Asian Sky Quarterly 2022 Q4

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

GLOBAL BUSINESS AVIATION MARKET UPDATE<br />

OEM BACKLOGS<br />

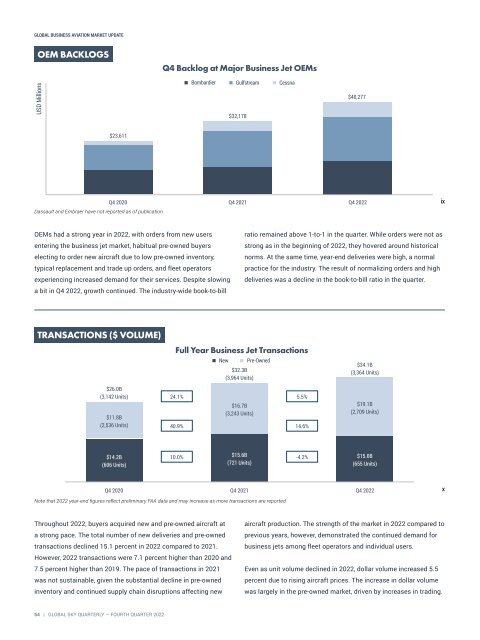

<strong>Q4</strong> Backlog at Major Business Jet OEMs<br />

USD Millions<br />

Bombardier Gulfstream Cessna<br />

$32,178<br />

$40,277<br />

$23,611<br />

Dassault and Embraer have not reported as of publication<br />

<strong>Q4</strong> 2020 <strong>Q4</strong> 2021 <strong>Q4</strong> <strong>2022</strong><br />

ix<br />

OEMs had a strong year in <strong>2022</strong>, with orders from new users<br />

entering the business jet market, habitual pre-owned buyers<br />

electing to order new aircraft due to low pre-owned inventory,<br />

typical replacement and trade up orders, and fleet operators<br />

experiencing increased demand for their services. Despite slowing<br />

a bit in <strong>Q4</strong> <strong>2022</strong>, growth continued. The industry-wide book-to-bill<br />

ratio remained above 1-to-1 in the quarter. While orders were not as<br />

strong as in the beginning of <strong>2022</strong>, they hovered around historical<br />

norms. At the same time, year-end deliveries were high, a normal<br />

practice for the industry. The result of normalizing orders and high<br />

deliveries was a decline in the book-to-bill ratio in the quarter.<br />

TRANSACTIONS ($ VOLUME)<br />

Full Year Business Jet Transactions<br />

New<br />

$32.3B<br />

(3,964 Units)<br />

Pre-Owned<br />

$34.1B<br />

(3,364 Units)<br />

$26.0B<br />

(3,142 Units)<br />

$11.8B<br />

(2,536 Units)<br />

24.1%<br />

40.9%<br />

$16.7B<br />

(3,243 Units)<br />

5.5%<br />

14.6%<br />

$19.1B<br />

(2,709 Units)<br />

$14.2B<br />

(606 Units)<br />

10.0%<br />

$15.6B<br />

(721 Units)<br />

-4.2%<br />

$15.0B<br />

(655 Units)<br />

<strong>Q4</strong> 2020 <strong>Q4</strong> 2021 <strong>Q4</strong> <strong>2022</strong><br />

x<br />

Note that <strong>2022</strong> year-end figures reflect preliminary FAA data and may increase as more transactions are reported.<br />

Throughout <strong>2022</strong>, buyers acquired new and pre-owned aircraft at<br />

a strong pace. The total number of new deliveries and pre-owned<br />

transactions declined 15.1 percent in <strong>2022</strong> compared to 2021.<br />

However, <strong>2022</strong> transactions were 7.1 percent higher than 2020 and<br />

7.5 percent higher than 2019. The pace of transactions in 2021<br />

was not sustainable, given the substantial decline in pre-owned<br />

inventory and continued supply chain disruptions affecting new<br />

aircraft production. The strength of the market in <strong>2022</strong> compared to<br />

previous years, however, demonstrated the continued demand for<br />

business jets among fleet operators and individual users.<br />

Even as unit volume declined in <strong>2022</strong>, dollar volume increased 5.5<br />

percent due to rising aircraft prices. The increase in dollar volume<br />

was largely in the pre-owned market, driven by increases in trading.<br />

54 | GLOBAL SKY QUARTERLY — FOURTH QUARTER <strong>2022</strong>