Notes to the Financial Statements - Efacec

Notes to the Financial Statements - Efacec

Notes to the Financial Statements - Efacec

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

24. Dividend per share<br />

The dividends paid by <strong>Efacec</strong> Capital, SGPS in 2007 were 19,753,096 Euro (0.474 Euro per share). Of this fi gure, 7,537,096 Euro<br />

relate <strong>to</strong> retained earnings of 2006 and 12,216,000 Euro are anticipated dividends for <strong>the</strong> year ending 31 December 2007. During<br />

<strong>the</strong> previous year, 22.745,607 Euro were paid (0.546 Euro per share). Dividends for minority interest were 163,674 Euro (79,304<br />

Euro in 2006) and relate entirely <strong>to</strong> <strong>the</strong> subsidiary company EFACEC – Serviços de Manutenção e Assistência, S.A.<br />

F. O<strong>the</strong>r notes<br />

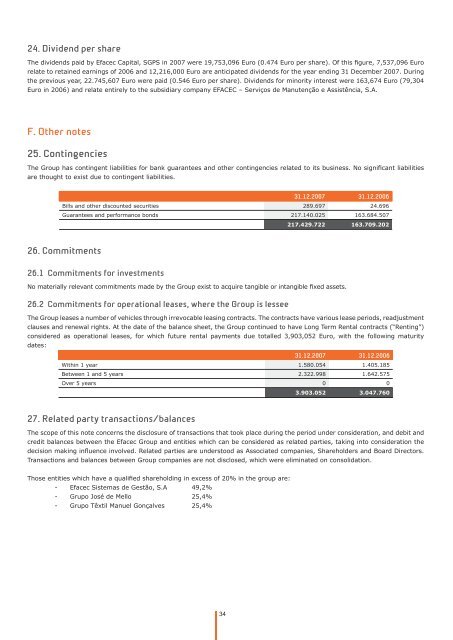

25. Contingencies<br />

The Group has contingent liabilities for bank guarantees and o<strong>the</strong>r contingencies related <strong>to</strong> its business. No signifi cant liabilities<br />

are thought <strong>to</strong> exist due <strong>to</strong> contingent liabilities.<br />

31.12.2007 31.12.2006<br />

Bills and o<strong>the</strong>r discounted securities 289.697 24.696<br />

Guarantees and performance bonds 217.140.025 163.684.507<br />

217.429.722 163.709.202<br />

26. Commitments<br />

26.1 Commitments for investments<br />

No materially relevant commitments made by <strong>the</strong> Group exist <strong>to</strong> acquire tangible or intangible fi xed assets.<br />

26.2 Commitments for operational leases, where <strong>the</strong> Group is lessee<br />

The Group leases a number of vehicles through irrevocable leasing contracts. The contracts have various lease periods, readjustment<br />

clauses and renewal rights. At <strong>the</strong> date of <strong>the</strong> balance sheet, <strong>the</strong> Group continued <strong>to</strong> have Long Term Rental contracts (“Renting”)<br />

considered as operational leases, for which future rental payments due <strong>to</strong>talled 3,903,052 Euro, with <strong>the</strong> following maturity<br />

dates:<br />

31.12.2007 31.12.2006<br />

Within 1 year 1.580.054 1.405.185<br />

Between 1 and 5 years 2.322.998 1.642.575<br />

Over 5 years 0 0<br />

27. Related party transactions/balances<br />

34<br />

3.903.052 3.047.760<br />

The scope of this note concerns <strong>the</strong> disclosure of transactions that <strong>to</strong>ok place during <strong>the</strong> period under consideration, and debit and<br />

credit balances between <strong>the</strong> <strong>Efacec</strong> Group and entities which can be considered as related parties, taking in<strong>to</strong> consideration <strong>the</strong><br />

decision making infl uence involved. Related parties are unders<strong>to</strong>od as Associated companies, Shareholders and Board Direc<strong>to</strong>rs.<br />

Transactions and balances between Group companies are not disclosed, which were eliminated on consolidation.<br />

Those entities which have a qualifi ed shareholding in excess of 20% in <strong>the</strong> group are:<br />

- <strong>Efacec</strong> Sistemas de Gestão, S.A 49,2%<br />

- Grupo José de Mello 25,4%<br />

- Grupo Têxtil Manuel Gonçalves 25,4%