Notes to the Financial Statements - Efacec

Notes to the Financial Statements - Efacec

Notes to the Financial Statements - Efacec

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

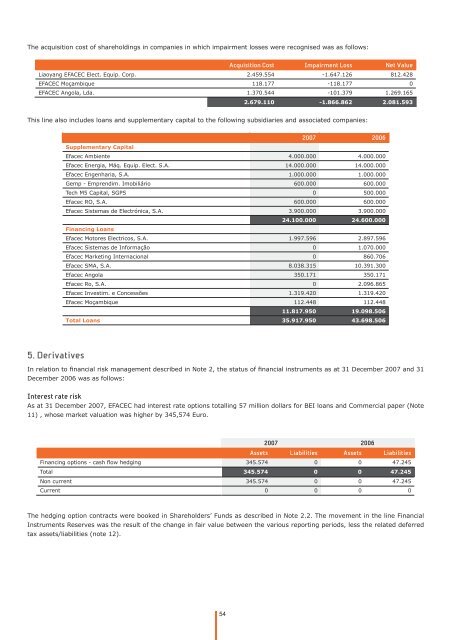

The acquisition cost of shareholdings in companies in which impairment losses were recognised was as follows:<br />

54<br />

Acquisition Cost Impairment Loss Net Value<br />

Liaoyang EFACEC Elect. Equip. Corp. 2.459.554 -1.647.126 812.428<br />

EFACEC Moçambique 118.177 -118.177 0<br />

EFACEC Angola, Lda. 1.370.544 -101.379 1.269.165<br />

2.679.110 -1.866.862 2.081.593<br />

This line also includes loans and supplementary capital <strong>to</strong> <strong>the</strong> following subsidiaries and associated companies:<br />

5. Derivatives<br />

2007 2006<br />

Supplementary Capital<br />

<strong>Efacec</strong> Ambiente 4.000.000 4.000.000<br />

<strong>Efacec</strong> Energia, Máq. Equip. Elect. S.A. 14.000.000 14.000.000<br />

<strong>Efacec</strong> Engenharia, S.A. 1.000.000 1.000.000<br />

Gemp - Emprendim. Imobiliário 600.000 600.000<br />

Tech M5 Capital, SGPS 0 500.000<br />

<strong>Efacec</strong> RO, S.A. 600.000 600.000<br />

<strong>Efacec</strong> Sistemas de Electrónica, S.A. 3.900.000 3.900.000<br />

Financing Loans<br />

24.100.000 24.600.000<br />

<strong>Efacec</strong> Mo<strong>to</strong>res Electricos, S.A. 1.997.596 2.897.596<br />

<strong>Efacec</strong> Sistemas de Informação 0 1.070.000<br />

<strong>Efacec</strong> Marketing Internacional 0 860.706<br />

<strong>Efacec</strong> SMA, S.A. 8.038.315 10.391.300<br />

<strong>Efacec</strong> Angola 350.171 350.171<br />

<strong>Efacec</strong> Ro, S.A. 0 2.096.865<br />

<strong>Efacec</strong> Investim. e Concessões 1.319.420 1.319.420<br />

<strong>Efacec</strong> Moçambique 112.448 112.448<br />

11.817.950 19.098.506<br />

Total Loans 35.917.950 43.698.506<br />

In relation <strong>to</strong> fi nancial risk management described in Note 2, <strong>the</strong> status of fi nancial instruments as at 31 December 2007 and 31<br />

December 2006 was as follows:<br />

Interest rate risk<br />

As at 31 December 2007, EFACEC had interest rate options <strong>to</strong>talling 57 million dollars for BEI loans and Commercial paper (Note<br />

11) , whose market valuation was higher by 345,574 Euro.<br />

2007 2006<br />

Assets Liabilities Assets Liabilities<br />

Financing options - cash fl ow hedging 345.574 0 0 47.245<br />

Total 345.574 0 0 47.245<br />

Non current 345.574 0 0 47.245<br />

Current 0 0 0 0<br />

The hedging option contracts were booked in Shareholders’ Funds as described in Note 2.2. The movement in <strong>the</strong> line <strong>Financial</strong><br />

Instruments Reserves was <strong>the</strong> result of <strong>the</strong> change in fair value between <strong>the</strong> various reporting periods, less <strong>the</strong> related deferred<br />

tax assets/liabilities (note 12).