MIPIM 2022 (21 MB)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Investing in Austria<br />

innovation is essential in project planning.<br />

The federal government, together with the<br />

provincial administrations, envisages a number<br />

of measures. By surveying and mobilising<br />

vacancies, for example, the existing supply of<br />

living space can be expanded and used more<br />

effectively. In addition, a nationwide monitoring<br />

of land consumption is planned.<br />

In connection with these developments the<br />

resurgence of Grätzl (neighbourhood development)<br />

in larger cities should also be strengthened<br />

and further developed. Grätzl are characterised<br />

by their small-scale structure, short<br />

distances, and accessibility by bicyde or on foot<br />

to infrastructural facilities and workplaces.<br />

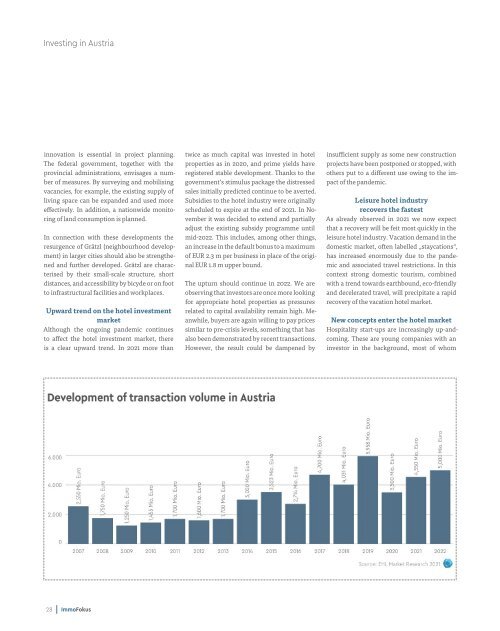

Upward trend on the hotel investment<br />

market<br />

Although the ongoing pandemic continues<br />

to affect the hotel investment market, there<br />

is a clear upward trend. In 20<strong>21</strong> more than<br />

twice as much capital was invested in hotel<br />

properties as in 2020, and prime yields have<br />

registered stable development. Thanks to the<br />

government‘s stimulus package the distressed<br />

sales initially predicted continue to be averted.<br />

Subsidies to the hotel industry were originally<br />

scheduled to expire at the end of 20<strong>21</strong>. In November<br />

it was decided to extend and partially<br />

adjust the existing subsidy programme until<br />

mid-<strong>2022</strong>. This includes, among other things,<br />

an increase in the default bonus to a maximum<br />

of EUR 2.3 m per business in place of the original<br />

EUR 1.8 m upper bound.<br />

The upturn should continue in <strong>2022</strong>. We are<br />

observing that investors are once more looking<br />

for appropriate hotel properties as pressures<br />

related to capital availability remain high. Meanwhile,<br />

buyers are again willing to pay prices<br />

similar to pre-crisis levels, something that has<br />

also been demonstrated by recent transactions.<br />

However, the result could be dampened by<br />

insufficient supply as some new construction<br />

projects have been postponed or stopped, with<br />

others put to a different use owing to the impact<br />

of the pandemic.<br />

Leisure hotel industry<br />

recovers the fastest<br />

As already observed in 20<strong>21</strong> we now expect<br />

that a recovery will be feit most quickly in the<br />

leisure hotel industry. Vacation demand in the<br />

domestic market, often labelled „staycations“,<br />

has increased enormously due to the pandemic<br />

and associated travel restrictions. In this<br />

context strong domestic tourism, combined<br />

with a trend towards earthbound, eco-friendly<br />

and decelerated travel, will precipitate a rapid<br />

recovery of the vacation hotel market.<br />

New concepts enter the hotel market<br />

Hospitality start-ups are increasingly up-andcoming.<br />

These are young companies with an<br />

investor in the background, most of whom<br />

28 ImmoFokus