Notes to the Financial Statements - Efacec

Notes to the Financial Statements - Efacec

Notes to the Financial Statements - Efacec

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

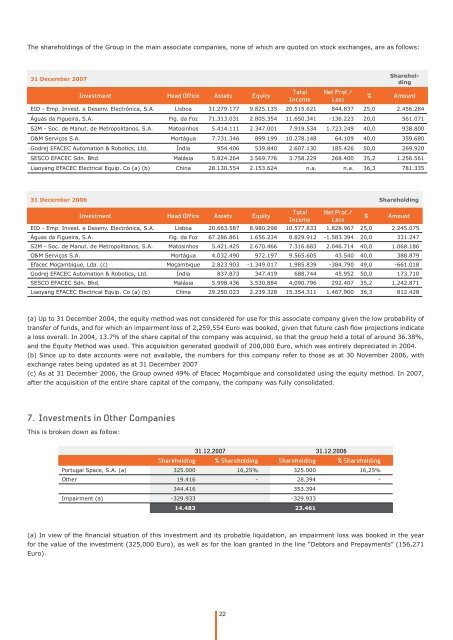

The shareholdings of <strong>the</strong> Group in <strong>the</strong> main associate companies, none of which are quoted on s<strong>to</strong>ck exchanges, are as follows:<br />

31 December 2007<br />

Investment Head Office Assets Equity<br />

22<br />

Total<br />

Income<br />

Net Prof./<br />

Loss<br />

Shareholding<br />

% Amount<br />

EID - Emp. Invest. e Desenv. Electrónica, S.A. Lisboa 31.279.177 9.825.135 20.515.621 844.837 25,0 2.456.284<br />

Águas da Figueira, S.A. Fig. da Foz 71.313.031 2.805.354 11.650.341 -136.223 20,0 561.071<br />

S2M - Soc. de Manut. de Metropolitanos, S.A. Ma<strong>to</strong>sinhos 5.414.111 2.347.001 7.919.534 1.723.249 40,0 938.800<br />

O&M Serviços S.A. Mortágua 7.731.346 899.199 10.278.148 64.109 40,0 359.680<br />

Godrej EFACEC Au<strong>to</strong>mation & Robotics, Ltd. Índia 954.406 539.840 2.607.130 185.426 50,0 269.920<br />

SESCO EFACEC Sdn. Bhd. Malásia 5.824.264 3.569.776 3.758.229 268.400 35,2 1.256.561<br />

Liaoyang EFACEC Electrical Equip. Co (a) (b) China 28.130.554 2.153.624 n.a. n.a. 36,3 781.335<br />

31 December 2006 Shareholding<br />

Investment Head Office Assets Equity<br />

Total<br />

Income<br />

Net Prof./<br />

Loss<br />

% Amount<br />

EID - Emp. Invest. e Desenv. Electrónica, S.A. Lisboa 20.663.587 8.980.298 10.577.833 1.828.967 25,0 2.245.075<br />

Águas da Figueira, S.A. Fig. da Foz 67.286.861 1.656.234 8.829.912 -1.583.394 20,0 331.247<br />

S2M - Soc. de Manut. de Metropolitanos, S.A. Ma<strong>to</strong>sinhos 5.421.425 2.670.466 7.316.683 2.046.714 40,0 1.068.186<br />

O&M Serviços S.A. Mortágua 4.032.490 972.197 9.565.605 43.540 40,0 388.879<br />

<strong>Efacec</strong> Moçambique, Lda. (c) Moçambique 2.823.903 -1.349.017 1.985.839 -384.790 49,0 -661.018<br />

Godrej EFACEC Au<strong>to</strong>mation & Robotics, Ltd. Índia 837.873 347.419 688.744 45.952 50,0 173.710<br />

SESCO EFACEC Sdn. Bhd. Malásia 5.998.436 3.530.884 4.090.796 292.407 35,2 1.242.871<br />

Liaoyang EFACEC Electrical Equip. Co (a) (b) China 29.250.023 2.239.328 15.354.311 1.467.900 36,3 812.428<br />

(a) Up <strong>to</strong> 31 December 2004, <strong>the</strong> equity method was not considered for use for this associate company given <strong>the</strong> low probability of<br />

transfer of funds, and for which an impairment loss of 2,259,554 Euro was booked, given that future cash fl ow projections indicate<br />

a loss overall. In 2004, 13.7% of <strong>the</strong> share capital of <strong>the</strong> company was acquired, so that <strong>the</strong> group held a <strong>to</strong>tal of around 36.38%,<br />

and <strong>the</strong> Equity Method was used. This acquisition generated goodwill of 200,000 Euro, which was entirely depreciated in 2004.<br />

(b) Since up <strong>to</strong> date accounts were not available, <strong>the</strong> numbers for this company refer <strong>to</strong> those as at 30 November 2006, with<br />

exchange rates being updated as at 31 December 2007<br />

(c) As at 31 December 2006, <strong>the</strong> Group owned 49% of <strong>Efacec</strong> Moçambique and consolidated using <strong>the</strong> equity method. In 2007,<br />

after <strong>the</strong> acquisition of <strong>the</strong> entire share capital of <strong>the</strong> company, <strong>the</strong> company was fully consolidated.<br />

7. Investments in O<strong>the</strong>r Companies<br />

This is broken down as follow:<br />

31.12.2007 31.12.2006<br />

Shareholding % Shareholding Shareholding % Shareholding<br />

Portugal Space, S.A. (a) 325.000 16,25% 325.000 16,25%<br />

O<strong>the</strong>r 19.416 - 28.394 -<br />

344.416 353.394<br />

Impairment (a) -329.933 -329.933<br />

14.483 23.461<br />

(a) In view of <strong>the</strong> fi nancial situation of this investment and its probable liquidation, an impairment loss was booked in <strong>the</strong> year<br />

for <strong>the</strong> value of <strong>the</strong> investment (325,000 Euro), as well as for <strong>the</strong> loan granted in <strong>the</strong> line “Deb<strong>to</strong>rs and Prepayments” (156,271<br />

Euro).