Annual report and accounts 2016

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

222<br />

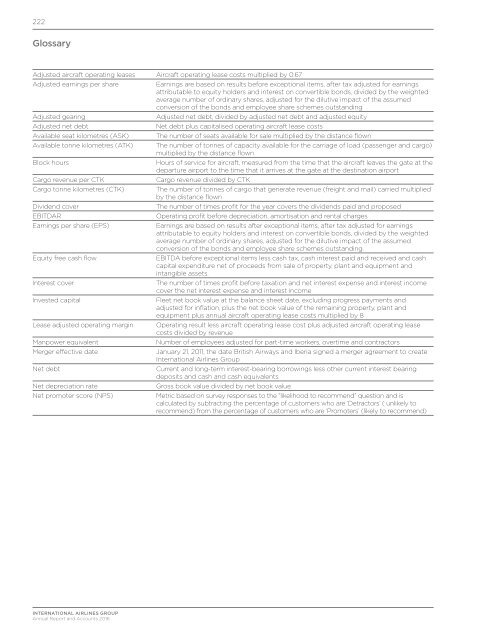

Glossary<br />

Adjusted aircraft operating leases Aircraft operating lease costs multiplied by 0.67<br />

Adjusted earnings per share<br />

Adjusted gearing<br />

Adjusted net debt<br />

Available seat kilometres (ASK)<br />

Available tonne kilometres (ATK)<br />

Block hours<br />

Cargo revenue per CTK<br />

Cargo tonne kilometres (CTK)<br />

Dividend cover<br />

EBITDAR<br />

Earnings per share (EPS)<br />

Equity free cash flow<br />

Interest cover<br />

Invested capital<br />

Lease adjusted operating margin<br />

Manpower equivalent<br />

Merger effective date<br />

Net debt<br />

Net depreciation rate<br />

Net promoter score (NPS)<br />

Earnings are based on results before exceptional items, after tax adjusted for earnings<br />

attributable to equity holders <strong>and</strong> interest on convertible bonds, divided by the weighted<br />

average number of ordinary shares, adjusted for the dilutive impact of the assumed<br />

conversion of the bonds <strong>and</strong> employee share schemes outst<strong>and</strong>ing<br />

Adjusted net debt, divided by adjusted net debt <strong>and</strong> adjusted equity<br />

Net debt plus capitalised operating aircraft lease costs<br />

The number of seats available for sale multiplied by the distance flown<br />

The number of tonnes of capacity available for the carriage of load (passenger <strong>and</strong> cargo)<br />

multiplied by the distance flown<br />

Hours of service for aircraft, measured from the time that the aircraft leaves the gate at the<br />

departure airport to the time that it arrives at the gate at the destination airport<br />

Cargo revenue divided by CTK<br />

The number of tonnes of cargo that generate revenue (freight <strong>and</strong> mail) carried multiplied<br />

by the distance flown<br />

The number of times profit for the year covers the dividends paid <strong>and</strong> proposed<br />

Operating profit before depreciation, amortisation <strong>and</strong> rental charges<br />

Earnings are based on results after exceptional items, after tax adjusted for earnings<br />

attributable to equity holders <strong>and</strong> interest on convertible bonds, divided by the weighted<br />

average number of ordinary shares, adjusted for the dilutive impact of the assumed<br />

conversion of the bonds <strong>and</strong> employee share schemes outst<strong>and</strong>ing.<br />

EBITDA before exceptional items less cash tax, cash interest paid <strong>and</strong> received <strong>and</strong> cash<br />

capital expenditure net of proceeds from sale of property, plant <strong>and</strong> equipment <strong>and</strong><br />

intangible assets.<br />

The number of times profit before taxation <strong>and</strong> net interest expense <strong>and</strong> interest income<br />

cover the net interest expense <strong>and</strong> interest income<br />

Fleet net book value at the balance sheet date, excluding progress payments <strong>and</strong><br />

adjusted for inflation, plus the net book value of the remaining property, plant <strong>and</strong><br />

equipment plus annual aircraft operating lease costs multiplied by 8<br />

Operating result less aircraft operating lease cost plus adjusted aircraft operating lease<br />

costs divided by revenue<br />

Number of employees adjusted for part-time workers, overtime <strong>and</strong> contractors<br />

January 21, 2011, the date British Airways <strong>and</strong> Iberia signed a merger agreement to create<br />

International Airlines Group<br />

Current <strong>and</strong> long-term interest-bearing borrowings less other current interest bearing<br />

deposits <strong>and</strong> cash <strong>and</strong> cash equivalents<br />

Gross book value divided by net book value<br />

Metric based on survey responses to the “likelihood to recommend” question <strong>and</strong> is<br />

calculated by subtracting the percentage of customers who are ‘Detractors’ ( unlikely to<br />

recommend) from the percentage of customers who are ‘Promoters’ (likely to recommend)<br />

INTERNATIONAL AIRLINES GROUP<br />

<strong>Annual</strong> Report <strong>and</strong> Accounts <strong>2016</strong>