- Page 1 and 2:

INTERNATIONAL AIRLINES GROUP The be

- Page 3 and 4:

Strategic report “2016 was a chal

- Page 5 and 6:

3 Chairman’s letter A firm focus

- Page 7 and 8:

5 Q A And, importantly, we have to

- Page 9 and 10:

7 IAG combines the leading airlines

- Page 11 and 12:

9 Operating highlights British Airw

- Page 13 and 14:

11 Business model and strategy Maxi

- Page 15 and 16:

13 4 5 6 Grow share of Europeto-Afr

- Page 17 and 18:

15 The performance indicators prese

- Page 19 and 20:

17 IT This year significant work ha

- Page 21 and 22:

19 and additional summer aircraft a

- Page 23 and 24:

21 This is why we have recently lau

- Page 25 and 26:

23 Aer Lingus Making the most of ou

- Page 27 and 28:

25 IAG Cargo Resilient performance

- Page 29 and 30:

27 Risk management and principal ri

- Page 31 and 32:

29 Risk Potential impact Management

- Page 33 and 34:

31 Risk Potential impact Management

- Page 35 and 36:

33 Financial overview A significant

- Page 37 and 38:

35 However, continued weakness in t

- Page 39 and 40:

37 Exchange impact before exception

- Page 41 and 42:

39 By supplier cost category: Handl

- Page 43 and 44:

41 Capacity 21% 11% 8% 60% Operatin

- Page 45 and 46:

43 Cash flow € million 2016 2015

- Page 47 and 48:

45 Sustainability Committed to our

- Page 49 and 50:

47 UN Sustainable Development Goals

- Page 51 and 52:

49 Aspect and link to SDGs Noise Wa

- Page 53 and 54:

51 Air quality - electric tug trial

- Page 55 and 56:

“2016 has really tested the Group

- Page 57 and 58:

55 I think we can be very proud tha

- Page 59 and 60:

57 James Lawrence Non-Executive Dir

- Page 61 and 62:

59 The Group operating companies Av

- Page 63 and 64:

61 The Board Secretary is Álvaro L

- Page 65 and 66:

63 Induction programme New director

- Page 67 and 68:

65 Other statutory information Dire

- Page 69 and 70:

67 The significant shareholders of

- Page 71 and 72:

69 Report of the Audit and Complian

- Page 73 and 74:

71 ICFR, which is a Spanish Corpora

- Page 75 and 76:

73 The Committee’s responsibiliti

- Page 77 and 78:

75 Report of the Safety Committee D

- Page 79 and 80:

77 Despite a growth in share price

- Page 81 and 82:

79 The table below summarises the m

- Page 83 and 84:

81 Malus and Clawback Provisions Th

- Page 85 and 86:

83 Service contracts and exit payme

- Page 87 and 88:

85 Annual Remuneration Report Commi

- Page 89 and 90:

87 Additional explanations in respe

- Page 91 and 92:

89 IAG PSP Award 2014 The IAG PSP a

- Page 93 and 94:

91 Statement of Voting The table be

- Page 95 and 96:

93 IAG’s total shareholder return

- Page 97 and 98:

95 The second performance condition

- Page 99 and 100:

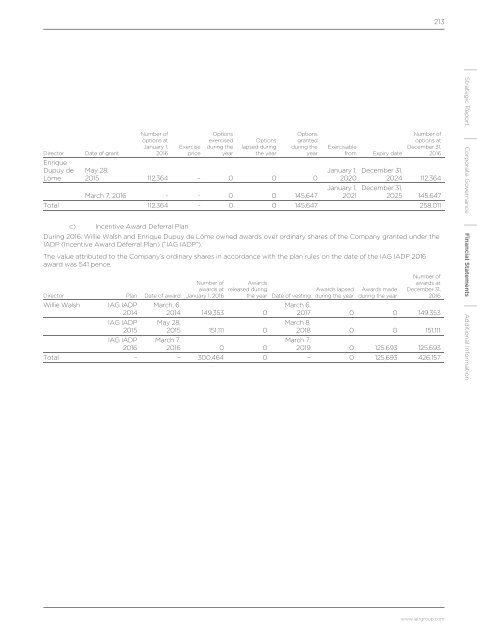

97 Incentive Award Deferral Plan Th

- Page 101 and 102:

