Notes to the Financial Statements - Efacec

Notes to the Financial Statements - Efacec

Notes to the Financial Statements - Efacec

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

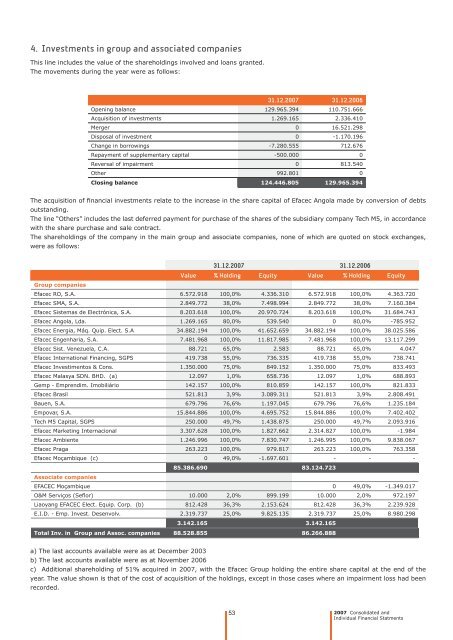

4. Investments in group and associated companies<br />

This line includes <strong>the</strong> value of <strong>the</strong> shareholdings involved and loans granted.<br />

The movements during <strong>the</strong> year were as follows:<br />

31.12.2007 31.12.2006<br />

Opening balance 129.965.394 110.751.666<br />

Acquisition of investments 1.269.165 2.336.410<br />

Merger 0 16.521.298<br />

Disposal of investment 0 -1.170.196<br />

Change in borrowings -7.280.555 712.676<br />

Repayment of supplementary capital -500.000 0<br />

Reversal of impairment 0 813.540<br />

O<strong>the</strong>r 992.801 0<br />

Closing balance 124.446.805 129.965.394<br />

The acquisition of fi nancial investments relate <strong>to</strong> <strong>the</strong> increase in <strong>the</strong> share capital of <strong>Efacec</strong> Angola made by conversion of debts<br />

outstanding.<br />

The line “O<strong>the</strong>rs” includes <strong>the</strong> last deferred payment for purchase of <strong>the</strong> shares of <strong>the</strong> subsidiary company Tech M5, in accordance<br />

with <strong>the</strong> share purchase and sale contract.<br />

The shareholdings of <strong>the</strong> company in <strong>the</strong> main group and associate companies, none of which are quoted on s<strong>to</strong>ck exchanges,<br />

were as follows:<br />

31.12.2007 31.12.2006<br />

Value % Holding Equity Value % Holding Equity<br />

Group companies<br />

<strong>Efacec</strong> RO, S.A. 6.572.918 100,0% 4.336.310 6.572.918 100,0% 4.363.720<br />

<strong>Efacec</strong> SMA, S.A. 2.849.772 38,0% 7.498.994 2.849.772 38,0% 7.160.384<br />

<strong>Efacec</strong> Sistemas de Electrónica, S.A. 8.203.618 100,0% 20.970.724 8.203.618 100,0% 31.684.743<br />

<strong>Efacec</strong> Angola, Lda. 1.269.165 80,0% 539.540 0 80,0% -785.952<br />

<strong>Efacec</strong> Energia, Máq. Quip. Elect. S.A 34.882.194 100,0% 41.652.659 34.882.194 100,0% 38.025.586<br />

<strong>Efacec</strong> Engenharia, S.A. 7.481.968 100,0% 11.817.985 7.481.968 100,0% 13.117.299<br />

<strong>Efacec</strong> Sist. Venezuela, C.A. 88.721 65,0% 2.583 88.721 65,0% 4.047<br />

<strong>Efacec</strong> International Financing, SGPS 419.738 55,0% 736.335 419.738 55,0% 738.741<br />

<strong>Efacec</strong> Investimen<strong>to</strong>s & Cons. 1.350.000 75,0% 849.152 1.350.000 75,0% 833.493<br />

<strong>Efacec</strong> Malasya SDN. BHD. (a) 12.097 1,0% 658.736 12.097 1,0% 688.893<br />

Gemp - Emprendim. Imobiliário 142.157 100,0% 810.859 142.157 100,0% 821.833<br />

<strong>Efacec</strong> Brasil 521.813 3,9% 3.089.311 521.813 3,9% 2.808.491<br />

Bauen, S.A. 679.796 76,6% 1.197.045 679.796 76,6% 1.235.184<br />

Empovar, S.A. 15.844.886 100,0% 4.695.752 15.844.886 100,0% 7.402.402<br />

Tech M5 Capital, SGPS 250.000 49,7% 1.438.875 250.000 49,7% 2.093.916<br />

<strong>Efacec</strong> Marketing Internacional 3.307.628 100,0% 1.827.662 2.314.827 100,0% -1.984<br />

<strong>Efacec</strong> Ambiente 1.246.996 100,0% 7.830.747 1.246.995 100,0% 9.838.067<br />

<strong>Efacec</strong> Praga 263.223 100,0% 979.817 263.223 100,0% 763.358<br />

<strong>Efacec</strong> Moçambique (c) 0 49,0% -1.697.601 - - -<br />

Associate companies<br />

85.386.690 83.124.723<br />

EFACEC Moçambique 0 49,0% -1.349.017<br />

O&M Serviços (Sefl or) 10.000 2,0% 899.199 10.000 2,0% 972.197<br />

Liaoyang EFACEC Elect. Equip. Corp. (b) 812.428 36,3% 2.153.624 812.428 36,3% 2.239.928<br />

E.I.D. - Emp. Invest. Desenvolv. 2.319.737 25,0% 9.825.135 2.319.737 25,0% 8.980.298<br />

3.142.165 3.142.165<br />

Total Inv. in Group and Assoc. companies 88.528.855 86.266.888<br />

a) The last accounts available were as at December 2003<br />

b) The last accounts available were as at November 2006<br />

c) Additional shareholding of 51% acquired in 2007, with <strong>the</strong> <strong>Efacec</strong> Group holding <strong>the</strong> entire share capital at <strong>the</strong> end of <strong>the</strong><br />

year. The value shown is that of <strong>the</strong> cost of acquisition of <strong>the</strong> holdings, except in those cases where an impairment loss had been<br />

recorded.<br />

53<br />

2007 Consolidated and<br />

Individual <strong>Financial</strong> Statments