(WIP) ACC 350 Exam 1 Study Material

Work in Process

Work in Process

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

1=7-11 See<br />

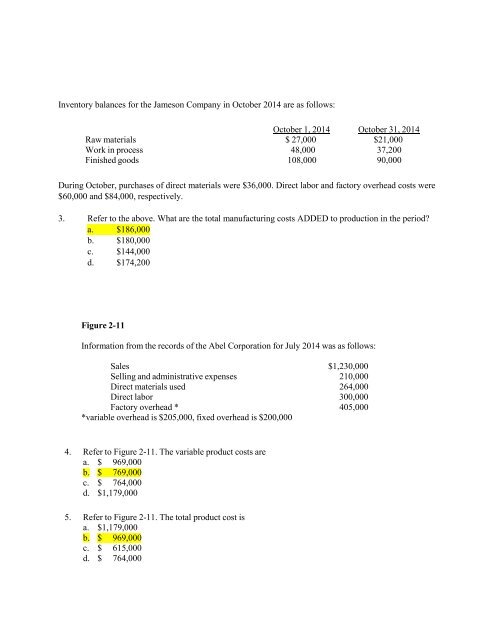

Inventory balances for the Jameson Company in October 2014 are as follows:<br />

October 1, 2014 October 31, 2014<br />

Raw materials $ 27,000 $21,000<br />

Work in process 48,000 37,200<br />

Finished goods 108,000 90,000<br />

During October, purchases of direct materials were $36,000. Direct labor and factory overhead costs were<br />

$60,000 and $84,000, respectively.<br />

3. Refer to the above. What are the total manufacturing costs ADDED to production in the period?<br />

a. $186,000<br />

b. $180,000<br />

c. $144,000<br />

d. $174,200<br />

Figure 2-11<br />

Information from the records of the Abel Corporation for July 2014 was as follows:<br />

Sales $1,230,000<br />

Selling and administrative expenses 210,000<br />

Direct materials used 264,000<br />

Direct labor 300,000<br />

Factory overhead * 405,000<br />

*variable overhead is $205,000, fixed overhead is $200,000<br />

4. Refer to Figure 2-11. The variable product costs are<br />

a. $ 969,000<br />

b. $ 769,000<br />

c. $ 764,000<br />

d. $1,179,000<br />

5. Refer to Figure 2-11. The total product cost is<br />

a. $1,179,000<br />

b. $ 969,000<br />

c. $ 615,000<br />

d. $ 764,000