(WIP) ACC 350 Exam 1 Study Material

Work in Process

Work in Process

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

P<br />

.<br />

soft<br />

7-19<br />

InClass Problems – Chapter 2<br />

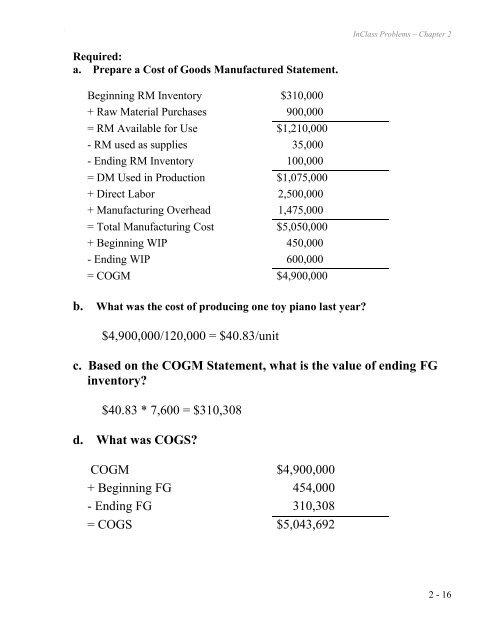

Required:<br />

a. Prepare a Cost of Goods Manufactured Statement.<br />

Beginning RM Inventory $310,000<br />

+ Raw <strong>Material</strong> Purchases 900,000<br />

= RM Available for Use $1,210,000<br />

- RM used as supplies 35,000<br />

- Ending RM Inventory 100,000<br />

= DM Used in Production $1,075,000<br />

+ Direct Labor 2,500,000<br />

+ Manufacturing Overhead 1,475,000<br />

= Total Manufacturing Cost $5,050,000<br />

+ Beginning <strong>WIP</strong> 450,000<br />

- Ending <strong>WIP</strong> 600,000<br />

= COGM $4,900,000<br />

b. What was the cost of producing one toy piano last year?<br />

$4,900,000/120,000 = $40.83/unit<br />

c. Based on the COGM Statement, what is the value of ending FG<br />

inventory?<br />

$40.83 * 7,600 = $310,308<br />

d. What was COGS?<br />

COGM $4,900,000<br />

+ Beginning FG 454,000<br />

- Ending FG 310,308<br />

= COGS $5,043,692<br />

2 - 16