Asian Sky Quarterly 2022 Q4

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

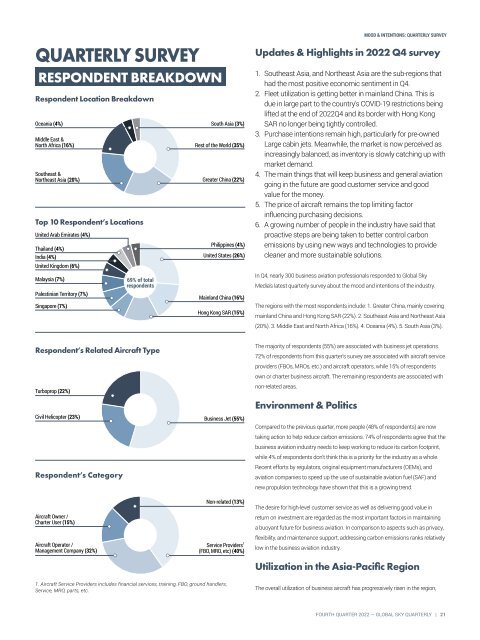

QUARTERLY SURVEY<br />

RESPONDENT BREAKDOWN<br />

Respondent Location Breakdown<br />

Oceania (4%)<br />

Middle East &<br />

North Africa (16%)<br />

Southeast &<br />

Northeast Asia (20%)<br />

Top 10 Respondent’s Locations<br />

United Arab Emirates (4%)<br />

Thailand (4%)<br />

India (4%)<br />

United Kingdom (6%)<br />

Malaysia (7%)<br />

Palestinian Territory (7%)<br />

Singapore (7%)<br />

69% of total<br />

respondents<br />

South Asia (3%)<br />

Rest of the World (35%)<br />

Greater China (22%)<br />

Philippines (4%)<br />

United States (26%)<br />

Mainland China (16%)<br />

Hong Kong SAR (15%)<br />

MOOD & INTENTIONS: QUARTERLY SURVEY<br />

Updates & Highlights in <strong>2022</strong> <strong>Q4</strong> survey<br />

1. Southeast Asia, and Northeast Asia are the sub-regions that<br />

had the most positive economic sentiment in <strong>Q4</strong>.<br />

2. Fleet utilization is getting better in mainland China. This is<br />

due in large part to the country's COVID-19 restrictions being<br />

lifted at the end of <strong>2022</strong><strong>Q4</strong> and its border with Hong Kong<br />

SAR no longer being tightly controlled.<br />

3. Purchase intentions remain high, particularly for pre-owned<br />

Large cabin jets. Meanwhile, the market is now perceived as<br />

increasingly balanced, as inventory is slowly catching up with<br />

market demand.<br />

4. The main things that will keep business and general aviation<br />

going in the future are good customer service and good<br />

value for the money.<br />

5. The price of aircraft remains the top limiting factor<br />

influencing purchasing decisions.<br />

6. A growing number of people in the industry have said that<br />

proactive steps are being taken to better control carbon<br />

emissions by using new ways and technologies to provide<br />

cleaner and more sustainable solutions.<br />

In <strong>Q4</strong>, nearly 300 business aviation professionals responded to Global <strong>Sky</strong><br />

Media’s latest quarterly survey about the mood and intentions of the industry.<br />

The regions with the most respondents include: 1. Greater China, mainly covering<br />

mainland China and Hong Kong SAR (22%). 2. Southeast Asia and Northeast Asia<br />

(20%). 3. Middle East and North Africa (16%). 4. Oceania (4%). 5. South Asia (3%).<br />

Respondent’s Related Aircraft Type<br />

The majority of respondents (55%) are associated with business jet operations.<br />

72% of respondents from this quarter’s survey are associated with aircraft service<br />

Turboprop (22%)<br />

Civil Helicopter (23%)<br />

Respondent’s Category<br />

Business Jet (55%)<br />

providers (FBOs, MROs, etc.) and aircraft operators, while 15% of respondents<br />

own or charter business aircraft. The remaining respondents are associated with<br />

non-related areas.<br />

Environment & Politics<br />

Compared to the previous quarter, more people (48% of respondents) are now<br />

taking action to help reduce carbon emissions. 74% of respondents agree that the<br />

business aviation industry needs to keep working to reduce its carbon footprint,<br />

while 4% of respondents don't think this is a priority for the industry as a whole.<br />

Recent efforts by regulators, original equipment manufacturers (OEMs), and<br />

aviation companies to speed up the use of sustainable aviation fuel (SAF) and<br />

new propulsion technology have shown that this is a growing trend.<br />

Aircraft Owner /<br />

Charter User (15%)<br />

Aircraft Operator /<br />

Management Company (32%)<br />

Non-related (13%)<br />

Service Providers 1<br />

(FBO, MRO, etc) (40%)<br />

The desire for high-level customer service as well as delivering good value in<br />

return on investment are regarded as the most important factors in maintaining<br />

a buoyant future for business aviation. In comparison to aspects such as privacy,<br />

flexibility, and maintenance support, addressing carbon emissions ranks relatively<br />

low in the business aviation industry.<br />

Utilization in the Asia-Pacific Region<br />

1. Aircraft Service Providers includes financial services, training, FBO, ground handlers,<br />

Service, MRO, parts, etc.<br />

The overall utilization of business aircraft has progressively risen in the region,<br />

FOURTH QUARTER <strong>2022</strong> — GLOBAL SKY QUARTERLY | 21