Annual report and accounts 2016

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

43<br />

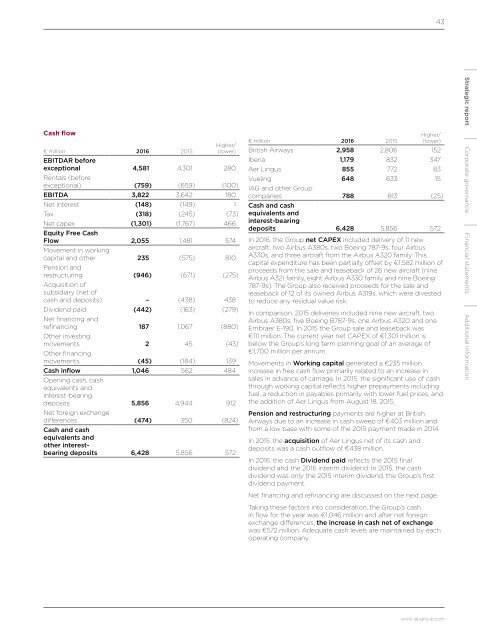

Cash flow<br />

€ million <strong>2016</strong> 2015<br />

Higher/<br />

(lower)<br />

EBITDAR before<br />

exceptional 4,581 4,301 280<br />

Rentals (before<br />

exceptional) (759) (659) (100)<br />

EBITDA 3,822 3,642 180<br />

Net interest (148) (149) 1<br />

Tax (318) (245) (73)<br />

Net capex (1,301) (1,767) 466<br />

Equity Free Cash<br />

Flow 2,055 1,481 574<br />

Movement in working<br />

capital <strong>and</strong> other 235 (575) 810<br />

Pension <strong>and</strong><br />

restructuring (946) (671) (275)<br />

Acquisition of<br />

subsidiary (net of<br />

cash <strong>and</strong> deposits) – (438) 438<br />

Dividend paid (442) (163) (279)<br />

Net financing <strong>and</strong><br />

refinancing 187 1,067 (880)<br />

Other investing<br />

movements 2 45 (43)<br />

Other financing<br />

movements (45) (184) 139<br />

Cash inflow 1,046 562 484<br />

Opening cash, cash<br />

equivalents <strong>and</strong><br />

interest-bearing<br />

deposits 5,856 4,944 912<br />

Net foreign exchange<br />

differences (474) 350 (824)<br />

Cash <strong>and</strong> cash<br />

equivalents <strong>and</strong><br />

other interestbearing<br />

deposits 6,428 5,856 572<br />

€ million <strong>2016</strong> 2015<br />

Higher/<br />

(lower)<br />

British Airways 2,958 2,806 152<br />

Iberia 1,179 832 347<br />

Aer Lingus 855 772 83<br />

Vueling 648 633 15<br />

IAG <strong>and</strong> other Group<br />

companies 788 813 (25)<br />

Cash <strong>and</strong> cash<br />

equivalents <strong>and</strong><br />

interest-bearing<br />

deposits 6,428 5,856 572<br />

In <strong>2016</strong>, the Group net CAPEX included delivery of 11 new<br />

aircraft, two Airbus A380s, two Boeing 787-9s, four Airbus<br />

A330s, <strong>and</strong> three aircraft from the Airbus A320 family. This<br />

capital expenditure has been partially offset by €1,582 million of<br />

proceeds from the sale <strong>and</strong> leaseback of 26 new aircraft (nine<br />

Airbus A321 family, eight Airbus A330 family <strong>and</strong> nine Boeing<br />

787-9s). The Group also received proceeds for the sale <strong>and</strong><br />

leaseback of 12 of its owned Airbus A319s, which were divested<br />

to reduce any residual value risk.<br />

In comparison, 2015 deliveries included nine new aircraft, two<br />

Airbus A380s, five Boeing B787-9s, one Airbus A320 <strong>and</strong> one<br />

Embraer E-190. In 2015 the Group sale <strong>and</strong> leaseback was<br />

€111 million. The current year net CAPEX of €1,301 million is<br />

below the Group’s long term planning goal of an average of<br />

€1,700 million per annum.<br />

Movements in Working capital generated a €235 million<br />

increase in free cash flow primarily related to an increase in<br />

sales in advance of carriage. In 2015, the significant use of cash<br />

through working capital reflects higher prepayments including<br />

fuel, a reduction in payables primarily with lower fuel prices, <strong>and</strong><br />

the addition of Aer Lingus from August 18, 2015.<br />

Pension <strong>and</strong> restructuring payments are higher at British<br />

Airways due to an increase in cash sweep of €403 million <strong>and</strong><br />

from a low base with some of the 2015 payment made in 2014.<br />

In 2015, the acquisition of Aer Lingus net of its cash <strong>and</strong><br />

deposits was a cash outflow of €438 million.<br />

In <strong>2016</strong>, the cash Dividend paid reflects the 2015 final<br />

dividend <strong>and</strong> the <strong>2016</strong> interim dividend. In 2015, the cash<br />

dividend was only the 2015 interim dividend, the Group’s first<br />

dividend payment.<br />

Net financing <strong>and</strong> refinancing are discussed on the next page.<br />

Taking these factors into consideration, the Group’s cash<br />

in flow for the year was €1,046 million <strong>and</strong> after net foreign<br />

exchange differences, the increase in cash net of exchange<br />

was €572 million. Adequate cash levels are maintained by each<br />

operating company.<br />

Strategic <strong>report</strong> Corporate governance Financial statements Additional information<br />

www.iairgroup.com