Strategic Financial Statements Repo

- Page 103 and 104:

101 Consolidated statement of other

- Page 105 and 106:

103 Consolidated cash flow statemen

- Page 107 and 108:

105 Consolidated statement of chang

- Page 109 and 110:

107 the Income statement. All other

- Page 111 and 112:

109 b Other interest-bearing deposi

- Page 113 and 114:

111 Employee leaving indemnities an

- Page 115 and 116:

113 IAG has initiated a project to

- Page 117 and 118:

115 For the year to December 31, 20

- Page 119 and 120:

117 7 Auditors’ remuneration The

- Page 121 and 122:

119 For the year to December 31, 20

- Page 123 and 124:

121 c Reconciliation of the total t

- Page 125 and 126:

123 13 Property, plant and equipmen

- Page 127 and 128:

125 16 Intangible assets and impair

- Page 129 and 130:

127 Basis for calculating recoverab

- Page 131 and 132:

129 19 Trade and other receivables

- Page 133 and 134:

131 2 Floating rate euro mortgage l

- Page 135 and 136:

133 depending on whether the employ

- Page 137 and 138:

135 At December 31, 2016 the Group

- Page 139 and 140:

137 27 Financial instruments a Fina

- Page 141 and 142:

139 The carrying amounts and fair v

- Page 143 and 144:

141 December 31, 2015 Financial ins

- Page 145 and 146:

143 31 Other reserves and non-contr

- Page 147 and 148:

145 Defined benefit schemes i. APS

- Page 149 and 150:

147 d Fair value of scheme assets A

- Page 151 and 152:

149 e Present value of scheme liabi

- Page 153 and 154:

151 33 Contingent liabilities and g

- Page 155 and 156:

Spanish corporate governance report

- Page 157 and 158:

155 Indicate the most significant m

- Page 159 and 160:

157 Explain any significant changes

- Page 161 and 162:

159 B. SHAREHOLDERS’ MEETING B.1

- Page 163 and 164: 161 C.1.3 Complete the following ta

- Page 165 and 166: 163 Individual or corporate name of

- Page 167 and 168: 165 When reviewing board appointmen

- Page 169 and 170: 167 C.1.10 Indicate what powers, if

- Page 171 and 172: 169 Selection of directors In ident

- Page 173 and 174: 171 C.1.20 ter List any business re

- Page 175 and 176: 173 C.1.31 Indicate whether the con

- Page 177 and 178: 175 C.1.36 No Outgoing auditor Indi

- Page 179 and 180: 177 C.1.42 Indicate and, where appr

- Page 181 and 182: 179 C.2 Board committees C.2.1 Give

- Page 183 and 184: 181 f. To establish the appropriate

- Page 185 and 186: 183 F. Other responsibilities: a. T

- Page 187 and 188: 185 c) Steps taken during the year:

- Page 189 and 190: 187 C.2.2 b) Functions The main fun

- Page 191 and 192: 189 D.4 List any relevant transacti

- Page 193 and 194: 191 E.2 Identify the bodies respons

- Page 195 and 196: 193 Main risk Government interventi

- Page 197 and 198: 195 Audit and Compliance Committee

- Page 199 and 200: 197 The financial risk assessment i

- Page 201 and 202: 199 F.3.2 Internal control policies

- Page 203 and 204: 201 F.4.2 Mechanisms in standard fo

- Page 205 and 206: 203 6. Listed companies drawing up

- Page 207 and 208: 205 21. The board of directors shou

- Page 209 and 210: 207 37. When an executive committee

- Page 211 and 212: 209 52. The terms of reference of s

- Page 213: 211 IAG Remuneration Policy complie

- Page 217 and 218: 215 Strategic Report Corporate Gove

- Page 219 and 220: 217 Name and address Principal acti

- Page 221 and 222: 219 Associates Name and address Han

- Page 223 and 224: 221 Strategic Report Corporate Gove

- Page 225 and 226: 223 Operating margin Overall load f

- Page 227 and 228: 225 In 2015, the definition of inve

- Page 229 and 230: 227 Sustainability indicators Indic

- Page 231 and 232: Shareholder information Registered