margin.”<br />

● Operating profit margin<br />

○ Also known as:<br />

■ Operating income margin<br />

■ Operating margin<br />

■ Return on Sales (ROS)<br />

○ Is a percentage