(WIP) ACC 350 Exam 1 Study Material

Work in Process

Work in Process

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

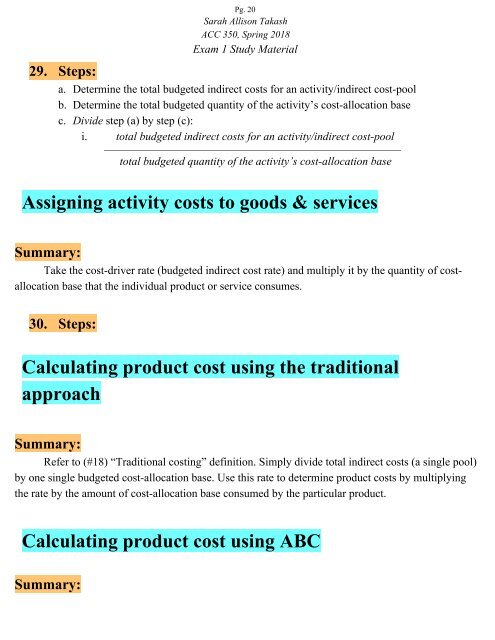

29. Steps:<br />

Pg. 20<br />

Sarah Allison Takash<br />

<strong>ACC</strong> <strong>350</strong>, Spring 2018<br />

<strong>Exam</strong> 1 <strong>Study</strong> <strong>Material</strong><br />

a. Determine the total budgeted indirect costs for an activity/indirect cost-pool<br />

b. Determine the total budgeted quantity of the activity’s cost-allocation base<br />

c. Divide step (a) by step (c):<br />

i. total budgeted indirect costs for an activity/indirect cost-pool<br />

total budgeted quantity of the activity’s cost-allocation base<br />

Assigning activity costs to goods & services<br />

Summary:<br />

Take the cost-driver rate (budgeted indirect cost rate) and multiply it by the quantity of costallocation<br />

base that the individual product or service consumes.<br />

30. Steps:<br />

Calculating product cost using the traditional<br />

approach<br />

Summary:<br />

Refer to (#18) “Traditional costing” definition. Simply divide total indirect costs (a single pool)<br />

by one single budgeted cost-allocation base. Use this rate to determine product costs by multiplying<br />

the rate by the amount of cost-allocation base consumed by the particular product.<br />

Calculating product cost using ABC<br />

Summary: