Annual report and accounts 2016

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

137<br />

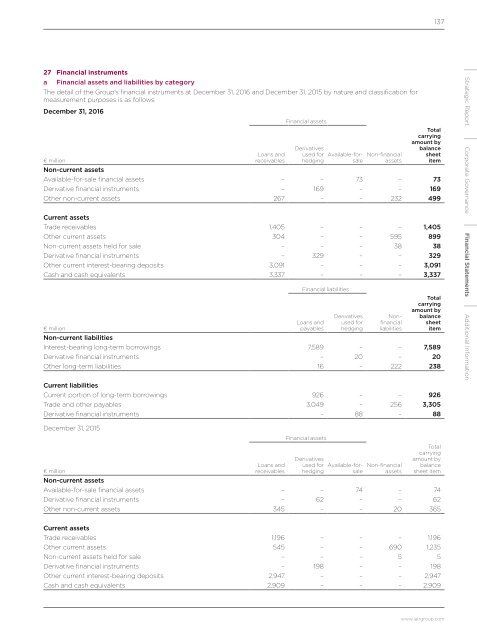

27 Financial instruments<br />

a<br />

Financial assets <strong>and</strong> liabilities by category<br />

The detail of the Group’s financial instruments at December 31, <strong>2016</strong> <strong>and</strong> December 31, 2015 by nature <strong>and</strong> classification for<br />

measurement purposes is as follows:<br />

December 31, <strong>2016</strong><br />

Financial assets<br />

Derivatives<br />

used for<br />

hedging<br />

Total<br />

carrying<br />

amount by<br />

balance<br />

sheet<br />

item<br />

Current assets<br />

Trade receivables 1,405 – – – 1,405<br />

Other current assets 304 – – 595 899<br />

Non-current assets held for sale – – – 38 38<br />

Derivative financial instruments – 329 – – 329<br />

Other current interest-bearing deposits 3,091 – – – 3,091<br />

Cash <strong>and</strong> cash equivalents 3,337 – – – 3,337<br />

Financial liabilities<br />

Derivatives<br />

used for<br />

hedging<br />

€ million<br />

Loans <strong>and</strong><br />

receivables<br />

Available-forsale<br />

Non-financial<br />

assets<br />

Non-current assets<br />

Available-for-sale financial assets – – 73 – 73<br />

Derivative financial instruments – 169 – – 169<br />

Other non-current assets 267 – – 232 499<br />

Nonfinancial<br />

liabilities<br />

Total<br />

carrying<br />

amount by<br />

balance<br />

sheet<br />

item<br />

Loans <strong>and</strong><br />

€ million<br />

payables<br />

Non-current liabilities<br />

Interest-bearing long-term borrowings 7,589 – – 7,589<br />

Derivative financial instruments – 20 – 20<br />

Other long-term liabilities 16 – 222 238<br />

Current liabilities<br />

Current portion of long-term borrowings 926 – – 926<br />

Trade <strong>and</strong> other payables 3,049 – 256 3,305<br />

Derivative financial instruments – 88 – 88<br />

Strategic Report Corporate Governance Financial Statements Additional Information<br />

December 31, 2015<br />

Financial assets<br />

Derivatives<br />

used for<br />

hedging<br />

Total<br />

carrying<br />

amount by<br />

balance<br />

sheet item<br />

€ million<br />

Loans <strong>and</strong><br />

receivables<br />

Available-forsale<br />

Non-financial<br />

assets<br />

Non-current assets<br />

Available-for-sale financial assets – – 74 – 74<br />

Derivative financial instruments – 62 – – 62<br />

Other non-current assets 345 – – 20 365<br />

Current assets<br />

Trade receivables 1,196 – – – 1,196<br />

Other current assets 545 – – 690 1,235<br />

Non-current assets held for sale – – – 5 5<br />

Derivative financial instruments – 198 – – 198<br />

Other current interest-bearing deposits 2,947 – – – 2,947<br />

Cash <strong>and</strong> cash equivalents 2,909 – – – 2,909<br />

www.iairgroup.com