Annual report and accounts 2016

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

149<br />

e<br />

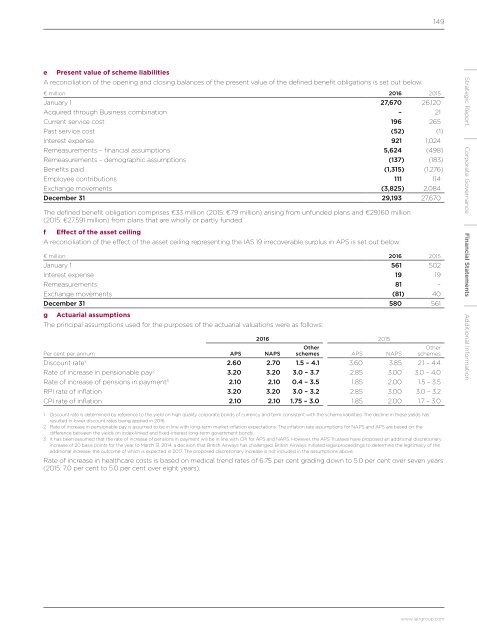

Present value of scheme liabilities<br />

A reconciliation of the opening <strong>and</strong> closing balances of the present value of the defined benefit obligations is set out below:<br />

€ million <strong>2016</strong> 2015<br />

January 1 27,670 26,120<br />

Acquired through Business combination – 21<br />

Current service cost 196 265<br />

Past service cost (52) (1)<br />

Interest expense 921 1,024<br />

Remeasurements – financial assumptions 5,624 (498)<br />

Remeasurements – demographic assumptions (137) (183)<br />

Benefits paid (1,315) (1,276)<br />

Employee contributions 111 114<br />

Exchange movements (3,825) 2,084<br />

December 31 29,193 27,670<br />

The defined benefit obligation comprises €33 million (2015: €79 million) arising from unfunded plans <strong>and</strong> €29,160 million<br />

(2015: €27,591 million) from plans that are wholly or partly funded.<br />

f Effect of the asset ceiling<br />

A reconciliation of the effect of the asset ceiling representing the IAS 19 irrecoverable surplus in APS is set out below:<br />

€ million <strong>2016</strong> 2015<br />

January 1 561 502<br />

Interest expense 19 19<br />

Remeasurements 81 –<br />

Exchange movements (81) 40<br />

December 31 580 561<br />

g Actuarial assumptions<br />

The principal assumptions used for the purposes of the actuarial valuations were as follows:<br />

<strong>2016</strong> 2015<br />

Per cent per annum<br />

APS NAPS<br />

Other<br />

schemes APS NAPS<br />

Other<br />

schemes<br />

Discount rate 1 2.60 2.70 1.5 – 4.1 3.60 3.85 2.1 – 4.4<br />

Rate of increase in pensionable pay 2 3.20 3.20 3.0 – 3.7 2.85 3.00 3.0 – 4.0<br />

Rate of increase of pensions in payment 3 2.10 2.10 0.4 – 3.5 1.85 2.00 1.5 – 3.5<br />

RPI rate of inflation 3.20 3.20 3.0 – 3.2 2.85 3.00 3.0 – 3.2<br />

CPI rate of inflation 2.10 2.10 1.75 – 3.0 1.85 2.00 1.7 – 3.0<br />

Strategic Report Corporate Governance Financial Statements Additional Information<br />

1 Discount rate is determined by reference to the yield on high quality corporate bonds of currency <strong>and</strong> term consistent with the scheme liabilities. The decline in these yields has<br />

resulted in lower discount rates being applied in <strong>2016</strong>.<br />

2 Rate of increase in pensionable pay is assumed to be in line with long-term market inflation expectations. The inflation rate assumptions for NAPS <strong>and</strong> APS are based on the<br />

difference between the yields on index-linked <strong>and</strong> fixed-interest long-term government bonds.<br />

3 It has been assumed that the rate of increase of pensions in payment will be in line with CPI for APS <strong>and</strong> NAPS. However, the APS Trustees have proposed an additional discretionary<br />

increase of 20 basis points for the year to March 31, 2014, a decision that British Airways has challenged. British Airways initiated legal proceedings to determine the legitimacy of the<br />

additional increase, the outcome of which is expected in 2017. The proposed discretionary increase is not included in the assumptions above.<br />

Rate of increase in healthcare costs is based on medical trend rates of 6.75 per cent grading down to 5.0 per cent over seven years<br />

(2015: 7.0 per cent to 5.0 per cent over eight years).<br />

www.iairgroup.com