Annual report and accounts 2016

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

144<br />

Notes to the consolidated financial statements continued<br />

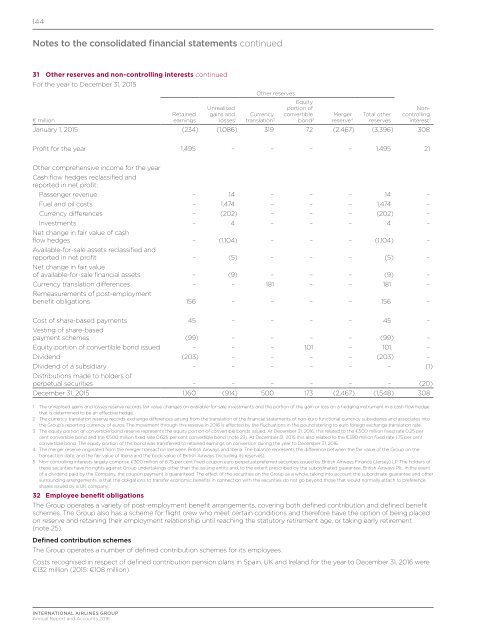

31 Other reserves <strong>and</strong> non-controlling interests continued<br />

For the year to December 31, 2015<br />

€ million<br />

Retained<br />

earnings<br />

Unrealised<br />

gains <strong>and</strong><br />

losses 1<br />

Other reserves<br />

Currency<br />

translation 2<br />

Equity<br />

portion of<br />

convertible<br />

bond 3<br />

Merger<br />

reserve 4<br />

Total other<br />

reserves<br />

Noncontrolling<br />

interest 5<br />

January 1, 2015 (234) (1,086) 319 72 (2,467) (3,396) 308<br />

Profit for the year 1,495 – – – – 1,495 21<br />

Other comprehensive income for the year<br />

Cash flow hedges reclassified <strong>and</strong><br />

<strong>report</strong>ed in net profit:<br />

Passenger revenue – 14 – – – 14 –<br />

Fuel <strong>and</strong> oil costs – 1,474 – – – 1,474 –<br />

Currency differences – (202) – – – (202) –<br />

Investments – 4 – – – 4 –<br />

Net change in fair value of cash<br />

flow hedges – (1,104) – – – (1,104) –<br />

Available-for-sale assets reclassified <strong>and</strong><br />

<strong>report</strong>ed in net profit – (5) – – – (5) –<br />

Net change in fair value<br />

of available-for-sale financial assets – (9) – – – (9) –<br />

Currency translation differences – – 181 – – 181 –<br />

Remeasurements of post-employment<br />

benefit obligations 156 – – – – 156 –<br />

Cost of share-based payments 45 – – – – 45 –<br />

Vesting of share-based<br />

payment schemes (99) – – – – (99) –<br />

Equity portion of convertible bond issued – – – 101 – 101 –<br />

Dividend (203) – – – – (203) –<br />

Dividend of a subsidiary – – – – – – (1)<br />

Distributions made to holders of<br />

perpetual securities – – – – – – (20)<br />

December 31, 2015 1,160 (914) 500 173 (2,467) (1,548) 308<br />

1 The unrealised gains <strong>and</strong> losses reserve records fair value changes on available-for-sale investments <strong>and</strong> the portion of the gain or loss on a hedging instrument in a cash flow hedge<br />

that is determined to be an effective hedge.<br />

2 The currency translation reserve records exchange differences arising from the translation of the financial statements of non-euro functional currency subsidiaries <strong>and</strong> associates into<br />

the Group’s <strong>report</strong>ing currency of euros. The movement through this reserve in <strong>2016</strong> is affected by the fluctuations in the pound sterling to euro foreign exchange translation rate.<br />

3 The equity portion of convertible bond reserve represents the equity portion of convertible bonds issued. At December 31, <strong>2016</strong>, this related to the €500 million fixed rate 0.25 per<br />

cent convertible bond <strong>and</strong> the €500 million fixed rate 0.625 per cent convertible bond (note 23). At December 31, 2015 this also related to the €390 million fixed rate 1.75 per cent<br />

convertible bond. The equity portion of this bond was transferred to retained earnings on conversion during the year to December 31, <strong>2016</strong>.<br />

4 The merger reserve originated from the merger transaction between British Airways <strong>and</strong> Iberia. The balance represents the difference between the fair value of the Group on the<br />

transaction date, <strong>and</strong> the fair value of Iberia <strong>and</strong> the book value of British Airways (including its reserves).<br />

5 Non-controlling interests largely comprise €300 million of 6.75 per cent fixed coupon euro perpetual preferred securities issued by British Airways Finance (Jersey) LP. The holders of<br />

these securities have no rights against Group undertakings other than the issuing entity <strong>and</strong>, to the extent prescribed by the subordinated guarantee, British Airways Plc. In the event<br />

of a dividend paid by the Company, the coupon payment is guaranteed. The effect of the securities on the Group as a whole, taking into account the subordinate guarantee <strong>and</strong> other<br />

surrounding arrangements, is that the obligations to transfer economic benefits in connection with the securities do not go beyond those that would normally attach to preference<br />

shares issued by a UK company.<br />

32 Employee benefit obligations<br />

The Group operates a variety of post-employment benefit arrangements, covering both defined contribution <strong>and</strong> defined benefit<br />

schemes. The Group also has a scheme for flight crew who meet certain conditions <strong>and</strong> therefore have the option of being placed<br />

on reserve <strong>and</strong> retaining their employment relationship until reaching the statutory retirement age, or taking early retirement<br />

(note 25).<br />

Defined contribution schemes<br />

The Group operates a number of defined contribution schemes for its employees.<br />

Costs recognised in respect of defined contribution pension plans in Spain, UK <strong>and</strong> Irel<strong>and</strong> for the year to December 31, <strong>2016</strong> were<br />

€132 million (2015: €108 million).<br />

INTERNATIONAL AIRLINES GROUP<br />

<strong>Annual</strong> Report <strong>and</strong> Accounts <strong>2016</strong>