Annual report and accounts 2016

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

150<br />

Notes to the consolidated financial statements continued<br />

32 Employee benefit obligations continued<br />

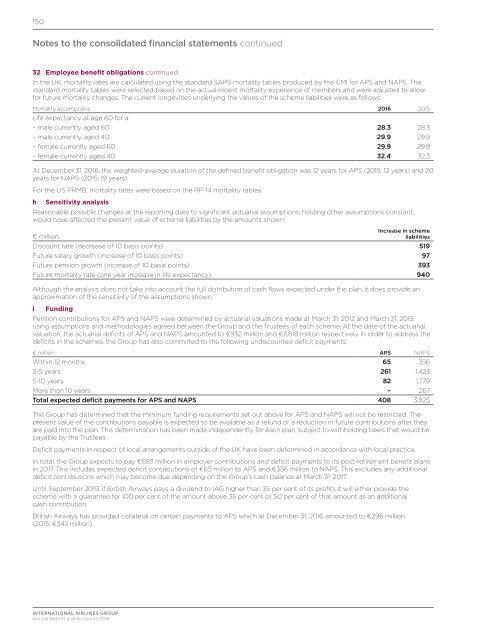

In the UK, mortality rates are calculated using the st<strong>and</strong>ard SAPS mortality tables produced by the CMI for APS <strong>and</strong> NAPS. The<br />

st<strong>and</strong>ard mortality tables were selected based on the actual recent mortality experience of members <strong>and</strong> were adjusted to allow<br />

for future mortality changes. The current longevities underlying the values of the scheme liabilities were as follows:<br />

Mortality assumptions <strong>2016</strong> 2015<br />

Life expectancy at age 60 for a:<br />

– male currently aged 60 28.3 28.3<br />

– male currently aged 40 29.9 29.9<br />

– female currently aged 60 29.9 29.9<br />

– female currently aged 40 32.4 32.3<br />

At December 31, <strong>2016</strong>, the weighted-average duration of the defined benefit obligation was 12 years for APS (2015: 12 years) <strong>and</strong> 20<br />

years for NAPS (2015: 19 years).<br />

For the US PRMB, mortality rates were based on the RP-14 mortality tables.<br />

h Sensitivity analysis<br />

Reasonable possible changes at the <strong>report</strong>ing date to significant actuarial assumptions, holding other assumptions constant,<br />

would have affected the present value of scheme liabilities by the amounts shown:<br />

Increase in scheme<br />

€ million<br />

liabilities<br />

Discount rate (decrease of 10 basis points) 519<br />

Future salary growth (increase of 10 basis points) 97<br />

Future pension growth (increase of 10 basis points) 393<br />

Future mortality rate (one year increase in life expectancy) 940<br />

Although the analysis does not take into account the full distribution of cash flows expected under the plan, it does provide an<br />

approximation of the sensitivity of the assumptions shown.<br />

i Funding<br />

Pension contributions for APS <strong>and</strong> NAPS were determined by actuarial valuations made at March 31, 2012 <strong>and</strong> March 31, 2015<br />

using assumptions <strong>and</strong> methodologies agreed between the Group <strong>and</strong> the Trustees of each scheme. At the date of the actuarial<br />

valuation, the actuarial deficits of APS <strong>and</strong> NAPS amounted to €932 million <strong>and</strong> €3,818 million respectively. In order to address the<br />

deficits in the schemes, the Group has also committed to the following undiscounted deficit payments:<br />

€ million APS NAPS<br />

Within 12 months 65 356<br />

2-5 years 261 1,423<br />

5-10 years 82 1,779<br />

More than 10 years – 267<br />

Total expected deficit payments for APS <strong>and</strong> NAPS 408 3,825<br />

The Group has determined that the minimum funding requirements set out above for APS <strong>and</strong> NAPS will not be restricted. The<br />

present value of the contributions payable is expected to be available as a refund or a reduction in future contributions after they<br />

are paid into the plan. This determination has been made independently for each plan, subject to withholding taxes that would be<br />

payable by the Trustees.<br />

Deficit payments in respect of local arrangements outside of the UK have been determined in accordance with local practice.<br />

In total, the Group expects to pay €683 million in employer contributions <strong>and</strong> deficit payments to its post-retirement benefit plans<br />

in 2017. This includes expected deficit contributions of €65 million to APS <strong>and</strong> €356 million to NAPS. This excludes any additional<br />

deficit contributions which may become due depending on the Group’s cash balance at March 31, 2017.<br />

Until September 2019, if British Airways pays a dividend to IAG higher than 35 per cent of its profits it will either provide the<br />

scheme with a guarantee for 100 per cent of the amount above 35 per cent or 50 per cent of that amount as an additional<br />

cash contribution.<br />

British Airways has provided collateral on certain payments to APS which at December 31, <strong>2016</strong> amounted to €296 million<br />

(2015: €343 million).<br />

INTERNATIONAL AIRLINES GROUP<br />

<strong>Annual</strong> Report <strong>and</strong> Accounts <strong>2016</strong>