Notes to the Financial Statements - Efacec

Notes to the Financial Statements - Efacec

Notes to the Financial Statements - Efacec

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

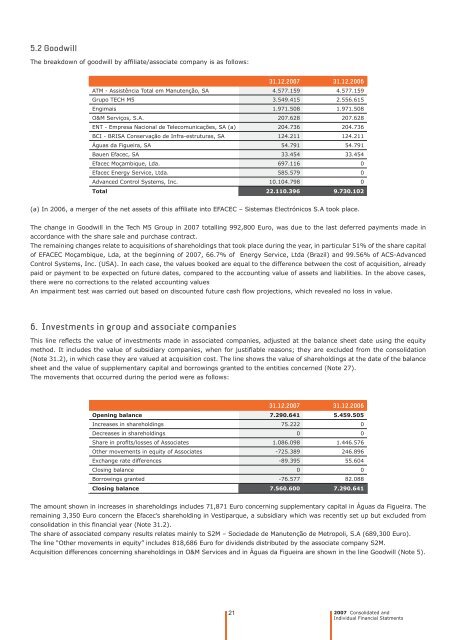

5.2 Goodwill<br />

The breakdown of goodwill by affi liate/associate company is as follows:<br />

31.12.2007 31.12.2006<br />

ATM - Assistência Total em Manutenção, SA 4.577.159 4.577.159<br />

Grupo TECH M5 3.549.415 2.556.615<br />

Engimais 1.971.508 1.971.508<br />

O&M Serviços, S.A. 207.628 207.628<br />

ENT - Empresa Nacional de Telecomunicações, SA (a) 204.736 204.736<br />

BCI - BRISA Conservação de Infra-estruturas, SA 124.211 124.211<br />

Águas da Figueira, SA 54.791 54.791<br />

Bauen <strong>Efacec</strong>, SA 33.454 33.454<br />

<strong>Efacec</strong> Moçambique, Lda. 697.116 0<br />

<strong>Efacec</strong> Energy Service, Ltda. 585.579 0<br />

Advanced Control Systems, Inc. 10.104.798 0<br />

Total 22.110.396 9.730.102<br />

(a) In 2006, a merger of <strong>the</strong> net assets of this affi liate in<strong>to</strong> EFACEC – Sistemas Electrónicos S.A <strong>to</strong>ok place.<br />

The change in Goodwill in <strong>the</strong> Tech M5 Group in 2007 <strong>to</strong>talling 992,800 Euro, was due <strong>to</strong> <strong>the</strong> last deferred payments made in<br />

accordance with <strong>the</strong> share sale and purchase contract.<br />

The remaining changes relate <strong>to</strong> acquisitions of shareholdings that <strong>to</strong>ok place during <strong>the</strong> year, in particular 51% of <strong>the</strong> share capital<br />

of EFACEC Moçambique, Lda, at <strong>the</strong> beginning of 2007, 66.7% of Energy Service, Ltda (Brazil) and 99.56% of ACS-Advanced<br />

Control Systems, Inc. (USA). In each case, <strong>the</strong> values booked are equal <strong>to</strong> <strong>the</strong> difference between <strong>the</strong> cost of acquisition, already<br />

paid or payment <strong>to</strong> be expected on future dates, compared <strong>to</strong> <strong>the</strong> accounting value of assets and liabilities. In <strong>the</strong> above cases,<br />

<strong>the</strong>re were no corrections <strong>to</strong> <strong>the</strong> related accounting values<br />

An impairment test was carried out based on discounted future cash fl ow projections, which revealed no loss in value.<br />

6. Investments in group and associate companies<br />

This line refl ects <strong>the</strong> value of investments made in associated companies, adjusted at <strong>the</strong> balance sheet date using <strong>the</strong> equity<br />

method. It includes <strong>the</strong> value of subsidiary companies, when for justifi able reasons; <strong>the</strong>y are excluded from <strong>the</strong> consolidation<br />

(Note 31.2), in which case <strong>the</strong>y are valued at acquisition cost. The line shows <strong>the</strong> value of shareholdings at <strong>the</strong> date of <strong>the</strong> balance<br />

sheet and <strong>the</strong> value of supplementary capital and borrowings granted <strong>to</strong> <strong>the</strong> entities concerned (Note 27).<br />

The movements that occurred during <strong>the</strong> period were as follows:<br />

31.12.2007 31.12.2006<br />

Opening balance 7.290.641 5.459.505<br />

Increases in shareholdings 75.222 0<br />

Decreases in shareholdings 0 0<br />

Share in profi ts/losses of Associates 1.086.098 1.446.576<br />

O<strong>the</strong>r movements in equity of Associates -725.389 246.896<br />

Exchange rate differences -89.395 55.604<br />

Closing balance 0 0<br />

Borrowings granted -76.577 82.088<br />

Closing balance 7.560.600 7.290.641<br />

The amount shown in increases in shareholdings includes 71,871 Euro concerning supplementary capital in Águas da Figueira. The<br />

remaining 3,350 Euro concern <strong>the</strong> <strong>Efacec</strong>’s shareholding in Vestiparque, a subsidiary which was recently set up but excluded from<br />

consolidation in this fi nancial year (Note 31.2).<br />

The share of associated company results relates mainly <strong>to</strong> S2M – Sociedade de Manutenção de Metropoli, S.A (689,300 Euro).<br />

The line “O<strong>the</strong>r movements in equity” includes 818,686 Euro for dividends distributed by <strong>the</strong> associate company S2M.<br />

Acquisition differences concerning shareholdings in O&M Services and in Águas da Figueira are shown in <strong>the</strong> line Goodwill (Note 5).<br />

21<br />

2007 Consolidated and<br />

Individual <strong>Financial</strong> Statments