Notes to the Financial Statements - Efacec

Notes to the Financial Statements - Efacec

Notes to the Financial Statements - Efacec

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

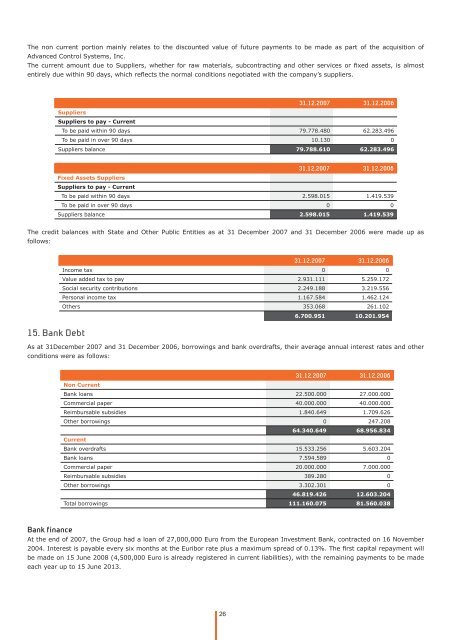

The non current portion mainly relates <strong>to</strong> <strong>the</strong> discounted value of future payments <strong>to</strong> be made as part of <strong>the</strong> acquisition of<br />

Advanced Control Systems, Inc.<br />

The current amount due <strong>to</strong> Suppliers, whe<strong>the</strong>r for raw materials, subcontracting and o<strong>the</strong>r services or fi xed assets, is almost<br />

entirely due within 90 days, which refl ects <strong>the</strong> normal conditions negotiated with <strong>the</strong> company’s suppliers.<br />

Suppliers<br />

26<br />

31.12.2007 31.12.2006<br />

Suppliers <strong>to</strong> pay - Current<br />

To be paid within 90 days 79.778.480 62.283.496<br />

To be paid in over 90 days 10.130 0<br />

Suppliers balance 79.788.610 62.283.496<br />

31.12.2007 31.12.2006<br />

Fixed Assets Suppliers<br />

Suppliers <strong>to</strong> pay - Current<br />

To be paid within 90 days 2.598.015 1.419.539<br />

To be paid in over 90 days 0 0<br />

Suppliers balance 2.598.015 1.419.539<br />

The credit balances with State and O<strong>the</strong>r Public Entities as at 31 December 2007 and 31 December 2006 were made up as<br />

follows:<br />

15. Bank Debt<br />

31.12.2007 31.12.2006<br />

Income tax 0 0<br />

Value added tax <strong>to</strong> pay 2.931.111 5.259.172<br />

Social security contributions 2.249.188 3.219.556<br />

Personal income tax 1.167.584 1.462.124<br />

O<strong>the</strong>rs 353.068 261.102<br />

6.700.951 10.201.954<br />

As at 31December 2007 and 31 December 2006, borrowings and bank overdrafts, <strong>the</strong>ir average annual interest rates and o<strong>the</strong>r<br />

conditions were as follows:<br />

31.12.2007 31.12.2006<br />

Non Current<br />

Bank loans 22.500.000 27.000.000<br />

Commercial paper 40.000.000 40.000.000<br />

Reimbursable subsidies 1.840.649 1.709.626<br />

O<strong>the</strong>r borrowings 0 247.208<br />

Current<br />

64.340.649 68.956.834<br />

Bank overdrafts 15.533.256 5.603.204<br />

Bank loans 7.594.589 0<br />

Commercial paper 20.000.000 7.000.000<br />

Reimbursable subsidies 389.280 0<br />

O<strong>the</strong>r borrowings 3.302.301 0<br />

46.819.426 12.603.204<br />

Total borrowings 111.160.075 81.560.038<br />

Bank finance<br />

At <strong>the</strong> end of 2007, <strong>the</strong> Group had a loan of 27,000,000 Euro from <strong>the</strong> European Investment Bank, contracted on 16 November<br />

2004. Interest is payable every six months at <strong>the</strong> Euribor rate plus a maximum spread of 0.13%. The fi rst capital repayment will<br />

be made on 15 June 2008 (4,500,000 Euro is already registered in current liabilities), with <strong>the</strong> remaining payments <strong>to</strong> be made<br />

each year up <strong>to</strong> 15 June 2013.