A player in sustainable development - Dalkia

A player in sustainable development - Dalkia

A player in sustainable development - Dalkia

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

STOCK MARKET<br />

A growth stock off er<strong>in</strong>g strong visibility<br />

Stock market sentiment, more uncerta<strong>in</strong> s<strong>in</strong>ce summer 2007, has paved the way for an <strong>in</strong>crease <strong>in</strong> volatility.<br />

Aga<strong>in</strong>st this backdrop, the Veolia Environnement stock has far outperformed the Paris exchange’s CAC 40,<br />

benefi t<strong>in</strong>g from its double status as a growth stock and a defensive stock.<br />

Return of stock market volatility<br />

After ris<strong>in</strong>g for four straight years,<br />

the Paris exchange’s CAC 40 <strong>in</strong>ched up<br />

<strong>in</strong> 2007 by just 1.3%. The US subprime<br />

mortgage crisis has rocked <strong>in</strong>vestor<br />

confi dence <strong>in</strong> the effi ciency of the<br />

<strong>in</strong>ternational fi nancial system. In Europe,<br />

the MSCI Europe <strong>in</strong>dex stagnated<br />

<strong>in</strong> 2007, refl ect<strong>in</strong>g the contrast<strong>in</strong>g<br />

<strong>development</strong>s <strong>in</strong> the ma<strong>in</strong> European<br />

<strong>in</strong>dices, with performances rang<strong>in</strong>g from<br />

-6.9% for Milan’s MIB 30 to +22.3% for<br />

Frankfurt’s DAX 30.<br />

Veolia Environnement stock<br />

held up well <strong>in</strong> 2007<br />

Aga<strong>in</strong>st this backdrop, the Veolia<br />

Environnement stock ga<strong>in</strong>ed 8.8%<br />

<strong>in</strong> 2007, clos<strong>in</strong>g the year at €62.45<br />

compared with €57.42 at December 29,<br />

2006 (1) . Veolia Environnement’s <strong>in</strong>tr<strong>in</strong>sic<br />

qualities, such as the recurrence and<br />

visibility of its <strong>in</strong>come from long-term<br />

contracts, the steady <strong>in</strong>crease <strong>in</strong><br />

20 2007 ANNUAL REPORT VEOLIA ENVIRONNEMENT<br />

dividends paid out, its position<strong>in</strong>g<br />

<strong>in</strong> fast-grow<strong>in</strong>g markets as well as its<br />

growth prospects, mean it is now<br />

a defensive stock as much as a growth<br />

stock.<br />

Capital <strong>in</strong>crease over-subscribed<br />

Confi dent <strong>in</strong> the upside potential of the<br />

global environmental services market,<br />

Veolia Environnement launched<br />

a €2.6 billion cash capital <strong>in</strong>crease with<br />

preferential rights <strong>in</strong> June 2007, on the<br />

basis of one new share for eight exist<strong>in</strong>g<br />

shares at a unit price of €49.70 per share<br />

(€5 par value and €44.70 issuance<br />

premium).<br />

With this rights issue, the company has<br />

improved its fi nancial fl exibility to be<br />

able to seize growth opportunities <strong>in</strong> its<br />

core bus<strong>in</strong>ess. Despite the tough stock<br />

market context, its capital <strong>in</strong>crease was<br />

over-subscribed 1.5 times, illustrat<strong>in</strong>g<br />

shareholders’ high level of confi dence<br />

<strong>in</strong> the company.<br />

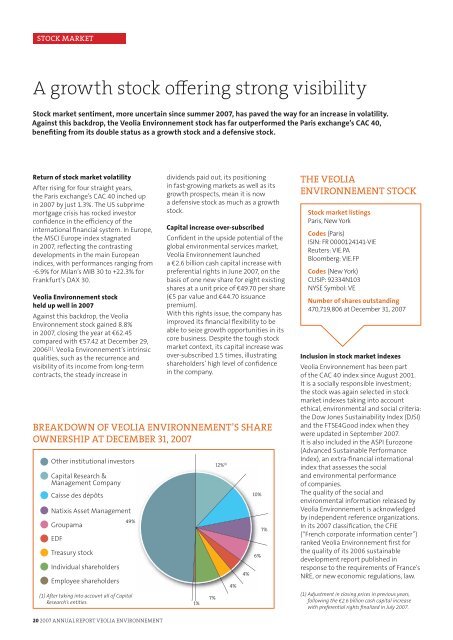

BREAKDOWN OF VEOLIA ENVIRONNEMENT’S SHARE<br />

OWNERSHIP AT DECEMBER 31, 2007<br />

Other <strong>in</strong>stitutional <strong>in</strong>vestors<br />

Capital Research &<br />

Management Company<br />

Caisse des dépôts<br />

Natixis Asset Management<br />

Groupama<br />

EDF<br />

Treasury stock<br />

Individual shareholders<br />

Employee shareholders<br />

49%<br />

(1) After tak<strong>in</strong>g <strong>in</strong>to account all of Capital<br />

Research’s entities.<br />

1%<br />

7%<br />

12% (1)<br />

4%<br />

4%<br />

10%<br />

6%<br />

7%<br />

THE VEOLIA<br />

ENVIRONNEMENT STOCK<br />

Stock market list<strong>in</strong>gs<br />

Paris, New York<br />

Codes (Paris)<br />

ISIN: FR 0000124141-VIE<br />

Reuters: VIE.PA<br />

Bloomberg: VIE.FP<br />

Codes (New York)<br />

CUSIP: 92334N103<br />

NYSE Symbol: VE<br />

Number of shares outstand<strong>in</strong>g<br />

470,719,806 at December 31, 2007<br />

Inclusion <strong>in</strong> stock market <strong>in</strong>dexes<br />

Veolia Environnement has been part<br />

of the CAC 40 <strong>in</strong>dex s<strong>in</strong>ce August 2001.<br />

It is a socially responsible <strong>in</strong>vestment;<br />

the stock was aga<strong>in</strong> selected <strong>in</strong> stock<br />

market <strong>in</strong>dexes tak<strong>in</strong>g <strong>in</strong>to account<br />

ethical, environmental and social criteria:<br />

the Dow Jones Susta<strong>in</strong>ability Index (DJSI)<br />

and the FTSE4Good <strong>in</strong>dex when they<br />

were updated <strong>in</strong> September 2007.<br />

It is also <strong>in</strong>cluded <strong>in</strong> the ASPI Eurozone<br />

(Advanced Susta<strong>in</strong>able Performance<br />

Index), an extra-fi nancial <strong>in</strong>ternational<br />

<strong>in</strong>dex that assesses the social<br />

and environmental performance<br />

of companies.<br />

The quality of the social and<br />

environmental <strong>in</strong>formation released by<br />

Veolia Environnement is acknowledged<br />

by <strong>in</strong>dependent reference organizations.<br />

In its 2007 classifi cation, the CFIE<br />

(“French corporate <strong>in</strong>formation center”)<br />

ranked Veolia Environnement fi rst for<br />

the quality of its 2006 susta<strong>in</strong>able<br />

<strong>development</strong> report published <strong>in</strong><br />

response to the requirements of France’s<br />

NRE, or new economic regulations, law.<br />

(1) Adjustment <strong>in</strong> clos<strong>in</strong>g prices <strong>in</strong> previous years,<br />

follow<strong>in</strong>g the €2.6 billion cash capital <strong>in</strong>crease<br />

with preferential rights fi nalized <strong>in</strong> July 2007.