Annual report and accounts 2016

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

120<br />

Notes to the consolidated financial statements continued<br />

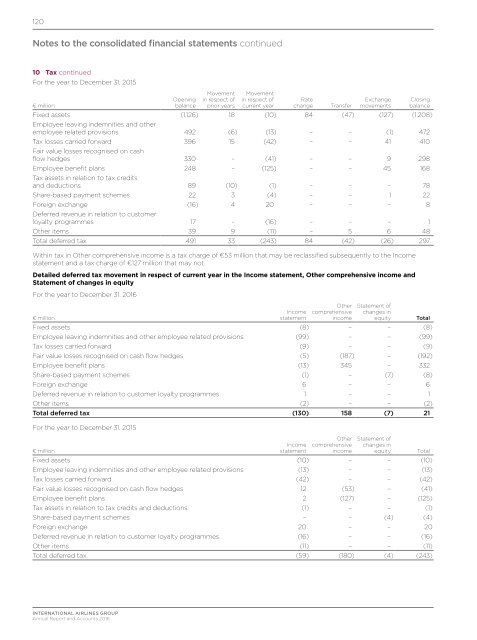

10 Tax continued<br />

For the year to December 31, 2015<br />

€ million<br />

Opening<br />

balance<br />

Movement<br />

in respect of<br />

prior years<br />

Movement<br />

in respect of<br />

current year<br />

Rate<br />

change<br />

Transfer<br />

Exchange<br />

movements<br />

Closing<br />

balance<br />

Fixed assets (1,126) 18 (10) 84 (47) (127) (1,208)<br />

Employee leaving indemnities <strong>and</strong> other<br />

employee related provisions 492 (6) (13) – – (1) 472<br />

Tax losses carried forward 396 15 (42) – – 41 410<br />

Fair value losses recognised on cash<br />

flow hedges 330 – (41) – – 9 298<br />

Employee benefit plans 248 – (125) – – 45 168<br />

Tax assets in relation to tax credits<br />

<strong>and</strong> deductions 89 (10) (1) – – – 78<br />

Share-based payment schemes 22 3 (4) – – 1 22<br />

Foreign exchange (16) 4 20 – – – 8<br />

Deferred revenue in relation to customer<br />

loyalty programmes 17 – (16) – – – 1<br />

Other items 39 9 (11) – 5 6 48<br />

Total deferred tax 491 33 (243) 84 (42) (26) 297<br />

Within tax in Other comprehensive income is a tax charge of €53 million that may be reclassified subsequently to the Income<br />

statement <strong>and</strong> a tax charge of €127 million that may not.<br />

Detailed deferred tax movement in respect of current year in the Income statement, Other comprehensive income <strong>and</strong><br />

Statement of changes in equity<br />

For the year to December 31, <strong>2016</strong><br />

Other<br />

comprehensive<br />

income<br />

Statement of<br />

changes in<br />

equity<br />

€ million<br />

Income<br />

statement<br />

Total<br />

Fixed assets (8) – – (8)<br />

Employee leaving indemnities <strong>and</strong> other employee related provisions (99) – – (99)<br />

Tax losses carried forward (9) – – (9)<br />

Fair value losses recognised on cash flow hedges (5) (187) – (192)<br />

Employee benefit plans (13) 345 – 332<br />

Share-based payment schemes (1) – (7) (8)<br />

Foreign exchange 6 – – 6<br />

Deferred revenue in relation to customer loyalty programmes 1 – – 1<br />

Other items (2) – – (2)<br />

Total deferred tax (130) 158 (7) 21<br />

For the year to December 31, 2015<br />

Other<br />

comprehensive<br />

income<br />

Statement of<br />

changes in<br />

equity<br />

€ million<br />

Income<br />

statement<br />

Total<br />

Fixed assets (10) – – (10)<br />

Employee leaving indemnities <strong>and</strong> other employee related provisions (13) – – (13)<br />

Tax losses carried forward (42) – – (42)<br />

Fair value losses recognised on cash flow hedges 12 (53) – (41)<br />

Employee benefit plans 2 (127) – (125)<br />

Tax assets in relation to tax credits <strong>and</strong> deductions (1) – – (1)<br />

Share-based payment schemes – – (4) (4)<br />

Foreign exchange 20 – – 20<br />

Deferred revenue in relation to customer loyalty programmes (16) – – (16)<br />

Other items (11) – – (11)<br />

Total deferred tax (59) (180) (4) (243)<br />

INTERNATIONAL AIRLINES GROUP<br />

<strong>Annual</strong> Report <strong>and</strong> Accounts <strong>2016</strong>