Asian Sky Quarterly 2022 Q4

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

GLOBAL PRE-OWNED MARKET UPDATE<br />

MEDIUM JETS - SHORT TERM MEDIAN VALUE CHANGE<br />

70%<br />

Increase Decrease Total<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

Jan1<br />

Jan15<br />

Feb1<br />

Feb15<br />

Mar1<br />

Mar15<br />

Apr1<br />

Apr15<br />

May1<br />

May15<br />

Jun1<br />

Jun15<br />

Jul1<br />

Jul15<br />

Aug1<br />

Aug15<br />

Sep1<br />

Sep15<br />

Oct1<br />

Oct15<br />

Nov1<br />

Nov15<br />

Dec1<br />

Dec15<br />

Jan1<br />

Jan15<br />

Feb1<br />

Feb15<br />

Mar1<br />

Mar15<br />

Apr1<br />

Apr15<br />

May1<br />

May15<br />

Jun1<br />

Jun15<br />

Jul1<br />

Jul15<br />

Aug1<br />

Aug15<br />

Sep1<br />

Sep15<br />

Oct1<br />

Oct15<br />

Nov1<br />

Nov15<br />

Dec1<br />

Dec15<br />

Jan1<br />

Jan15<br />

Feb1<br />

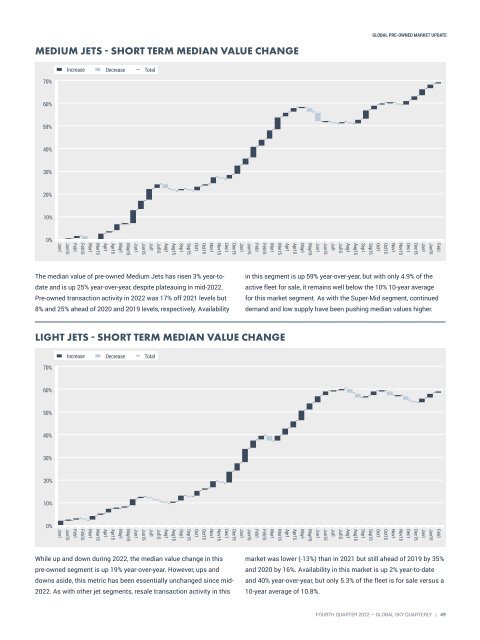

The median value of pre-owned Medium Jets has risen 3% year-todate<br />

and is up 25% year-over-year, despite plateauing in mid-<strong>2022</strong>.<br />

Pre-owned transaction activity in <strong>2022</strong> was 17% off 2021 levels but<br />

8% and 25% ahead of 2020 and 2019 levels, respectively. Availability<br />

in this segment is up 59% year-over-year, but with only 4.9% of the<br />

active fleet for sale, it remains well below the 10% 10-year average<br />

for this market segment. As with the Super-Mid segment, continued<br />

demand and low supply have been pushing median values higher.<br />

LIGHT JETS - SHORT TERM MEDIAN VALUE CHANGE<br />

70%<br />

Increase Decrease Total<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

Jan1<br />

Jan15<br />

Feb1<br />

Feb15<br />

Mar1<br />

Mar15<br />

Apr1<br />

Apr15<br />

May1<br />

May15<br />

Jun1<br />

Jun15<br />

Jul1<br />

Jul15<br />

Aug1<br />

Aug15<br />

Sep1<br />

Sep15<br />

Oct1<br />

Oct15<br />

Nov1<br />

Nov15<br />

Dec1<br />

Dec15<br />

Jan1<br />

Jan15<br />

Feb1<br />

Feb15<br />

Mar1<br />

Mar15<br />

Apr1<br />

Apr15<br />

May1<br />

May15<br />

Jun1<br />

Jun15<br />

Jul1<br />

Jul15<br />

Aug1<br />

Aug15<br />

Sep1<br />

Sep15<br />

Oct1<br />

Oct15<br />

Nov1<br />

Nov15<br />

Dec1<br />

Dec15<br />

Jan1<br />

Jan15<br />

Feb1<br />

While up and down during <strong>2022</strong>, the median value change in this<br />

pre-owned segment is up 19% year-over-year. However, ups and<br />

downs aside, this metric has been essentially unchanged since mid-<br />

<strong>2022</strong>. As with other jet segments, resale transaction activity in this<br />

market was lower (-13%) than in 2021 but still ahead of 2019 by 35%<br />

and 2020 by 16%. Availability in this market is up 2% year-to-date<br />

and 40% year-over-year, but only 5.3% of the fleet is for sale versus a<br />

10-year average of 10.8%.<br />

FOURTH QUARTER <strong>2022</strong> — GLOBAL SKY QUARTERLY | 49