Notes to the Financial Statements - Efacec

Notes to the Financial Statements - Efacec

Notes to the Financial Statements - Efacec

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

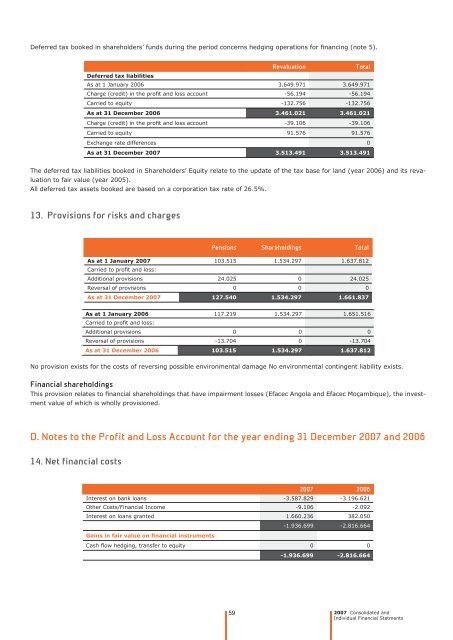

Deferred tax booked in shareholders’ funds during <strong>the</strong> period concerns hedging operations for fi nancing (note 5).<br />

59<br />

Revaluation Total<br />

Deferred tax liabilities<br />

As at 1 January 2006 3.649.971 3.649.971<br />

Charge (credit) in <strong>the</strong> profi t and loss account -56.194 -56.194<br />

Carried <strong>to</strong> equity -132.756 -132.756<br />

As at 31 December 2006 3.461.021 3.461.021<br />

Charge (credit) in <strong>the</strong> profi t and loss account -39.106 -39.106<br />

Carried <strong>to</strong> equity 91.576 91.576<br />

Exchange rate differences 0<br />

As at 31 December 2007 3.513.491 3.513.491<br />

The deferred tax liabilities booked in Shareholders’ Equity relate <strong>to</strong> <strong>the</strong> update of <strong>the</strong> tax base for land (year 2006) and its revaluation<br />

<strong>to</strong> fair value (year 2005).<br />

All deferred tax assets booked are based on a corporation tax rate of 26.5%.<br />

13. Provisions for risks and charges<br />

Pensions Shareholdings Total<br />

As at 1 January 2007<br />

Carried <strong>to</strong> profi t and loss:<br />

103.515 1.534.297 1.637.812<br />

Additional provisions 24.025 0 24.025<br />

Reversal of provisions 0 0 0<br />

As at 31 December 2007 127.540 1.534.297 1.661.837<br />

As at 1 January 2006<br />

Carried <strong>to</strong> profi t and loss:<br />

117.219 1.534.297 1.651.516<br />

Additional provisions 0 0 0<br />

Reversal of provisions -13.704 0 -13.704<br />

As at 31 December 2006 103.515 1.534.297 1.637.812<br />

No provision exists for <strong>the</strong> costs of reversing possible environmental damage No environmental contingent liability exists.<br />

<strong>Financial</strong> shareholdings<br />

This provision relates <strong>to</strong> fi nancial shareholdings that have impairment losses (<strong>Efacec</strong> Angola and <strong>Efacec</strong> Moçambique), <strong>the</strong> investment<br />

value of which is wholly provisioned.<br />

D. <strong>Notes</strong> <strong>to</strong> <strong>the</strong> Profit and Loss Account for <strong>the</strong> year ending 31 December 2007 and 2006<br />

14. Net financial costs<br />

2007 2006<br />

Interest on bank loans -3.587.829 -3.196.621<br />

O<strong>the</strong>r Costs/<strong>Financial</strong> Income -9.106 -2.092<br />

Interest on loans granted 1.660.236 382.050<br />

Gains in fair value on fi nancial instruments<br />

-1.936.699 -2.816.664<br />

Cash fl ow hedging, transfer <strong>to</strong> equity 0 0<br />

-1.936.699 -2.816.664<br />

2007 Consolidated and<br />

Individual <strong>Financial</strong> Statments