Annual report and accounts 2016

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

127<br />

Basis for calculating recoverable amount<br />

The recoverable amounts of CGUs have been measured based on their value-in-use.<br />

Value-in-use is calculated using a discounted cash flow model, with the royalty methodology used for br<strong>and</strong>s. Cash flow<br />

projections are based on the Business plan approved by the Board covering a five year period. Cash flows extrapolated beyond<br />

the five year period are projected to increase based on long-term growth rates. Cash flow projections are discounted using the<br />

CGU’s pre-tax discount rate.<br />

<strong>Annual</strong>ly the Group prepares <strong>and</strong> the Board approves five year business plans. Business plans were approved in the fourth quarter<br />

of the year. The business plan cash flows used in the value-in-use calculations reflect all restructuring of the business that has been<br />

approved by the Board <strong>and</strong> which can be executed by Management under existing agreements.<br />

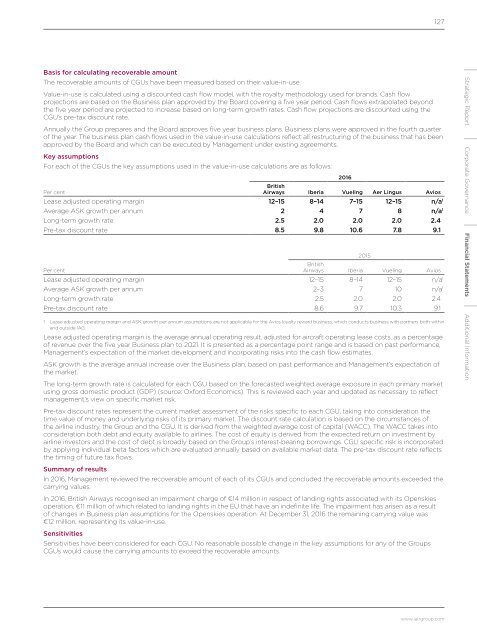

Key assumptions<br />

For each of the CGUs the key assumptions used in the value-in-use calculations are as follows:<br />

<strong>2016</strong><br />

Per cent<br />

British<br />

Airways Iberia Vueling Aer Lingus Avios<br />

Lease adjusted operating margin 12–15 8–14 7–15 12–15 n/a 1<br />

Average ASK growth per annum 2 4 7 8 n/a 1<br />

Long-term growth rate 2.5 2.0 2.0 2.0 2.4<br />

Pre-tax discount rate 8.5 9.8 10.6 7.8 9.1<br />

2015<br />

Per cent<br />

British<br />

Airways Iberia Vueling Avios<br />

Lease adjusted operating margin 12–15 8–14 12–15 n/a 1<br />

Average ASK growth per annum 2–3 7 10 n/a 1<br />

Long-term growth rate 2.5 2.0 2.0 2.4<br />

Pre-tax discount rate 8.6 9.7 10.3 9.1<br />

1 Lease adjusted operating margin <strong>and</strong> ASK growth per annum assumptions are not applicable for the Avios loyalty reward business, which conducts business with partners both within<br />

<strong>and</strong> outside IAG.<br />

Lease adjusted operating margin is the average annual operating result, adjusted for aircraft operating lease costs, as a percentage<br />

of revenue over the five year Business plan to 2021. It is presented as a percentage point range <strong>and</strong> is based on past performance,<br />

Management’s expectation of the market development <strong>and</strong> incorporating risks into the cash flow estimates.<br />

ASK growth is the average annual increase over the Business plan, based on past performance <strong>and</strong> Management’s expectation of<br />

the market.<br />

The long-term growth rate is calculated for each CGU based on the forecasted weighted average exposure in each primary market<br />

using gross domestic product (GDP) (source: Oxford Economics). This is reviewed each year <strong>and</strong> updated as necessary to reflect<br />

management’s view on specific market risk.<br />

Strategic Report Corporate Governance Financial Statements Additional Information<br />

Pre-tax discount rates represent the current market assessment of the risks specific to each CGU, taking into consideration the<br />

time value of money <strong>and</strong> underlying risks of its primary market. The discount rate calculation is based on the circumstances of<br />

the airline industry, the Group <strong>and</strong> the CGU. It is derived from the weighted average cost of capital (WACC). The WACC takes into<br />

consideration both debt <strong>and</strong> equity available to airlines. The cost of equity is derived from the expected return on investment by<br />

airline investors <strong>and</strong> the cost of debt is broadly based on the Group’s interest-bearing borrowings. CGU specific risk is incorporated<br />

by applying individual beta factors which are evaluated annually based on available market data. The pre-tax discount rate reflects<br />

the timing of future tax flows.<br />

Summary of results<br />

In <strong>2016</strong>, Management reviewed the recoverable amount of each of its CGUs <strong>and</strong> concluded the recoverable amounts exceeded the<br />

carrying values.<br />

In <strong>2016</strong>, British Airways recognised an impairment charge of €14 million in respect of l<strong>and</strong>ing rights associated with its Openskies<br />

operation, €11 million of which related to l<strong>and</strong>ing rights in the EU that have an indefinite life. The impairment has arisen as a result<br />

of changes in Business plan assumptions for the Openskies operation. At December 31, <strong>2016</strong> the remaining carrying value was<br />

€12 million, representing its value-in-use.<br />

Sensitivities<br />

Sensitivities have been considered for each CGU. No reasonable possible change in the key assumptions for any of the Groups<br />

CGUs would cause the carrying amounts to exceed the recoverable amounts.<br />

www.iairgroup.com