(WIP) ACC 350 Exam 1 Study Material

Work in Process

Work in Process

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Solutions<br />

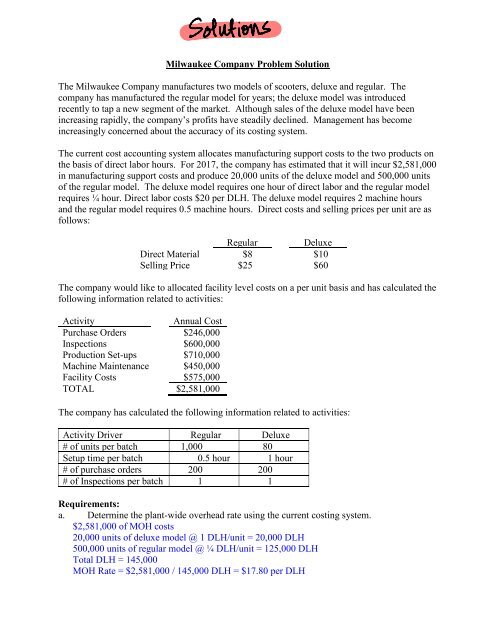

Milwaukee Company Problem Solution<br />

The Milwaukee Company manufactures two models of scooters, deluxe and regular. The<br />

company has manufactured the regular model for years; the deluxe model was introduced<br />

recently to tap a new segment of the market. Although sales of the deluxe model have been<br />

increasing rapidly, the company’s profits have steadily declined. Management has become<br />

increasingly concerned about the accuracy of its costing system.<br />

The current cost accounting system allocates manufacturing support costs to the two products on<br />

the basis of direct labor hours. For 2017, the company has estimated that it will incur $2,581,000<br />

in manufacturing support costs and produce 20,000 units of the deluxe model and 500,000 units<br />

of the regular model. The deluxe model requires one hour of direct labor and the regular model<br />

requires ¼ hour. Direct labor costs $20 per DLH. The deluxe model requires 2 machine hours<br />

and the regular model requires 0.5 machine hours. Direct costs and selling prices per unit are as<br />

follows:<br />

Regular Deluxe<br />

Direct <strong>Material</strong> $8 $10<br />

Selling Price $25 $60<br />

The company would like to allocated facility level costs on a per unit basis and has calculated the<br />

following information related to activities:<br />

Activity<br />

Annual Cost<br />

Purchase Orders $246,000<br />

Inspections $600,000<br />

Production Set-ups $710,000<br />

Machine Maintenance $450,000<br />

Facility Costs $575,000<br />

TOTAL $2,581,000<br />

The company has calculated the following information related to activities:<br />

Activity Driver Regular Deluxe<br />

# of units per batch 1,000 80<br />

Setup time per batch 0.5 hour 1 hour<br />

# of purchase orders 200 200<br />

# of Inspections per batch 1 1<br />

Requirements:<br />

a. Determine the plant-wide overhead rate using the current costing system.<br />

$2,581,000 of MOH costs<br />

20,000 units of deluxe model @ 1 DLH/unit = 20,000 DLH<br />

500,000 units of regular model @ ¼ DLH/unit = 125,000 DLH<br />

Total DLH = 145,000<br />

MOH Rate = $2,581,000 / 145,000 DLH = $17.80 per DLH