Asian Sky Quarterly 2022 Q4

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MENA PROFILE: BUSINESS JET<br />

PRE-OWNED MARKET SITUATION 1<br />

Inventory Value (USD) 2<br />

450,000,000<br />

400,000,000<br />

350,000,000<br />

Corp. Airliner<br />

300,000,000<br />

250,000,000<br />

200,000,000<br />

Long Range<br />

150,000,000<br />

100,000,000<br />

Large<br />

50,000,000<br />

0<br />

Medium<br />

Light<br />

Jan<br />

20<br />

Mar<br />

20<br />

May<br />

20<br />

Jul<br />

20<br />

Sep<br />

20<br />

Nov<br />

20<br />

Jan<br />

21<br />

Mar<br />

21<br />

May<br />

21<br />

Jul<br />

21<br />

Sep<br />

21<br />

Nov<br />

21<br />

Jan<br />

22<br />

Mar<br />

22<br />

May<br />

22<br />

Jul<br />

22<br />

Sep<br />

22<br />

Nov<br />

22<br />

Jan<br />

23<br />

Source: AMSTAT & Global <strong>Sky</strong> Media<br />

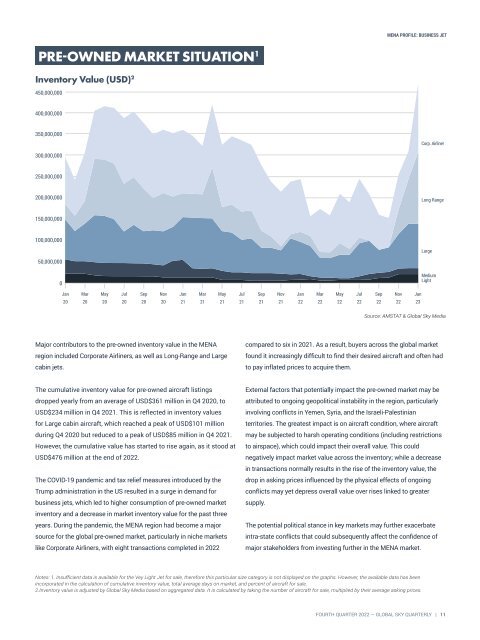

Major contributors to the pre-owned inventory value in the MENA<br />

region included Corporate Airliners, as well as Long-Range and Large<br />

cabin jets.<br />

compared to six in 2021. As a result, buyers across the global market<br />

found it increasingly difficult to find their desired aircraft and often had<br />

to pay inflated prices to acquire them.<br />

The cumulative inventory value for pre-owned aircraft listings<br />

dropped yearly from an average of USD$361 million in <strong>Q4</strong> 2020, to<br />

USD$234 million in <strong>Q4</strong> 2021. This is reflected in inventory values<br />

for Large cabin aircraft, which reached a peak of USD$101 million<br />

during <strong>Q4</strong> 2020 but reduced to a peak of USD$85 million in <strong>Q4</strong> 2021.<br />

However, the cumulative value has started to rise again, as it stood at<br />

USD$476 million at the end of <strong>2022</strong>.<br />

The COVID-19 pandemic and tax relief measures introduced by the<br />

Trump administration in the US resulted in a surge in demand for<br />

business jets, which led to higher consumption of pre-owned market<br />

inventory and a decrease in market inventory value for the past three<br />

years. During the pandemic, the MENA region had become a major<br />

source for the global pre-owned market, particularly in niche markets<br />

like Corporate Airliners, with eight transactions completed in <strong>2022</strong><br />

External factors that potentially impact the pre-owned market may be<br />

attributed to ongoing geopolitical instability in the region, particularly<br />

involving conflicts in Yemen, Syria, and the Israeli-Palestinian<br />

territories. The greatest impact is on aircraft condition, where aircraft<br />

may be subjected to harsh operating conditions (including restrictions<br />

to airspace), which could impact their overall value. This could<br />

negatively impact market value across the inventory; while a decrease<br />

in transactions normally results in the rise of the inventory value, the<br />

drop in asking prices influenced by the physical effects of ongoing<br />

conflicts may yet depress overall value over rises linked to greater<br />

supply.<br />

The potential political stance in key markets may further exacerbate<br />

intra-state conflicts that could subsequently affect the confidence of<br />

major stakeholders from investing further in the MENA market.<br />

Notes: 1. Insufficient data is available for the Vey Light Jet for sale, therefore this particular size category is not displayed on the graphs. However, the available data has been<br />

incorporated in the calculation of cumulative inventory value, total average days on market, and percent of aircraft for sale.<br />

2.Inventory value is adjusted by Global <strong>Sky</strong> Media based on aggregated data. It is calculated by taking the number of aircraft for sale, multiplied by their average asking prices.<br />

FOURTH QUARTER <strong>2022</strong> — GLOBAL SKY QUARTERLY | 11