Notes to the Financial Statements - Efacec

Notes to the Financial Statements - Efacec

Notes to the Financial Statements - Efacec

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

On 30 November 2006, a second Commercial Paper programme was also agreed with <strong>the</strong> Santander Totta Bank <strong>to</strong> a maximum<br />

value of 7,500,000 Euro. The programme has a contract period of 5 years with annual renewals. EFACEC Capital can issue<br />

Commercial Paper by direct placement. As far as Mediation Rates are concerned, <strong>the</strong> issues have a maximum rate equal <strong>to</strong> <strong>the</strong><br />

Euribor rate for <strong>the</strong> period in question, plus 0.325%. The current issues fall due on 17 March 2008.<br />

Bank overdrafts<br />

These overdrafts do not have a defi ned reimbursement date, and can be renewed at various times and are short term in nature.<br />

The average interest rate on <strong>the</strong>m is based on Euribor plus an average spread of around 0.4%.<br />

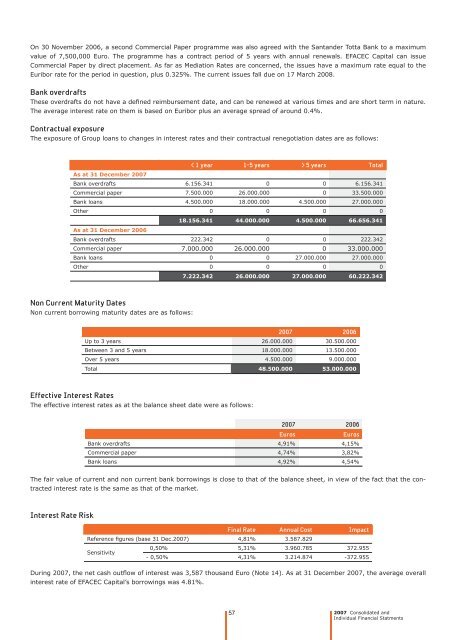

Contractual exposure<br />

The exposure of Group loans <strong>to</strong> changes in interest rates and <strong>the</strong>ir contractual renegotiation dates are as follows:<br />

< 1 year 1-5 years > 5 years Total<br />

As at 31 December 2007<br />

Bank overdrafts 6.156.341 0 0 6.156.341<br />

Commercial paper 7.500.000 26.000.000 0 33.500.000<br />

Bank loans 4.500.000 18.000.000 4.500.000 27.000.000<br />

O<strong>the</strong>r 0 0 0 0<br />

As at 31 December 2006<br />

18.156.341 44.000.000 4.500.000 66.656.341<br />

Bank overdrafts 222.342 0 0 222.342<br />

Commercial paper 7.000.000 26.000.000 0 33.000.000<br />

Bank loans 0 0 27.000.000 27.000.000<br />

O<strong>the</strong>r 0 0 0 0<br />

7.222.342 26.000.000 27.000.000 60.222.342<br />

Non Current Maturity Dates<br />

Non current borrowing maturity dates are as follows:<br />

2007 2006<br />

Up <strong>to</strong> 3 years 26.000.000 30.500.000<br />

Between 3 and 5 years 18.000.000 13.500.000<br />

Over 5 years 4.500.000 9.000.000<br />

Total 48.500.000 53.000.000<br />

Effective Interest Rates<br />

The effective interest rates as at <strong>the</strong> balance sheet date were as follows:<br />

2007 2006<br />

Euros Euros<br />

Bank overdrafts 4,91% 4,15%<br />

Commercial paper 4,74% 3,82%<br />

Bank loans 4,92% 4,54%<br />

The fair value of current and non current bank borrowings is close <strong>to</strong> that of <strong>the</strong> balance sheet, in view of <strong>the</strong> fact that <strong>the</strong> contracted<br />

interest rate is <strong>the</strong> same as that of <strong>the</strong> market.<br />

Interest Rate Risk<br />

Final Rate Annual Cost Impact<br />

Reference fi gures (base 31 Dec.2007) 4,81% 3.587.829<br />

Sensitivity<br />

0,50% 5,31% 3.960.785 372.955<br />

- 0,50% 4,31% 3.214.874 -372.955<br />

During 2007, <strong>the</strong> net cash outfl ow of interest was 3,587 thousand Euro (Note 14). As at 31 December 2007, <strong>the</strong> average overall<br />

interest rate of EFACEC Capital’s borrowings was 4.81%.<br />

57<br />

2007 Consolidated and<br />

Individual <strong>Financial</strong> Statments