(WIP) ACC 350 Exam 1 Study Material

Work in Process

Work in Process

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Requirements:<br />

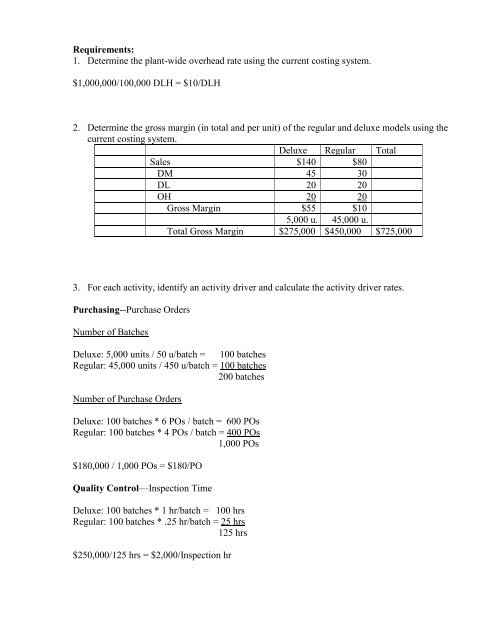

1. Determine the plant-wide overhead rate using the current costing system.<br />

$1,000,000/100,000 DLH = $10/DLH<br />

2. Determine the gross margin (in total and per unit) of the regular and deluxe models using the<br />

current costing system.<br />

Deluxe Regular Total<br />

Sales $140 $80<br />

DM 45 30<br />

DL 20 20<br />

OH 20 20<br />

Gross Margin $55 $10<br />

5,000 u. 45,000 u.<br />

Total Gross Margin $275,000 $450,000 $725,000<br />

3. For each activity, identify an activity driver and calculate the activity driver rates.<br />

Purchasing--Purchase Orders<br />

Number of Batches<br />

Deluxe: 5,000 units / 50 u/batch = 100 batches<br />

Regular: 45,000 units / 450 u/batch = 100 batches<br />

200 batches<br />

Number of Purchase Orders<br />

Deluxe: 100 batches * 6 POs / batch = 600 POs<br />

Regular: 100 batches * 4 POs / batch = 400 POs<br />

1,000 POs<br />

$180,000 / 1,000 POs = $180/PO<br />

Quality Control—Inspection Time<br />

Deluxe: 100 batches * 1 hr/batch = 100 hrs<br />

Regular: 100 batches * .25 hr/batch = 25 hrs<br />

125 hrs<br />

$250,000/125 hrs = $2,000/Inspection hr