Asian Sky Quarterly 2022 Q4

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

GLOBAL BUSINESS AVIATION MARKET UPDATE<br />

GLOBAL ECONOMY<br />

14.0%<br />

Global GDP YoY Percent Change<br />

12.0%<br />

10.0%<br />

8.0%<br />

6.0%<br />

4.0%<br />

2.0%<br />

0.0%<br />

Q1 2021 Q2 2021 Q3 2021 <strong>Q4</strong> 2021 Q1 <strong>2022</strong> Q2 <strong>2022</strong> Q3 <strong>2022</strong> <strong>Q4</strong> <strong>2022</strong> Q1 2023 Q2 2023 Q3 2023 <strong>Q4</strong> 2023<br />

(Forecast) (Forecast) (Forecast) (Forecast)<br />

i<br />

Supply chain disruptions and high inflation drove central<br />

banks around the world to raise interest rates in <strong>2022</strong>, creating<br />

uncertainty. The war in Ukraine and the ensuing energy instability in<br />

Europe, in addition to zero-COVID policies in China through much of<br />

the year, contributed to economic headwinds. As a result, economic<br />

growth slowed, and stock prices and wealth declined. ii<br />

Heading into 2023, economists expect economic headwinds to<br />

persist. There is a consensus that most major economies will<br />

experience a recession during the year due to higher interest<br />

rates. iii However, there is also agreement that any recession that<br />

does occur will be a moderate one. The International Monetary<br />

Fund recently increased its 2023 growth forecasts citing slowing<br />

inflation, an opening of China’s economy, the strong labor market<br />

in the U.S., and the better-than-expected response to the energy<br />

crisis in Europe. The report indicates there are still risks to<br />

economic growth, which will be slower in 2023 than <strong>2022</strong>, but the<br />

overall global economy is weathering tough conditions better than<br />

expected so far, which will promote higher growth than previously<br />

forecast. iv<br />

FLIGHT OPERATIONS<br />

Global Business Jet Flights<br />

North America<br />

Rest of World<br />

629,714 652,741<br />

23.7% 21.6%<br />

814,816<br />

24.0%<br />

926,138 929,319 896,868<br />

27.9% 23.5% 23.6%<br />

973,906 945,218<br />

905,513<br />

25.3% 27.9% 23.2%<br />

76.3% 78.4%<br />

76.0% 72.1% 76.5% 76.4% 74.7% 72.1% 76.8%<br />

<strong>Q4</strong> 2020 Q1 2021 Q2 2021 Q3 2021 <strong>Q4</strong> 2021 Q1 <strong>2022</strong> Q2 <strong>2022</strong> Q3 <strong>2022</strong> <strong>Q4</strong> <strong>2022</strong><br />

v<br />

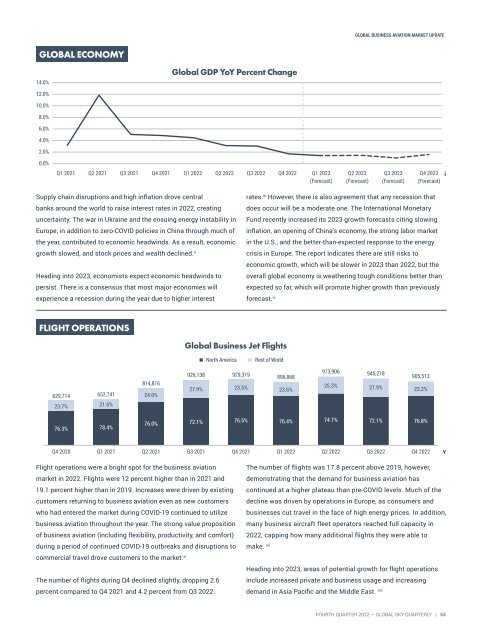

Flight operations were a bright spot for the business aviation<br />

market in <strong>2022</strong>. Flights were 12 percent higher than in 2021 and<br />

19.1 percent higher than in 2019. Increases were driven by existing<br />

customers returning to business aviation even as new customers<br />

who had entered the market during COVID-19 continued to utilize<br />

business aviation throughout the year. The strong value proposition<br />

of business aviation (including flexibility, productivity, and comfort)<br />

during a period of continued COVID-19 outbreaks and disruptions to<br />

commercial travel drove customers to the market. vi<br />

The number of flights during <strong>Q4</strong> declined slightly, dropping 2.6<br />

percent compared to <strong>Q4</strong> 2021 and 4.2 percent from Q3 <strong>2022</strong>.<br />

The number of flights was 17.8 percent above 2019, however,<br />

demonstrating that the demand for business aviation has<br />

continued at a higher plateau than pre-COVID levels. Much of the<br />

decline was driven by operations in Europe, as consumers and<br />

businesses cut travel in the face of high energy prices. In addition,<br />

many business aircraft fleet operators reached full capacity in<br />

<strong>2022</strong>, capping how many additional flights they were able to<br />

make. vii<br />

Heading into 2023, areas of potential growth for flight operations<br />

include increased private and business usage and increasing<br />

demand in Asia Pacific and the Middle East. viii<br />

FOURTH QUARTER <strong>2022</strong> — GLOBAL SKY QUARTERLY | 53