Annual report and accounts 2016

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

140<br />

Notes to the consolidated financial statements continued<br />

27 Financial instruments continued<br />

The fair value of Level 3 financial assets cannot be measured reliably; as such these assets are stated at historic cost less<br />

accumulated impairment losses with the exception of the Group’s investment in The Airline Group Limited. This unlisted investment<br />

had previously been valued at nil, since the fair value could not be reasonably calculated. During the year to December 31, 2014<br />

other shareholders disposed of a combined holding of 49.9 per cent providing a market reference from which to determine a fair<br />

value. The investment remains classified as a Level 3 financial asset due to the valuation criteria applied not being observable.<br />

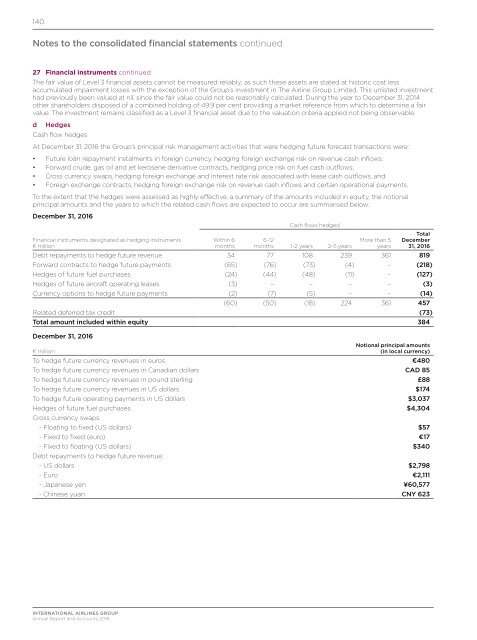

d Hedges<br />

Cash flow hedges<br />

At December 31, <strong>2016</strong> the Group’s principal risk management activities that were hedging future forecast transactions were:<br />

• Future loan repayment instalments in foreign currency, hedging foreign exchange risk on revenue cash inflows;<br />

• Forward crude, gas oil <strong>and</strong> jet kerosene derivative contracts, hedging price risk on fuel cash outflows;<br />

• Cross currency swaps, hedging foreign exchange <strong>and</strong> interest rate risk associated with lease cash outflows; <strong>and</strong><br />

• Foreign exchange contracts, hedging foreign exchange risk on revenue cash inflows <strong>and</strong> certain operational payments.<br />

To the extent that the hedges were assessed as highly effective, a summary of the amounts included in equity, the notional<br />

principal amounts <strong>and</strong> the years to which the related cash flows are expected to occur are summarised below:<br />

December 31, <strong>2016</strong><br />

Financial instruments designated as hedging instruments<br />

€ million<br />

Within 6<br />

months<br />

Cash flows hedged<br />

6-12<br />

months 1-2 years 2-5 years<br />

More than 5<br />

years<br />

Total<br />

December<br />

31, <strong>2016</strong><br />

Debt repayments to hedge future revenue 34 77 108 239 361 819<br />

Forward contracts to hedge future payments (65) (76) (73) (4) – (218)<br />

Hedges of future fuel purchases (24) (44) (48) (11) – (127)<br />

Hedges of future aircraft operating leases (3) – – – – (3)<br />

Currency options to hedge future payments (2) (7) (5) – – (14)<br />

(60) (50) (18) 224 361 457<br />

Related deferred tax credit (73)<br />

Total amount included within equity 384<br />

December 31, <strong>2016</strong><br />

Notional principal amounts<br />

€ million<br />

(in local currency)<br />

To hedge future currency revenues in euros €480<br />

To hedge future currency revenues in Canadian dollars CAD 85<br />

To hedge future currency revenues in pound sterling £88<br />

To hedge future currency revenues in US dollars $174<br />

To hedge future operating payments in US dollars $3,037<br />

Hedges of future fuel purchases $4,304<br />

Cross currency swaps:<br />

- Floating to fixed (US dollars) $57<br />

- Fixed to fixed (euro) €17<br />

- Fixed to floating (US dollars) $340<br />

Debt repayments to hedge future revenue:<br />

- US dollars $2,798<br />

- Euro €2,111<br />

- Japanese yen ¥60,577<br />

- Chinese yuan CNY 623<br />

INTERNATIONAL AIRLINES GROUP<br />

<strong>Annual</strong> Report <strong>and</strong> Accounts <strong>2016</strong>