Annual report and accounts 2016

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

132<br />

Notes to the consolidated financial statements continued<br />

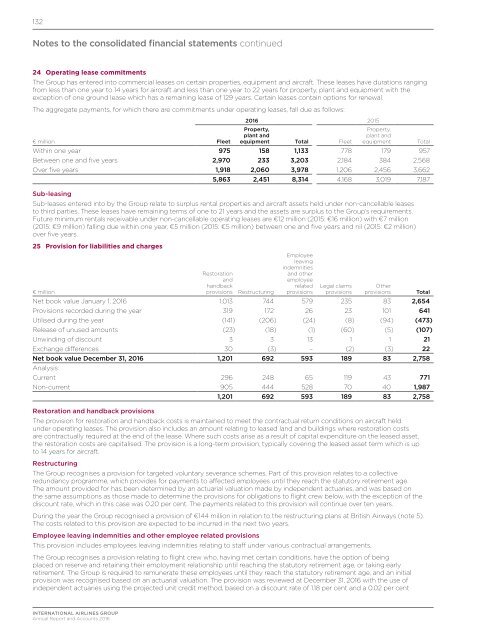

24 Operating lease commitments<br />

The Group has entered into commercial leases on certain properties, equipment <strong>and</strong> aircraft. These leases have durations ranging<br />

from less than one year to 14 years for aircraft <strong>and</strong> less than one year to 22 years for property, plant <strong>and</strong> equipment with the<br />

exception of one ground lease which has a remaining lease of 129 years. Certain leases contain options for renewal.<br />

The aggregate payments, for which there are commitments under operating leases, fall due as follows:<br />

<strong>2016</strong> 2015<br />

€ million Fleet<br />

Property,<br />

plant <strong>and</strong><br />

equipment Total Fleet<br />

Property,<br />

plant <strong>and</strong><br />

equipment Total<br />

Within one year 975 158 1,133 778 179 957<br />

Between one <strong>and</strong> five years 2,970 233 3,203 2,184 384 2,568<br />

Over five years 1,918 2,060 3,978 1,206 2,456 3,662<br />

5,863 2,451 8,314 4,168 3,019 7,187<br />

Sub-leasing<br />

Sub‐leases entered into by the Group relate to surplus rental properties <strong>and</strong> aircraft assets held under non-cancellable leases<br />

to third parties. These leases have remaining terms of one to 21 years <strong>and</strong> the assets are surplus to the Group’s requirements.<br />

Future minimum rentals receivable under non-cancellable operating leases are €12 million (2015: €16 million) with €7 million<br />

(2015: €9 million) falling due within one year, €5 million (2015: €5 million) between one <strong>and</strong> five years <strong>and</strong> nil (2015: €2 million)<br />

over five years.<br />

25 Provision for liabilities <strong>and</strong> charges<br />

Employee<br />

leaving<br />

indemnities<br />

€ million<br />

Restoration<br />

<strong>and</strong><br />

h<strong>and</strong>back<br />

provisions Restructuring<br />

<strong>and</strong> other<br />

employee<br />

related<br />

provisions<br />

Legal claims<br />

provisions<br />

Other<br />

provisions Total<br />

Net book value January 1, <strong>2016</strong> 1,013 744 579 235 83 2,654<br />

Provisions recorded during the year 319 172 26 23 101 641<br />

Utilised during the year (141) (206) (24) (8) (94) (473)<br />

Release of unused amounts (23) (18) (1) (60) (5) (107)<br />

Unwinding of discount 3 3 13 1 1 21<br />

Exchange differences 30 (3) – (2) (3) 22<br />

Net book value December 31, <strong>2016</strong> 1,201 692 593 189 83 2,758<br />

Analysis:<br />

Current 296 248 65 119 43 771<br />

Non-current 905 444 528 70 40 1,987<br />

1,201 692 593 189 83 2,758<br />

Restoration <strong>and</strong> h<strong>and</strong>back provisions<br />

The provision for restoration <strong>and</strong> h<strong>and</strong>back costs is maintained to meet the contractual return conditions on aircraft held<br />

under operating leases. The provision also includes an amount relating to leased l<strong>and</strong> <strong>and</strong> buildings where restoration costs<br />

are contractually required at the end of the lease. Where such costs arise as a result of capital expenditure on the leased asset,<br />

the restoration costs are capitalised. The provision is a long-term provision, typically covering the leased asset term which is up<br />

to 14 years for aircraft.<br />

Restructuring<br />

The Group recognises a provision for targeted voluntary severance schemes. Part of this provision relates to a collective<br />

redundancy programme, which provides for payments to affected employees until they reach the statutory retirement age.<br />

The amount provided for has been determined by an actuarial valuation made by independent actuaries, <strong>and</strong> was based on<br />

the same assumptions as those made to determine the provisions for obligations to flight crew below, with the exception of the<br />

discount rate, which in this case was 0.20 per cent. The payments related to this provision will continue over ten years.<br />

During the year the Group recognised a provision of €144 million in relation to the restructuring plans at British Airways (note 5).<br />

The costs related to this provision are expected to be incurred in the next two years.<br />

Employee leaving indemnities <strong>and</strong> other employee related provisions<br />

This provision includes employees leaving indemnities relating to staff under various contractual arrangements.<br />

The Group recognises a provision relating to flight crew who, having met certain conditions, have the option of being<br />

placed on reserve <strong>and</strong> retaining their employment relationship until reaching the statutory retirement age, or taking early<br />

retirement. The Group is required to remunerate these employees until they reach the statutory retirement age, <strong>and</strong> an initial<br />

provision was recognised based on an actuarial valuation. The provision was reviewed at December 31, <strong>2016</strong> with the use of<br />

independent actuaries using the projected unit credit method, based on a discount rate of 1.18 per cent <strong>and</strong> a 0.02 per cent<br />

INTERNATIONAL AIRLINES GROUP<br />

<strong>Annual</strong> Report <strong>and</strong> Accounts <strong>2016</strong>